Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

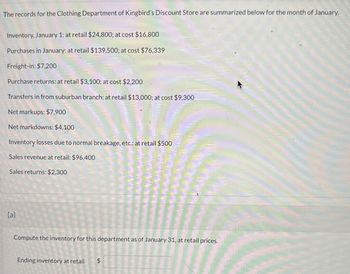

Transcribed Image Text:The records for the Clothing Department of Kingbird's Discount Store are summarized below for the month of January.

Inventory, January 1: at retail $24,800; at cost $16,800

Purchases in January: at retail $139,500; at cost $76,339

Freight-in: $7,200

Purchase returns: at retail $3,100; at cost $2,200

Transfers in from suburban branch: at retail $13,000; at cost $9,300

Net markups: $7,900

Net markdowns: $4,100

Inventory losses due to normal breakage, etc.: at retail $500

Sales revenue at retail: $96,400

Sales returns: $2,300

(a)

Compute the inventory for this department as of January 31, at retail prices.

Ending inventory at retail

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Logo Gear purchased $2,250 worth of merchandise during the month, and its monthly income statement shows cost of goods sold of $2,000. What was the beginning inventory if the ending inventory was $1,000?arrow_forwardThe records for the Clothing Department of Oriole's Discount Store are summarized below for the month of January. Inventory, January 1: at retail $25,300; at cost $17,300 Purchases in January: at retail $137,800; at cost $84,760 Freight-in: $7,200 Purchase returns: at retail $2,900; at cost $2,200 Transfers in from suburban branch: at retail $13,200; at cost $9,100 Net markups: $8,100 Net markdowns: $4,000 Inventory losses due to normal breakage, etc.: at retail $400 Sales revenue at retail: $96,700 Sales returns: $2,400arrow_forwardThe records for the Clothing Department of Sheffield's Discount Store are summarized below for the month of January. Inventory, January 1: at retail $24,900; at cost $17,200 Purchases in January: at retail $139,300; at cost $85,588 Freight-in: $6,900 Purchase returns: at retail $3,100; at cost $2,400 Transfers in from suburban branch: at retail $12,800; at cost $9,000 Net markups: $7,800 Net markdowns: $3,900 Inventory losses due to normal breakage, etc.: at retail $400 Sales revenue at retail: $96,100 Sales returns: $2,300 (a) ✓ Your answer is correct. Compute the inventory for this department as of January 31, at retail prices. Ending inventory at retail $ 83600 (b) eTextbook and Media × Your answer is incorrect. Compute the ending inventory using lower-of-average-cost-or-market. Ending inventory at lower-of-average-cost-or-market $ 53760 Attempts: 3 of 5 usedarrow_forward

- The records for the Clothing Department of Sage's Discount Store are summarized below for the month of January. Inventory, January 1: at retail $24,900; at cost $16,600 Purchases in January: at retail $138,700; at cost $81,892 Freight-in: $7,000 Purchase returns: at retail $3,000; at cost $2,200 Transfers in from suburban branch: at retail $12,800; at cost $9,300 Net markups: $8,200 Net markdowns: $4,000 Inventory losses due to normal breakage, etc: at retail $400 Sales revenue at retail: $96,600 Sales returns: $2,400arrow_forwardThe records for the Clothing Department of Blossom's Discount Store are summarized below for the month of January. Inventory, January 1: at retail $25,000; at cost $17,200 Purchases in January: at retail $138,900; at cost $80,320 Freight-in: $6,900 Purchase returns: at retail $3,000; at cost $2,400 Transfers in from suburban branch: at retail $13,100; at cost $9,000 Net markups: $8,000 Net markdowns: $3,900 Inventory losses due to normal breakage, etc.: at retail $500 Sales revenue at retail: $95,500 Sales returns: $2,300 (a) × Your answer is incorrect. Compute the inventory for this department as of January 31, at retail prices. Ending inventory at retail +A $ 35496arrow_forwardThe records of Hamilton Apparel display the following data for the month of October: Sales $72,500 Purchase (at cost) $35,000 Sales returns $1,500 Purchase (at retail) $65,800 Markups $6,500 Purchase return (at cost) $1,500 Markup cancellations $900 Purchase return (at retail) $2,100 Markdowns $5,200 Beginning inventory (at cost) $20,500 Markdown cancellations $1,200 Beginning inventory (at retail) $30,700 Freight on purchase $2,200 Required: a. Estimate the ending inventory using the retail inventory method. Round the cost ratio to two decimal places based on % (e.g, 36.76%). [Please note it is NOT conventional retail method]. ۵ b. Estimate the ending inventory using the conventional retail inventory method. Round the cost ratio to two decimal places based on % (e.g, 36.76%).arrow_forward

