Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

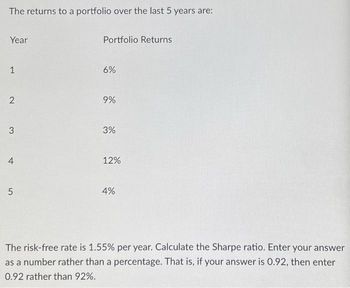

Transcribed Image Text:The returns to a portfolio over the last 5 years are:

Year

1

2

3.

4

5

Portfolio Returns

6%

9%

3%

12%

4%

The risk-free rate is 1.55% per year. Calculate the Sharpe ratio. Enter your answer

as a number rather than a percentage. That is, if your answer is 0.92, then enter

0.92 rather than 92%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Bhupatbhaiarrow_forwardYour current portfolio is 100% invested in the market. You are considering investing some of your money in a portfolio run by Big Alpha Asset Management (BAAM). BAAM's returns have been quite good over the last five years. In order to understand by how much you could improve the Sharpe Ratio of your current portfolio by putting some of your money in BAAM, you run the following regression using past annualized returns on both the market and BAAM: RBAAM, Rft = a₁ + Bi (RM₁t - Rft) + €₁,t You estimate the following coefficients, which are all statistically significant: a=0.09; 3= 1.2 Additionally, you estimate the volatility of the residuals from the cove regression (idiosyncratic volatility) to be 0.14. In that same period the market's annualized volatility was 0.2078. Additionally, you expect the market's excess return to be 0.05 over the coming year. If you believe that the above estimates are representative of what will happen in the coming year, what is the maximum Sharpe Ratio you…arrow_forwardman.6arrow_forward

- Your portfolio has provided you with returns of 8.6 percent, 14.2 percent, -3.7 percent, and 12.0 percent over the past four years. respectively. What is the geometric average return for this period? a). 7.78%b). 5.99%c). 7.54%arrow_forwardYou are a provider of portfolio insurance and are establishing a four-year program. The portfolio you manage is currently worth $70 million, and you promise to provide a minimum return of 0%. The equity portfolio has a standard deviation of 25% per year, and T-bills pay 6.2% per year. Assume that the portfolio pays no dividends. Required: a-1. How much of the portfolio should be sold and placed in bills? (Input the value as a positive value. Do not round intermediate calculations and round your final percentage answer to 2 decimal places.) a-2. How much of the portfolio should be sold and placed in equity? (Input the value as a positive value. Do not round intermediate calculations and round your final percentage answer to 2 decimal places.) b-1. Calculate the put delta and the amount held in bills if the stock portfolio falls by 3% on the first day of trading, before the hedge is in place? (Input the value as a positive value. Do not round intermediate calculations. Round your…arrow_forwardFremont Enterprises has an expected return of 14% and Laurelhurst News has an expected return of 19%. If you put 44% of your portfolio in Laurelhurst and 56% in Fremont, what is the expected return of your portfolio? The expected return on the portfolio is \%. (Rounded to two decimal places.)arrow_forward

- Use the data below to answer the following question. If you have a risk-aversion factor of 2.5 and the risk-free rate is 2%, you would invest _______% of your money in the risky portfolio. Year Return 2014 -15% 2015 -5% 2016 30% 2017 -10% 2018 35%arrow_forwardA manager's portfolio generated a return of 11.3% over the past year. The portfolio's beta was 1.16 and the return standard deviation was 15.7%. The market return was 9.8%, its return standard deviation was 13.4%, and the risk-free rate was 3.7%. What are the portfolio's Sharpe ratio, Treynor ratio, and Jensen's alpha?arrow_forwardState the return rate (in %) for your optimal portfolio.arrow_forward

- 4. Consider the following information. Your portfolio is invested 30 percent each in A and C, and 40 percent in B. What is the expected return and standard deviation of this portfolio? (10 marks) State of Probability of Rate of Return if State Occurs Economy State of Economy Stock A Stock B Stock C Boom 0.15 0.30 0.45 0.33 Good 0.45 0.12 0.10 0.15 Poor 0.35 0.01 -0.15 -0.05 Bust 0.05 -0.06 -0.30 -0.09arrow_forwardYour portfolio had the values in the following table for the four years listed: Data table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) Beginning Value Ending Value 2016 $59,462 $55,536 2017 55,536 64,852 2018 64,852 67,183 2019 67,183 70,997 . a. Calculate your return for each year over the 4-year period. Then calculate the average return over the 4-year period. b. Calculate the portfolio standard deviation. Question content area bottom Part 1 The return for 2016 is enter your response here%. (Round to two decimal places.)arrow_forwardA portfolio has a 4.0 percent chance of losing 15 percent or more according to the VaR when T = 1.This can be interpreted to mean that the portfolio is expected to have an annual loss of 15 percent or more once in every how many years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education