Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

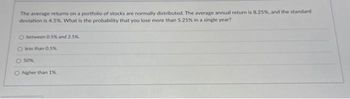

Transcribed Image Text:The average returns on a portfolio of stocks are normally distributed. The average annual return is 8.25%, and the standard

deviation is 4,5%. What is the probability that you lose more than 5.25% in a single year?

O between 0.5% and 2.5%

O less than 0.5%

O 50%

O higher than 1%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that your estimates of the possible one-year returns from investing in the common stock of the AYZ Corporation were as follows: Probability of occurrence 0.15 0.25 0.3 0.15 0.15 Possible return -10% 5% 20% 35% 50% What are the expected return? Calculate the standard deviation?arrow_forwardTyler Trucks stock has an annual return mean and standard deviation of 12.5 percent and 46 percent, respectively. Michael Moped Manufacturing stock has an annual return mean and standard deviation of 12.0 percent and 46 percent, respectively. Your portfolio allocates equal funds to Tyler Trucks stock and Michael Moped Manufacturing stock. The return correlation between Tyler Trucks and Michael Moped Manufacturing is -.50. What is the smallest expected loss for your portfolio in the coming month with a probability of 1.0 percent? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places. Smallest expected loss %arrow_forwardStock R has a beta of 2.5, Stock S has a beta of 0.65, the required return on an average stock is 14%, and the risk-free rate of return is 6%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? Round your answer to two decimal places. %arrow_forward

- Expected returnarrow_forwardAssume that the risk-free rate is 6.4% and the market return is 8%. Calculate the expected rate of return of a stock with a volatility (beta) of 3%.arrow_forwardAssume the risk-free rate is 3% and the market return is 10%. Stock X Stock Y Stock Z Beta 0.65 0.90 Current price $13.50 $26.50 Correlation (X/Y) = 0.35 (X/Z) = 0 (Y/Z) = 0.55 a) Most equity research concludes that Stock X is much more volatile compared to the “market". On average, Stock X's volatility is about 1.5 times that of the stock market. Based on CAPM, estimate the required return of Stock X. b) It is expected that Stock Y will pay a per share dividend of $0.43 one year from now, and the dividend will increase by an average of 6% per year in the foreseeable future. According to CAPM, is Stock Y overvalued or undervalued? c) Assume that Stock Z is fairly-priced today. Stock Z has just paid a dividend of $2. It is expected that its dividend will increase by 50% in the first year, 0% in the second year, 10% in the third year, and starting from the fourth year, the company will maintain the dividend growth rate to be 5% forever. How much would Stock Z be worth today if its…arrow_forward

- Read the information for 3 stocks X, Y and Z below. Rate of return when state occurs (For Stock X, Y, and Z) State of Economy Probability of State Stock X Stock Y Stock Z Boom 0.3 0.4 0.45 0.6 Normal 0.5 0.2 0.15 0.08 Recession 0.2 0 -0.3 -0.4 If your portfolio includes 35 percent of X, 40 percent of Y and 25 percent of Z, answerthe following questions: (a) Calculate the portfolio expected return.(b) Calculate the variance and the standard deviation of the portfolio (c) If the expected T-bill rate is 3.80 percent, calculate the expected risk premiumon the portfolio.arrow_forwardwhat is the expected return and should you buy it?arrow_forwardStock R has a beta of 2.0, Stock S has a beta of 0.35, the required return on an average stock is 9%, and the risk-free rate of return is 3%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? Round your answer to two decimal places. %arrow_forward

- You expect the risk-free rate to be 4 percent and the market return to be 10 percent. You also have the following information about three stocks. Current Expected Expected Stock Beta Price Price Dividend U 1.5 $10 $11.50 $1.00 N 1.1 $27 $30 $0.00 Ο 0.8 $35 $36 $1.50 (Question 2 of 2) What is the required rate of return (based on the CAPM) for an equally weighted portfolio of the three stocks? (Enter your answer as a percentage, i.e., "10.25" for 10.25 percentarrow_forwardThe returns of a stock follow the normal distribution, with average return of 13.2% and standard deviation of 23.7%. What is the probability that in any given year, the stock's return will be between -34.2% and +36.9%? Assume the following: the one standard deviation probability range is 0.68; the two standard deviation probability range is 0.95; and the three standard deviation probability range is 0.99. 0.685 O 0.955 O 0.750 0.815 O 0.950arrow_forwardA stock has a required return of 10%; the risk- free rate is 3.5%, and the market risk premium is 4%. a. What is the stock's beta? b. If the market risk premium increased to 10%, what would happen to the stock's required rate of return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education