FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

On January 1, 2020, the Ivanhoe Company budget committee has reached agreement on the following data for the 6 months ending June 30, 2020.

| Sales units: | First quarter 6,000; second quarter 6,900; third quarter 7,400. | |

| Ending raw materials inventory: | 40% of the next quarter’s production requirements. | |

| Ending finished goods inventory: | 25% of the next quarter’s expected sales units. | |

| Third-quarter production: | 7,840 units. |

The ending raw materials and finished goods inventories at December 31, 2019, follow the same percentage relationships to production and sales that occur in 2020. 4 pounds of raw materials are required to make each unit of finished goods. Raw materials purchased are expected to cost $5 per pound.

Transcribed Image Text:Prepare a direct materials budget by quarters for the 6-month period ended June 30, 202O.

IVANHOE COMPANY

Direct Materials Budget

For the Six Months Ending June 30, 2020

Quarter

1

2

Units to be Produced

Direct Materials Per Unit

Total Pounds Needed for Production

Add +:

Desired Ending Direct Materials (Pounds)

Total Materials Required

Less :

Beginning Direct Materials (Pounds)

Direct Materials Purchases

Cost Per Pound

Total Cost of Direct Materials Purchases

$

%24

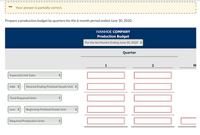

Transcribed Image Text:Your answer is partially correct.

Prepare a production budget by quarters for the 6-month period ended June 30, 2020.

IVANHOE COMPANY

Production Budget

For the Six Months Ending June 30, 2020 +

Quarter

1

2

M

Expected Unit Sales

Add +:

Desired Ending Finished Goods Unit +

Total Required Units

Less +:

Beginning Finished Goods Unit

Required Production Units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Scannell, Inc. sells tire rims. Its sales budget for the nine months ended September 30, 2024, and additional information follow: (Click the icon to view the budget.) (Click the icon to view additional information.) Prepare an inventory, purchases, and cost of goods sold budget for each of the first three quarters of the year. Compute cost of goods sold for the entire nine-month period. Plus: Less: More info Scannell, Inc. Inventory, Purchases, and Cost of Goods Sold Budget Nine Months Ended September 30, 2024 Quarter Ended March 31 In the past, cost of goods sold has been 40% of total sales. The director of marketing and the financial vice president agree that each quarter's ending inventory should not be below $15,000 plus 10% of cost of goods sold for the following quarter. The marketing director expects sales of $200,000 during the fourth quarter. The January 1 inv ory was $19,000. Print Done X Data table Cash sales, 30% Credit sales, 70% Total sales $ $ Quarter Ended June 30…arrow_forwardOn January 1, 2022, the Bramble Company budget committee has reached agreement on the following data for the 6 months ending June 30, 2022. Sales units: Ending raw materials inventory: Ending finished goods inventory: Third-quarter production: First quarter 5,800; second quarter 6,960; third quarter 8,120. 40% of the next quarter's production requirements. 25% of the next quarter's expected sales units. 8,470 units. The ending raw materials and finished goods inventories at December 31, 2021, follow the same percentage relationships to production and sales that occur in 2022. Three pounds of raw materials are required to make each unit of finished goods. Raw materials purchased are expected to cost $4 per pound. Prepare a production budget by quarters for the 6-month period ended June 30, 2022. BRAMBLE COMPANY Production Budget 1 Quarter 2arrow_forwardThe income statement for the first quarter of 2019 was as follows: Income Statement For the Quarter Ended March 31, 2019 Sales Cost of goods sold Gross profit Operating expenses ales salaries Rent expense Depreciation Utilities Miscellaneous Total operating expenses Net income $52,000 24,000 12,000 3,600 12,800 $720,000 396,000 324,000 104,400 $219,600 Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2020.arrow_forward

