Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

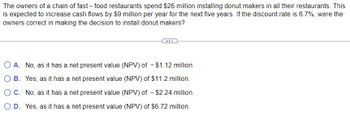

Transcribed Image Text:The owners of a chain of fast-food restaurants spend $26 million installing donut makers in all their restaurants. This

is expected to increase cash flows by $9 million per year for the next five years. If the discount rate is 6.7%, were the

owners correct in making the decision to install donut makers?

A. No, as it has a net present value (NPV) of - $1.12 million.

B. Yes, as it has a net present value (NPV) of $11.2 million.

O C. No, as it has a net present value (NPV) of - $2.24 million.

D. Yes, as it has a net present value (NPV) of $6.72 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. A consulting firm is considering the purchase of a new computer system for their enterprise management needs. A vendor has quoted a purchase price of $240,000. The consulting firm plans to borrow one-fourth of the purchase price from a bank at 8% compounded annually. The loan is to be repaid in equal annual payments over a six year period. The remainder of the purchase price is available through other funding sources (e.g. not a loan or money that must be repaid). The time. computer system is expected to last eight years and has a salvage value of $8,000 at that During the 8-year period, the consultant firm also expects to pay a technician $25,000 per year to maintain the system but will also save an estimated $55,000 per year through increased efficiencies in operations. The consulting firm project manager has determined that a MARR of 12%/year should be used to evaluate this investment project. What is the external rate of return for the investment project? Should the new computer…arrow_forward(Ignore income taxes in this problem.) Your Company uses a discount rate of 10%. The company has an opportunity to buy a machine now for $38,000 that will yield cash inflows of $10,000 per year for each of the next five years. The machine would have no salvage value. The net present value of this machine to the nearest whole dollar is: If the NPV is negative, enter your number with a – in front. Otherwise, just enter the number.arrow_forwardThe owners of a chain of fast-food restaurants spend $29 million installing donut makers in all their restaurants. This is expected to increase cash flows by $10 million per year for the next five years. If the discount rate is 6.2% were the owners correct in making the decision to install donut makers? O Yes, as it has a net present value (NPV) of $13 million. O No, as it has a net present value (NPV) of -$1 million. O No, as it has a net present value (NPV) of -$3 million. QYes, as it has a net present value (NPV) of $8 million.arrow_forward

- A small northern California consulting firm wants to start a recapitalization pool for replacement of network servers. If the company invests $14,000 at the end of year 1 but decreases the amount invested by 5% each year, how much will be in the account 5 years from now? Interest is earned at a rate of 12% per year. Five years from now, the account will have $.arrow_forwardYou are operating an old machine that is expected to produce a cash inflow of $5,100 in each of the next 3 years before it fails. You can replace it now with a new machine that costs $20,100 but is much more efficient and will provide a cash flow of $10,150 a year 4 years. Calculate the equivalent annual cost of the new machine if the discount rate is 14%. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Equivalent ann the purchase price Should you replace your equipment now? Yes Noarrow_forwardYou wrote a piece of software that does a better job of allowing computers to network than any other program designed for this purpose. A large networking company wants to incorporate your software into its systems and is offering to pay you $549,000 today, plus $549,000 at the end of each of the following six years, for permission to do this. If the appropriate interest rate is 6 percent, what is the present value of the cash flow stream that the company is offering you? (Round factor values to 4 decimal places, e.g. 1.5215 and final answer to 2 decimal places, e.g. 15.25.) Present value $arrow_forward

- The owners of a chain of fast-food restaurants spend $25 million installing donut makers in all their restaurants. This is expected to increase cash flows by $9 million per year for the next five years. the discount rate is 6.2%, were the owners correct in making the decision to install donut makers? OA. Yes, as it has a net present value (NPV) of $8 million. O B. Yes, as it has a net present value (NPV) of $13 million. OC. No, as it has a net present value (NPV) of - $3 million. OD. No, as it has a net present value (NPV) of $1 million. Carrow_forwardBOYDZ Condiments is a spice-making firm. Recently, it developed a new process for producing spices. The process requires new machinery that would cost $1,618,338, have a life of five years, and would produce the cash flows shown in the following table. Year Cash Flow 1 $442,372 2 -254,300 3 779,920 4 998,420 5 591,480 What is the NPV if the discount rate is 16 percent? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) NPV is $_______arrow_forwardYou are operating an old machine that is expected to produce a cash inflow of $5,600 in each of the next 3 years before it fails. You can replace it now with a new machine that costs $20,600 but is much more efficient and will provide a cash flow of $10,900 a year for 4 years. Calculate the equivalent annual cost of the new machine if the discount rate is 15%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Equivalent annual cost of the purchase price $ 791.60 xarrow_forward

- Nikularrow_forwardYou wrote a piece of software that does a better job of allowing computers to network than any other program designed for this purpose. A large networking company wants to incorporate your software into its systems and is offering to pay you $450,000 today, plus $450,000 at the end of each of the following six years, for permission to do this. If the appropriate interest rate is 6 percent, what is the present value of the cash flow stream that the company is offering you? (Round factor values to 4 decimal places, e.g. 1.5215 and final answer to 2 decimal places, e.g. 15.25.) Present value $arrow_forwardYou own a movie theater. The theater generates $100,000 per year in net income. This is expected to grow at 2% per year. Someone offers to buy the theater from you. How much should you charge as the selling price of the theater? Explain in word form too please to help justify answer!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education