- The records of Hamilton Apparel display the following data for the month of October: Sales $72,500 Purchase (at cost) $35,000 Sales returns $1,500 Purchase (at retail) $65.800 Markups $6,500 Purchase return (at cost) $1,500 Markup cancellations $900 Purchase return (at retail) $2,100 Markdowns $5,200 Beginning inventory (at cost) $20,500 Markdown cancellations $1,200 Beginning inventory (at retail) $30,700 Freight on purchase $2,200 Required: a. Estimate the ending inventory using the retail inventory method. Round the cost ratio to two decimal places based on % (e.g, 36.76%). [Please note it is NOT conventional retail method]. W b. Estimate the ending inventory using the conventional retail inventory method. Round the cost ratio to two decimal places based on % (e.g, 36.76%).arrow_forwardThe records of Hot’s Department Store report the following data for the month of January: Beginning inventory at cost P 440,000 Beginning inventory at sales price 800,000 Purchases at cost 4,500,000 Initial markup on purchases 2,900,000 Purchase returns at cost 240,000 Purchase returns at sales price 350,000 Freight on purchases 100,000 Additional markup 250,000 Markup cancellations 100,000 Markdown 600,000 Markdown cancellations 100,000 Net sales 6,500,000 Sales allowance 100,000 Sales returns 500,000 Employee discounts 200,000 Theft and other losses 100,000 Using the average retail inventory method, Hot’s ending inventory at cost isarrow_forwardThe records of Carla's Boutique report the following data for the month of April. Sales revenue $95,600 Purchases (at cost) $47,200 Sales returns 1,800 Purchases (at sales price) 85,800 Markups 9,500 Purchase returns (at cost) 1,800 Markup cancellations 1,400 Purchase returns (at sales price) 2,800 Markdowns 8,600 Beginning inventory (at cost) 36,103 Markdown cancellations 2,700 Beginning inventory (at sales price) 50,600 Freight on purchases 2,100 Compute the ending inventory by the conventional retail inventory method. (Round ratios for computational purposes to O decimal places, eg 78% and final answer to O decimal places, eg. 28,987.) Ending inventory using conventional retail inventory method 2$arrow_forward

- General Accountarrow_forwardCompute the inventory for this department as of January 31, at retail prices. Ending Inventory $ ______________arrow_forwardThe records of Sage’s Boutique report the following data for the month of April. Sales revenue $91,200 Purchases (at cost) $45,400 Sales returns 1,900 Purchases (at sales price) 92,100 Markups 10,000 Purchase returns (at cost) 1,900 Markup cancellations 1,300 Purchase returns (at sales price) 3,000 Markdowns 9,200 Beginning inventory (at cost) 36,560 Markdown cancellations 2,600 Beginning inventory (at sales price) 44,200 Freight on purchases 2,300 Compute the ending inventory by the conventional retail inventory method. (Round ratios for computational purposes to 0 decimal places, e.g. 78% and final answer to 0 decimal places, e.g. 28,987.) Ending inventory using conventional retail inventory method $enter the dollar amount of the ending inventory by the conventional retail inventory method rounded to 0 decimal placesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College