Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

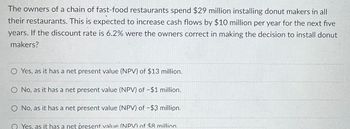

Transcribed Image Text:The owners of a chain of fast-food restaurants spend $29 million installing donut makers in all

their restaurants. This is expected to increase cash flows by $10 million per year for the next five

years. If the discount rate is 6.2% were the owners correct in making the decision to install donut

makers?

O Yes, as it has a net present value (NPV) of $13 million.

O No, as it has a net present value (NPV) of -$1 million.

O No, as it has a net present value (NPV) of -$3 million.

QYes, as it has a net present value (NPV) of $8 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 7arrow_forwardDonna Clark wants to open a restaurant in a historic building. The property can be leased for 20 years but not purchased. She believes her restaurant can generate a net cash flow of $75,000 the first year and expects an annual growth rate of 4 percent thereafter. If a discount rate of 17 percent is used to evaluate this business, what is the present value of the cash flows that it will generate? (Round factor values to 5 decimal places, e.g. 1.52145 and final answer to 2 decimal places, e.g. 52.75.) Present value tAarrow_forwardYou have been asked to analyze the net present value of building a bridge in Asia. You estimate that building the bridge will cost you $50 million up front and that it will generate $4 million in cash flows next year via toll collection and that these cash flows will grow 10% a year for the following four years (Years 2-5). After year 5, you expect the cash flows to continue to grow at the inflation rate (2%). Assuming a cost of capital of 8%, what is the NPV of this project to you? Would you recommend taking on this project and why?arrow_forward

- 5. Southwestern Moving and Storage wants to have enough money to purchase a new tractor-trailer in 3 years. If the unit will costs approximately $450,000 three years from now, how much should the company set aside each year if the account earns 4% per year? Show your cash flow diagram.arrow_forwardA neighborhood shopping center is expected to generate after-tax cash flow of $750,000 per year (at end of year) indefinitely. If an interested buyer has a cost of money of 13 %, how much will he be willing to pay for this shopping center? A $6.64 million B) $7.50 million $5.77 million D $2.21 millionarrow_forward1. A consulting firm is considering the purchase of a new computer system for their enterprise management needs. A vendor has quoted a purchase price of $240,000. The consulting firm plans to borrow one-fourth of the purchase price from a bank at 8% compounded annually. The loan is to be repaid in equal annual payments over a six year period. The remainder of the purchase price is available through other funding sources (e.g. not a loan or money that must be repaid). The time. computer system is expected to last eight years and has a salvage value of $8,000 at that During the 8-year period, the consultant firm also expects to pay a technician $25,000 per year to maintain the system but will also save an estimated $55,000 per year through increased efficiencies in operations. The consulting firm project manager has determined that a MARR of 12%/year should be used to evaluate this investment project. What is the external rate of return for the investment project? Should the new computer…arrow_forward

- (Ignore income taxes in this problem.) Your Company uses a discount rate of 10%. The company has an opportunity to buy a machine now for $38,000 that will yield cash inflows of $10,000 per year for each of the next five years. The machine would have no salvage value. The net present value of this machine to the nearest whole dollar is: If the NPV is negative, enter your number with a – in front. Otherwise, just enter the number.arrow_forwardYou run a construction firm. You have just won a contract to build a government office complex. Building it will require an investment of $9.5 million today and $5.5 million in one year. The government will pay you $21.7 million in one year upon the building's completion. Suppose the interest rate is 10.3%. a. What is the NPV of this opportunity? b. How can your firm turn this NPV into cash today? www. a. What is the NPV of this opportunity? The NPV of the proposal is $ million. (Round to two decimal places.) b. How can your firm turn this NPV into cash today? (Select the best choice below.) O A. The firm can borrow $19.67 million today and pay it back with 10.3% interest using the $21.7 million it will receive from the government. B. The firm can borrow $15.0 million today and pay it back with 10.3% interest using the $21.7 million it will receive from the government. O C. The firm can borrow $15.0 million today and pay it back with 10.3% interest using the $19.67 million it will…arrow_forwardA small northern California consulting firm wants to start a recapitalization pool for replacement of network servers. If the company invests $14,000 at the end of year 1 but decreases the amount invested by 5% each year, how much will be in the account 5 years from now? Interest is earned at a rate of 12% per year. Five years from now, the account will have $.arrow_forward

- The owners of a chain of fast-food restaurants spend $26 million installing donut makers in all their restaurants. This is expected to increase cash flows by $9 million per year for the next five years. If the discount rate is 6.7%, were the owners correct in making the decision to install donut makers? A. No, as it has a net present value (NPV) of - $1.12 million. B. Yes, as it has a net present value (NPV) of $11.2 million. O C. No, as it has a net present value (NPV) of - $2.24 million. D. Yes, as it has a net present value (NPV) of $6.72 million.arrow_forwardYou wrote a piece of software that does a better job of allowing computers to network than any other program designed for this purpose. A large networking company wants to incorporate your software into its systems and is offering to pay you $549,000 today, plus $549,000 at the end of each of the following six years, for permission to do this. If the appropriate interest rate is 6 percent, what is the present value of the cash flow stream that the company is offering you? (Round factor values to 4 decimal places, e.g. 1.5215 and final answer to 2 decimal places, e.g. 15.25.) Present value $arrow_forwardThe owners of a chain of fast-food restaurants spend $25 million installing donut makers in all their restaurants. This is expected to increase cash flows by $9 million per year for the next five years. the discount rate is 6.2%, were the owners correct in making the decision to install donut makers? OA. Yes, as it has a net present value (NPV) of $8 million. O B. Yes, as it has a net present value (NPV) of $13 million. OC. No, as it has a net present value (NPV) of - $3 million. OD. No, as it has a net present value (NPV) of $1 million. Carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education