Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

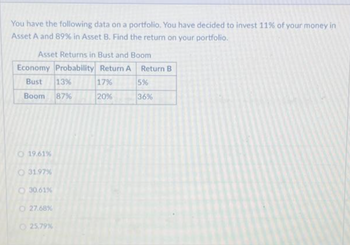

Transcribed Image Text:You have the following data on a portfolio. You have decided to invest 11% of your money in

Asset A and 89% in Asset B. Find the return on your portfolio.

Asset Returns in Bust and Boom

Economy Probability Return A

Bust 13%

17%

Boom

87%

20%

O 19.61%

O 31.97%

O 30.61%

O27.68%

25,79%

Return B

5%

36%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Vijayarrow_forwardThis question requires you to consider a three-asset portfolio valued at 10 million AUD. The portfolio consists of the following assets: AMP, Commonwealth Bank (CBA) and QBE. The variance covariance matrix of 5 day continuously compounded returns is equal to (a) Define the Value at Risk (VAR) for a portfolio. (b) Assuming portfolio weights of AMP (40%), CBA (30%), QBE (30%), calculate the 99 % 5 day relative VaR estimate (employ a z score measured to 2 decimal places) (c) Calculate the VaR diversification benefit of the portfolio.arrow_forwardAssume that you have just received information from your investment advisor that your portfolio has reached a value of $1,250,000. Your portfolio consists of three stocks, as follows: Stock Amount Invested % of Total Beta A $250,000 20% 1.12 B $400,000 32% .85 C $600,000 48% .55 Total: $1,250,000 100% Calculate the beta of this investment portfolio. Assume that the expected market return ( r m ) is 9 percent and the expected risk- free rate ( RF ) is 2 percent. What is the expected return ( r j ) for this investment portfolio?arrow_forward

- 103.arrow_forwardUse the data below to answer the following question. If you have a risk-aversion factor of 2.5 and the risk-free rate is 2%, you would invest _______% of your money in the risky portfolio. Year Return 2014 -15% 2015 -5% 2016 30% 2017 -10% 2018 35%arrow_forwardState the return rate (in %) for your optimal portfolio.arrow_forward

- Could part 2 be answeredarrow_forward4. Consider the following information. Your portfolio is invested 30 percent each in A and C, and 40 percent in B. What is the expected return and standard deviation of this portfolio? (10 marks) State of Probability of Rate of Return if State Occurs Economy State of Economy Stock A Stock B Stock C Boom 0.15 0.30 0.45 0.33 Good 0.45 0.12 0.10 0.15 Poor 0.35 0.01 -0.15 -0.05 Bust 0.05 -0.06 -0.30 -0.09arrow_forwardCurrent Attempt in Progress You have just invested in a portfolio of three stocks. The amount of money that you invested in each stock and its beta are summarized below. Stock A B C Investment $190,000 285,000 475,000 Beta of the portfolio Beta Expected rate of return 1.45 0.60 Calculate the beta of the portfolio and use the Capital Asset Pricing Model (CAPM) to compute the expected rate of return for the portfolio. Assume that the expected rate of return on the market is 17 percent and that the risk-free rate is 6 percent. (Round beta answer to 3 decimal places, e.g. 52.750 and expected rate of return answer to 2 decimal places, e.g. 52.75%.) 1.30 %arrow_forward

- How can you work this out in Excel? Suppose that we have an investment with an annual return of 10% and an annual standard deviation of 25%. Over a one-year period, what range of returns can we expect with approximately 95% confidence? 1.-15.36% to 55.36% 2.5% to 45% 3.-23.45% to 56.78% 4. -40% to 60%arrow_forwardSolve step by steparrow_forwardConsider a position consisting of 200,000 investment in asset A and 300,000 investment in asset B. Assume that the daily volatility of the assets are 1.5% and 1.8% respectively, and that coefficient of correlation between their returns is 0.4. What is the five day 95% VAR for the portfolio (given 95% confidence level represents 1.65 standard deviations on the left side of the normal distribution)?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education