Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:1

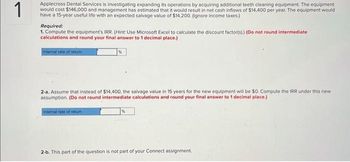

Applecross Dental Services is investigating expanding its operations by acquiring additional teeth cleaning equipment. The equipment

would cost $146,000 and management has estimated that it would result in net cash inflows of $14,400 per year. The equipment would

have a 15-year useful life with an expected salvage value of $14,200. (Ignore income taxes.)

Required:

1. Compute the equipment's IRR. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate

calculations and round your final answer to 1 decimal place.)

Internal rate of return

%

2-a. Assume that instead of $14,400, the salvage value in 15 years for the new equipment will be $0. Compute the IRR under this new

assumption. (Do not round intermediate calculations and round your final answer to 1 decimal place.)

Internal rate of retum

%

2-b. This part of the question is not part of your Connect assignment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- please note there are several required answersarrow_forwardHow do I solve for the chart?arrow_forwardFoster Company wants to buy a special automated machine to replace an existing manual system. The initial outlay (cost) is $3,500,000. The new machine will last 5 years with no expected salvage value. The expected annual cash flows are as follows: Year Cash Inflow Cash Outflow 0 $ - $ 3,500,000.00 1 $ 3,900,000.00 $ 3,000,000.00 2 $ 3,900,000.00 $ 3,000,000.00 3 $ 3,900,000.00 $ 3,000,000.00 4 $ 3,900,000.00 $ 3,000,000.00 5 $ 3,900,000.00 $ 3,000,000.00 Foster has a cost of capital equal to 10%. 1. Calculate the payback period. Payback period: yearsarrow_forward

- Kanye Company is evaluating the purchase of a rebuilt spot-welding machine to be used in the manufacture of a new product. The machine will cost $166,000, has an estimated useful life of 7 years, a salvage value of zero, and will increase net annual cash flows by $32,982. Click here to view the factor table. What is its approximate internal rate of return? (Round answer to O decimal place, e.g. 13%.) Internal rate of return %arrow_forwardDomesticarrow_forwardElijah Enterprises will need to upgrade the computer system in 4 years. They anticipate the upgrade to cost $105,300. If the discount rate is 13%, what will be the required yearly investment needed to obtain the money for the upgrade?Round your (1+R)^n value to 2 decimal places and use that number for your final amount required rounded to the nearest dollar. Future Value / (1+R)^n = Amount Required / = What would be required if the discount rate was 8%? Future Value / (1+R)^n = Amount Required / =arrow_forward

- Elijah Enterprises will need to upgrade the computer system in 5 years. They anticipate the upgrade to cost $98,900. If the discount rate is 15%, what will be the required yearly investment needed to obtain the money for the upgrade?Round your (1+R)^n value to 2 decimal places and use that number for your final amount required rounded to the nearest dollar.arrow_forwardThe production department is proposing the purchase of an automatic insertion machine. It has identified 3 machines, each with an estimated life of 10 years. Which machine offers the best internal rate of return? Annual net cash flows Average investment Machine A only Machine B only Machine C only O Machines A and B Machine A $ 50,000 250,000 Machine B $ 40,000 300,000 Machine $ 75,000 500,000arrow_forwardGodoarrow_forward

- Central Mass Ambulance Service can purchase a new ambulance for $200,000 that will provide an annual net cash flow of $50,000 per year for five years. The salvage value of the ambulance will be $25,000. Assume the ambulance is sold at the end of year 5. Calculate the NPV of the ambulance if the required rate of return is 9%. (Round your answer to the nearest $1.) A) $(10,731) B) $10,731 C) $(5,517) D) $5,517arrow_forwardElijah Enterprises will need to upgrade the computer system in 6 years. They anticipate the upgrade to cost $95,300. If the discount rate is 15%, what will be the required yearly investment needed to obtain the money for the upgrade?Round your (1+R)^n value to 2 decimal places and use that number for your final amount required rounded to the nearest dollar. Future Value / (1+R)^n = Amount Required / = What would be required if the discount rate was 8%? Future Value / (1+R)^n = Amount Required / =arrow_forwardManagement of Daniel Jackson, a confectioner, is considering purchasing a new jelly bean-making machine at a cost of $256,144. They project that the cash flows from this investment will be $102,150 for the next seven years. If the appropriate discount rate is 14 percent, what is the IRR that Daniel Jackson management can expect on this project? (Do not round discount factors. Round other intermediate calculations to 0 decimal places e.g. 15 and final answer to 2 decimal places, e.g. 5.25%.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education