FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

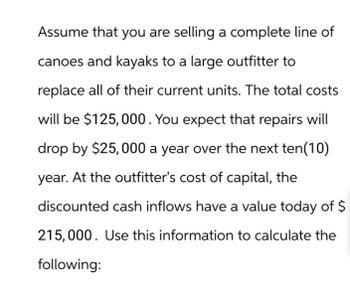

Transcribed Image Text:Assume that you are selling a complete line of

canoes and kayaks to a large outfitter to

replace all of their current units. The total costs

will be $125,000. You expect that repairs will

drop by $25,000 a year over the next ten (10)

year. At the outfitter's cost of capital, the

discounted cash inflows have a value today of $

215,000. Use this information to calculate the

following:

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A construction management company is examining its cash flow requirements for the next few years. The company expects to replace software and in-field computing equipment at various times. Specifically, the company expects to spend $5,000 1 year from now, $11,000 3 years from now, and $17,000 each year in years 6 through 10. What is the future worth in year 10 of the planned expenditures, at an interest rate of 13.00% per year? (Round the final answer to three decimal places.) The future worth is determined to be $arrow_forwardVijayarrow_forwardWe are examining a new project. We expect to sell 6,000 units per year at $74 net cash flow apiece for the next 10 years. In other words, the annual cash flow is projected to be $74 × 6,000 = $444,000. The relevant discount rate is 18 percent, and the initial investment required is $1,710,000. After the first year, the project can be dismantled and sold for $1,540,000. Suppose you think it is likely that expected sales will be revised upward to 9,000 units if the first year is a success and revised downward to 4,600 units if the first year is not a success. a. If success and failure are equally likely, what is the NPV of the project? Consider the possibility of abandonment in answering. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the value of the option to abandon? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- Herky Foods is considering acquisition of a new wrapping machine. By purchasing the machine, Herky will save money on packaging in each of the next 5 years, producing the series of cash inflows shown in the following table: The initial investment is estimated at $1.46 million. Using a 9% discount rate, determine the net present value (NPV) of the machine given its expected operating cash inflows. Based on the project's NPV, should Herky make this investment? The net present value (NPV) of the new wrapping machine is $. (Round to the nearest cent.)arrow_forward(Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $6,000,000 and would generate annual net cash inflows of $1,100,000 per year for 9 years. Calculate the project's NPV using a discount rate of 5 percent. If the discount rate is 5 percent, then the project's NPV is $___________________(Round to the nearest dollar.)arrow_forwardVishanoarrow_forward

- You are thinking of making an investment in a new factory. The factory will generate revenues of $1,960,000 per year for as long as you maintain it. You expect that the maintenance costs will start at $90,160 per year and will increase 5% per year thereafter. Assume that all revenue and maintenance costs occur at the end of the year. You intend to run the factory as long as it continues to make a positive cash flow (as long as the cash generated by the plant exceeds the maintenance costs). The factory can be built and become operational immediately and the interest rate is 6% per year. a. What is the present value of the revenues? - b. What is the present value of the maintenance costs? c. If the plant costs $19,600,000 to build, should you invest in the factory? EIERarrow_forwardWhat is the net present value of the flier project, which is a 3-year project where Dispersion would spread fliers all over Fairfax? The project would involve an initial investment in equipment of $232,000.00 today. To finance the project, Dispersion would borrow $232,000.00. The firm would receive $232,000.00 from the bank today and would pay the bank $294,695.40 in 3 years (consisting of an interest payment of $62,695.40 and a principal payment of $232,000.00). Cash flows from capital spending would be $0.00 in year 1, $0.00 in year 2, and $30,500.00 in year 3. Operating cash flows are expected to be $144,900.00 in year 1, $99,400.00 in year 2, and -$28,200.00 in year 3. The cash flow effects from the change in net working capital are expected to be -$8,310.00 at time 0; -$21,700.00 in year 1; $12,100.00 in year 2, and $16,900.00 in year 3. The tax rate is 35.00 percent. The cost of capital is 7.45 percent and the interest rate on the loan would be 8.03 percent. -$13,600.79 (plus or…arrow_forwardXYZ, which currently sells art products, is considering project Q, which would involve teaching art lessons For most of its existence, XYZ sold art products, taught art lessons, and painted murals Project Q Would require an initial investment of $87,300 today and is expected to produce annual cash flows of $10,200 each year forever with the first annual cash flow expected in 1 year What is the NPV of project Q. based on the information in this paragraph and the following table and applying the pure play approach to detemining a project's cost of capital? Firm XYZ Frisco Frescos NorCal Art Art Factory Line of business Sells art products Paints murals at residential and commercial sights Teaches art lessons Sells art products, teaches art lessons, & paints murals WACC 144 percent 82 percent 95 percent 77 percent O a. $20,068 (plus or minus $10) Ob. $144,518 (plus or minus $10) OC. $37,090 (plus or minus $10) O d. $45,168 (plus or minus $10) O e. None of the above is within $10 of the…arrow_forward

- The Merriweather Printing Company is trying to decide on the merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each of the next four years. The estimated cash flows associated with this project are as follows: Year. Project cash flow 0 ? 1 $810,000 2 $390,000 3 $260,000 4 $460,000 If you know that the project has a regular payback of 2.4 years, what is the projects IRR?arrow_forwardManagement of Sunland Home Furnishings is considering acquiring a new machine that can create customized window treatments. The equipment will cost $266,550 and will generate cash flows of $81,750 over each of the next six years. If the cost of capital is 15 percent, what is the MIRR on this project? - MMR = ? %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education