Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

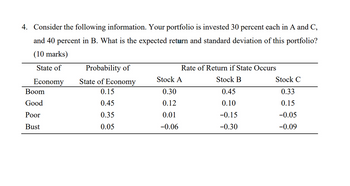

Transcribed Image Text:4. Consider the following information. Your portfolio is invested 30 percent each in A and C,

and 40 percent in B. What is the expected return and standard deviation of this portfolio?

(10 marks)

State of

Probability of

Rate of Return if State Occurs

Economy

State of Economy

Stock A

Stock B

Stock C

Boom

0.15

0.30

0.45

0.33

Good

0.45

0.12

0.10

0.15

Poor

0.35

0.01

-0.15

-0.05

Bust

0.05

-0.06

-0.30

-0.09

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- What is the present value of an ordinary annuity with annual payments of $660 at 9% annual interest for 25 years? Click the icon to view the table. The present value of an ordinary annuity is S (Round to the nearest cent as needed.)arrow_forward9. Plot the following risky portfolios on a graph: B 10 11 Portfolio A Expected return, % 8 Standard Deviation, % 13 C D E F 12.5 14 16 20 15 19 19 22 G 20 25 H 23 33 a) Which of these portfolios are efficient? Which portfolios are inefficient? b) Suppose you can also borrow and lend at an interest-rate of 10 percent. Which of the above portfolios is the best one? c) Suppose you are prepared to tolerate a standard deviation of 15 percent. What is the maximum expected return that you can achieve if you cannot borrow nor lend? d) What is your optimal strategy, if you can borrow or lend at 10 percent and are prepared to tolerate a standard deviation of 15 percent? What is the maximum expected return that you can achieve?arrow_forwardConsider the following information about three stocks: Probability 0.22 State of Economy Boom Normal Bust 0.53 0.25 Stock A 0.24 0.00 0.17 -0.28 Stock B 0.36 0.13 -0.45 Stock C 0.55 0.09 Instructions: a) If your portfolio is invested 40% each in A and B and 20% in C, what is the portfolio expected return? The variance? The standard deviation? b) If the expected T-bill rate is 3.80%, the expected inflation rate is 3.50% what are the approximate and exact expected real returns on the portfolio? what is the approximate real risk premium? Show your steps.arrow_forward

- 1. Suppose your expectations regarding the stock market are as follows: State of the Probability HPR Economy Boom 0.3 33% Normal growth 0.3 19 Recession 0.4 -15 a. What is the expected return, variance and standard deviation? 2. Assume that you manage a risky portfolio with an expected rate of return of 13% and a standard deviation of 29%. The T-bill rate is 5%. Your client chooses to invest 75% of a portfolio in your fund and 25% in a T-bill money market fund. a. What is the expected return and standard deviation of your client's portfolio? b. What is the reward-to-volatility ratio (S) of your risky portfolio and your client's overall portfolio? Explain the sharp ratio.arrow_forwardRead the information for 3 stocks X, Y and Z below. Rate of return when state occurs (For Stock X, Y, and Z) State of Economy Probability of State Stock X Stock Y Stock Z Boom 0.3 0.4 0.45 0.6 Normal 0.5 0.2 0.15 0.08 Recession 0.2 0 -0.3 -0.4 If your portfolio includes 35 percent of X, 40 percent of Y and 25 percent of Z, answerthe following questions: (a) Calculate the portfolio expected return.(b) Calculate the variance and the standard deviation of the portfolio (c) If the expected T-bill rate is 3.80 percent, calculate the expected risk premiumon the portfolio.arrow_forwardConsider the following information: Rate of Return if State Occurs State of Probability of State of Economy Stock A Stock B Stock C Economy Boom 0.15 0.32 0.42 0.33 Good 0.45 0.19 0.13 0.12 Poor 0.30 -0.05 -0.08 -0.06 Bust 0.10 - 0.16 -0.28 0.09 a. Your portfolio is invested 30 percent each in A and C, and 40 percent in B. What is the expected return of the portfolio? (Round your answer to 2 decimal places. (e.g., 32.16)) Expected return % b-1What is the variance of this portfolio? (Do not round intermediate calculations and round your answer to 5 decimal places. (e.g., 32.16161)) Variance b-2What is the standard deviation? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) Standard deviation %arrow_forward

- Consider the following information: Rate of Return if State Occurs Probability of State State of Economy of Economy Stock A Stock B Stock C Boom .10 34 44 24 Good .60 .19 15 08 Poor .25 -.01 09 -.07 Bust .05 -15 -.19 -11 a. Your portfolio is invested 25 percent each in A and C, and 50 percent in B. What is the expected return of the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-1. What is the variance of this portfolio? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What is the standard deviation? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Expected return b-1. Variance % b-2. Standard deviation %arrow_forwardRadhubhaiarrow_forwardConsider the following information on a portfolio of three stocks: State of Probability of Economy State of Economy Boom .12 Normal Bust .33 Stock A Rate of Return .07 .16 Stock B Rate of Return .32 .27 -.26 Stock Rate of Return .45 .25 -.35 a. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio's expected return, the variance, and the standard deviation ? Note: Do not round intermediate calculations . Round your variance answer to 5 decimal places, e.g., .16161. Enter your other answers as a percent rounded to 2 decimal places , e.g., 32.16. bIf the expected T-bill rate is 4.5 percent, what is the expected risk premium on the portfolio ? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16 . % a. Expected return Variance Standard deviation % b. Expected risk premium %arrow_forward

- 10. Share A and share B has the below returns. Rate of return (%) Rate of return (%) Share A Share B 3 5 7 9 10 8 -3 5 (d) Calculate for each share: iii. Mean returns. iv. Standard deviation of returns. (e) You decided to invest 70% in Share A and 30% in Share B. Calculate your portfolio return and the portfolio risk.arrow_forwardConsider the following information on a portfolio of three stocks: State of Economy Probability of State of Economy Stock A Rate of Return Stock B Rate of Return Stock C Rate of Return Boom.13.02.32.50 Normal.55.10.22.20 Bust .32.16.21.35 If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio's expected return, the variance, and the standard deviation? Note: Do not round intermediate calculations. Round your variance answer to 5 decimal places, e.g., 16161. Enter your other answers as a percent rounded to 2 decimal places, e. g., 32.16. If the expected T-bill rate is 4.25 percent, what is the expected risk premium on the portfolio? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.arrow_forwardKindly explain all steps please, concept plsss stepwise.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education