- Lily’s Manufacturing Company has budgeted the following unit sales: 2021 Units January 10,000 February 8,000 March 9,000 April 11,000 May 15,000 The finished goods units on hand on December 31, 2020, was 1,000 units. Each unit requires 2 pounds of raw materials that are estimated to cost an average of $3 per pound. It is the company's policy to maintain a finished goods inventory at the end of each month equal to 10% of next month's anticipated sales. They also have a policy of maintaining a raw materials inventory at the end of each month equal to 20% of the pounds needed for the following month's production.…arrow_forwardMary's Baskets Company expects to manufacture and sell 23,000 baskets in 2019 for $6 each. There are 3,000 baskets in beginning finished goods inventory with target ending inventory of 3,000 baskets. The company keeps no work- in-process inventory. What amount of sales revenue will be reported on the 2019 budgeted income statement? O A. $120,000 B. $156,000 OC. $102,000 OD. $138,000 Calculator Nextarrow_forwardHoward Temple, Inc., expects to sell 20,000 pool cues for $12.00 each. Direct materials costs are $2.00, direct man $4.00, and manufacturing overhead is $0.80 per pool cue. The following inventory levels apply to 2020: Beginning Inventory Ending Inventory Direct materials 24,000 units 24,000 units Work-in-Process Inventory 0 units O units Finished Goods Inventory 2,000 units 2,500 units What are the 2020 budgeted costs for direct materials, direct manufacturing labor, and manufacturing overhead. O $48,000; S96,000; $19.200 O $44,000; $88,000, $17.600 O $41.000, $82.000; $16,400 O $40,000, S80,000: $16,000 - Previousarrow_forward

- Sunland Company has accumulated the following budget data for the year 2022: 1. 2. 3. 4. 5. 6. Sales: 29,200 units; unit selling price $82 Cost of one unit of finished goods: direct materials, 2 kg at $5 per kilogram; direct labour, 3 hours at $13 per hour; and manufacturing overhead, $5 per direct labour hour Inventories (raw materials only): beginning, 9,900 kg; ending, 15,700 kg Raw materials cost: $5 per kilogram Selling and administrative expenses: $219,000 Income taxes: 30% of income before income taxes Prepare a schedule showing the calculation of the cost of goods sold for 2022. SUNLAND COMPANY Computation of Cost of Goods Sold For the Year Ending December 31, 2022 Cost of goods sold Manufacturing overhead Beginning inventory Direct materials Ending inventory Number of units sold Selling and administrative expenses Direct labour Cost of one unit of finished goods eTextbook and Media $ $ $arrow_forwardGIVEN: Below is a Production Budget for the third quarter of a company's fiscal year that includes forecasted monthly unit sales. Additionally, management wishes to have 20% of the following month's unit sales as Desired Ending Inventory. July Aug Sep Q3 Oct Unit Sales: 30,000 32,000 34,000 38,000 Desired Ending Inventory: Total Required Units: Beginning Inventory: No. of Units to be Produced: 6,000 22) The Desired Beginning Inventory for August is: A) 6,000 B) 6,400 C) 6,800 D) 7,000 23) The number of units to be produced in September is: A) 34,800 B) 38,800 C) 41,600 D) 46,400arrow_forward6arrow_forward

- Rerun Manufacturing Company is in the process of preparing its 2020 budget and is anticipating the following changes: 30% increase in the number of units sold. 20% increase in the direct material unit cost. 15% increase in the direct labor cost per unit. 10% increase in the manufacturing overhead cost per unit. 20% increase in the sales price. 7% increase in the administrative expenses. Rerun does not keep any units in inventory. The composition of the cost of finished products during 2019 for direct materials, direct labor, and factory overhead, respectively, was in the ratio of 3:2:1. The condensed income statement for 2019 is as follows: Sales (37,000 units) $518,000 25,900 492,100 Less sales returns Net sales Cost of Goods Sold 313,000 Gross Profit $179,100 $ 67,000 Selling Expenses Admin. Expenses 37,000 104,000 Net Income $ 75,100 What are estimated net sales for 2020, assuming the sales return/gross sales relationship remains constant? Multiple Choice $767,676. $685,425.…arrow_forwardCrane Company has 2,120 pounds of raw materials in its December 31, 2026, ending inventory. Required production for January and February of 2027 are 4,240 and 5,300 units, respectively. Two pounds of raw materials are needed for each unit, and the estimated cost per pound is $8. Management desires an ending inventory equal to 25% of next month's materials requirements. Prepare the direct materials budget for January. CRANE COMPANY Direct Materials Budget SA $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education