FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

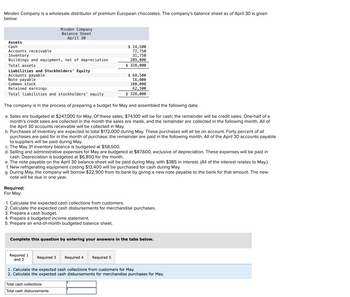

Transcribed Image Text:Minden Company is a wholesale distributor of premium European chocolates. The company's balance sheet as of April 30 is given

below:

Assets

Cash

Accounts receivable

Inventory

Buildings and equipment, net of depreciation

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Minden Company

Balance Sheet

April 30

Note payable

Common stock

Retained earnings

Total liabilities and stockholders' equity

Required:

For May:

The company is in the process of preparing a budget for May and assembled the following data:

a. Sales are budgeted at $247,000 for May. Of these sales, $74,100 will be for cash; the remainder will be credit sales. One-half of a

month's credit sales are collected in the month the sales are made, and the remainder are collected in the following month. All of

the April 30 accounts receivable will be collected in May.

b. Purchases of inventory are expected to total $172,000 during May. These purchases will all be on account. Forty percent of all

purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the April 30 accounts payable

to suppliers will be paid during May.

c. The May 31 inventory balance is budgeted at $58,500.

d. Selling and administrative expenses for May are budgeted at $87,600, exclusive of depreciation. These expenses will be paid in

cash. Depreciation is budgeted at $6,850 for the month.

e. The note payable on the April 30 balance sheet will be paid during May, with $385 in interest. (All of the interest relates to May.)

f. New refrigerating equipment costing $13,400 will be purchased for cash during May.

g. During May, the company will borrow $22,900 from its bank by giving a new note payable to the bank for that amount. The new

note will be due in one year.

4. Prepare a budgeted income statement.

5. Prepare an end-of-month budgeted balance sheet.

1. Calculate the expected cash collections from customers.

2. Calculate the expected cash disbursements for merchandise purchases.

3. Prepare a cash budget.

Required 1

and 2

$ 14,500

72,750

31,750

209,000

$ 328,000

$ 69,500

16,000

180,000

62,500

$ 328,000

Complete this question by entering your answers in the tabs below.

Required 3 Required 4 Required 5

Total cash collections

Total cash disbursements

1. Calculate the expected cash collections from customers for May.

2. Calculate the expected cash disbursements for merchandise purchases for May.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please complete all the requirementsarrow_forwardPlease solve all 4 requirementsarrow_forwardClassique Household Furnishings & Appliances is a family-owned furniture store. You are the management accountant of the concern and have been given the task of preparing the cash budget for the business for the quarter ending September 30, 2018. Your data collection has yielded the following: month Cash Sales Sales on Account Purchases on Account May $50,000 $480,000 $390,000 June $65,000 $600,000 $360,000 July $43,400 $720,000 $450,000 August $52,800 $640,000 $400,000 September $56,750 $800,000 $500,000 ii) An analysis of the records shows that trade receivables (accounts receivable) for sales on accountare settled according to the following credit pattern, in accordance with the credit terms 5/30, n90:50% in the month of sale35% in the first month following the sale15% in the second month following the sale iii) Accounts payable are settled as follows, in accordance with the credit terms – 4/30, n60:70% in the month in which the inventory is purchased30% in the…arrow_forward

- On March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the company's sales are made on account. The following information has been provided by Spicer's management. Month January February March April May Credit Sales $ 300,000 (actual) 400,000 (actual) 559,000 (estimated) 556,000 (estimated) 800,000 (estimated) The company's collection activity on credit sales historically has been as follows. Collections in the month of the sale Collections one month after the sale. Collections two months after the sale Uncollectible accounts. 50% 30 Cash balance on March 31 Cash balance on April 30 Cash balance on May 31 15 5 Spicer's total cash expenditures for March, April, and May have been estimated at $1.200,000 (an average of $400.000 per month). Its cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter. Compute Spicer's budgeted cash…arrow_forwardOn March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the company's sales are made on account. The following information has been provided by Spicer's management. Month Credit Sales January $ 300,000 (actual) February 400,000 (actual) March 629,000 (estimated) April 571,000 (estimated) May 800,000 (estimated) The company's collection activity on credit sales historically has been as follows. Collections in the month of the sale 50 % Collections one month after the sale 30 Collections two months after the sale 15 Uncollectible accounts 5 Spicer's total cash expenditures for March, April, and May have been estimated at $1,200,000 (an average of $400, 000 per month). Its cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter. Compute Spicer's budgeted cash balance at the ends of March, April, and May.arrow_forwardPrepare the following budgets for the months of April, May, and June: 1. Sales budget. 2. Production budget.3. Direct materials budget. The management of Zigby Manufacturing prepared the following balance sheet for March 31. ZIGBY MANUFACTURING Balance Sheet March 31 Assets Liabilities and Equity Cash $ 65,000 Liabilities Accounts receivable 399,000 Accounts payable $ 204,500 Raw materials inventory 90,200 Loan payable 27,000 Finished goods inventory 308,028 Long-term note payable 500,000 $ 731,500 Equipment $ 630,000 Equity Less: Accumulated depreciation 165,000 465,000 Common stock 350,000 Retained earnings 245,728 595,728 Total assets $ 1,327,228 Total liabilities and equity $ 1,327,228 To prepare a master budget for April, May, and June, management gathers the following information. Sales for March total 22,800 units. Budgeted sales in units follow: April, 22,800; May, 16,000; June, 23,000; and July, 22,800.…arrow_forward

- The management accountant at Miller Merchandising & More, Odail Russell is in the process of preparing the cash budget for the business for the fourth quarter of 2021. It is customary for the business to borrow money during this quarter. Extracts from the sales and purchases budgets are as follows: Month Cash Sales Sales on account Purchase August September October November December $85[m1] ,000 $70,000 $88,550 $77,160 $174,870 $640,000 $550,000 $600,000 $800,000 $500,000 $420,000 $550,000 $500,000 $600,000 $450,000 An analysis of the records shows that trade receivables are settled according to the following credit pattern, in accordance with the credit terms 4/30, n90: 50% in the month of sale 30% in the first month following the sale 20% in the second month following the sale Expected purchases include monthly cash purchases of 5%. All other purchases are on account. Accounts payable are settled as follows, in…arrow_forwardA Company is preparing a cash budget for June The company has $83,750 cash at the beginning of June and anticipates $102,930 in cash receipts and $116,870 in cash disbursements during June. This company has an agreement with its bank to maintain a cash balance of at least $81 250. As of May 31. the company owes $30,000 to the bank To maintain the $81.250 required balance, during June the company must O Borrow $11 440 O Repay $13,940 O Borrow $30 000 Repay $30,000 O Repay $11,440arrow_forwardThe management accountant at Miller Merchandising & More, Odail Russell is in the process of preparing the cash budget for the business for the fourth quarter of 2021. It is customary for the business to borrow money during this quarter. Extracts from the sales and purchases budgets are as follows: Cash Sales Month Sales On Account Purchases August $85,000 $640,000 $420,000 September $70,000 $550,000 $550,000 October $88,550 $600,000 $500,000 November $77,160 $800,000 $600,000 December $174,870 $500,000 $450,000 An analysis of the records shows that trade receivables are settled according to the following credit pattern, in accordance with the credit terms 4/30, n90: 50% in the month of sale 30% in the first month following the sale 20% in the second month following the sale 2) Expected purchases include monthly cash purchases of 5%. All other purchases are on account. Accounts…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education