FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

The production manager of Rordan Corporation has submitted the following quarterly production

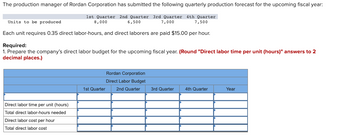

Transcribed Image Text:The production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year:

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

8,000

6,500

Units to be produced

7,000

7,500

Each unit requires 0.35 direct labor-hours, and direct laborers are paid $15.00 per hour.

Required:

1. Prepare the company's direct labor budget for the upcoming fiscal year. (Round "Direct labor time per unit (hours)" answers to 2

decimal places.)

Direct labor time per unit (hours)

Total direct labor-hours needed

Direct labor cost per hour

Total direct labor cost

1st Quarter

Rordan Corporation

Direct Labor Budget

2nd Quarter

3rd Quarter 4th Quarter

Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The income statement for the first quarter of 2019 was as follows: Income Statement For the Quarter Ended March 31, 2019 Sales Cost of goods sold Gross profit Operating expenses ales salaries Rent expense Depreciation Utilities Miscellaneous Total operating expenses Net income $52,000 24,000 12,000 3,600 12,800 $720,000 396,000 324,000 104,400 $219,600 Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2020.arrow_forwardThe production department of Headstrong Company has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Units to be produced 8,100 9,100 7,100 6,100 In addition, the beginning raw materials inventory for the first quarter is budgeted to be 1,950 kilograms and the beginning accounts payable for the first quarter are budgeted to be $3,490. Each unit requires 3.1 kg of raw material that costs $2.50 per kilogram. Management desires to end each quarter with an inventory of raw materials equal to 10% of the following quarter’s production needs. The desired ending inventory for the fourth quarter is 2,325 kilograms. Management plans to pay for 80% of raw material purchases in the quarter acquired and 20% in the following quarter. Each unit requires 0.6 direct labour-hours, and direct labour-hour workers are paid $19.5 per hour. Required: 1-a. Prepare the company's direct…arrow_forwardPrepare the direct material budgets for the upcoming five years. The budgets should also include a schedule of expected cash disbursements for purchase of materials, by year and in total. Make your assumptions about the safety stock of materials and the timing of payments clear. Total Raw materials $23 ( Distilled water $2, Rose oil $2, Sandalwood $2, Cedar $2, Musk $8, vanilla $5, Ethyl $1, Methyl $1) Box $10 Bottle $20 Labour $7arrow_forward

- Sales budget data for Paige Company are given in BE9.2. Management desires to have an ending finished goods inventory equal to 25% of the next quarter’s expected unit sales. Prepare a production budget by quarters for the first 6 months of 2020.arrow_forwardBlue Wave Co. predicts the following unit sales for the coming four months: September, 3,300 units; October, 4,900 units; November, 6,700 units; and December, 7,900 units. The company's policy is to maintain finished goods inventory equal to 50% of the next month's sales. At the end of August, the company had 2,800 finished units on hand. Prepare a production budget for each of the months of September, October, and November. Blue Wave Co. Production Budget September, October and November September Next month's budgeted sales (units) Units to be produced % October % November %arrow_forwardS ABC Company's raw materials purchases for June, July, and August are budgeted at $39,000, $29,000, and $54,000, respectively. Based on past experience, ABC expects that 70% of a month's raw material purchases will be paid in the month of purchase and 30% in the month following the purchase. Required: Prepare an analysis of cash disbursements from raw materials purchases for ABC Company for August. Budgeted raw material purchases August cash payments: Current month's purchases Prior month's purchases Total cash payments June July August $ 0arrow_forward

- GIVEN: Below is a Production Budget for the third quarter of a company's fiscal year that includes forecasted monthly unit sales. Additionally, management wishes to have 20% of the following month's unit sales as Desired Ending Inventory. July Aug Sep Q3 Oct Unit Sales: 30,000 32,000 34,000 38,000 Desired Ending Inventory: Total Required Units: Beginning Inventory: No. of Units to be Produced: 6,000 22) The Desired Beginning Inventory for August is: A) 6,000 B) 6,400 C) 6,800 D) 7,000 23) The number of units to be produced in September is: A) 34,800 B) 38,800 C) 41,600 D) 46,400arrow_forwardPrepare a production budget for the months of April, May, and June.arrow_forwardD’s Company Ltd expects to have a cash balance of $45000 on March 1, 2024.Relevant monthly budget data for the months of March and April are as follows:• Collections from customers: March $85000; April $150000• Payments for direct materials: March $50000; April $75000• Direct labour: March $30000; April $45000. Wages are paid in the month they are incurred.• Manufacturing overhead: March $21000; April $25000. These costs include depreciation of$1500 per month. All other overhead costs are paid as incurred.• Selling and administrative expenses: March $15000; April $20000. These costs are exclusive ofdepreciation. They are paid as incurred.• Sales of marketable securities in March are expected to be realised $12000 in cash.D’s Company Ltd. has a line of credit at a local bank that enables it to borrow up to$25000. Thecompany wants to maintain a minimum monthly cash balance of $20000. prepare cash budgets for march n april 2024arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education