Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:5

nts

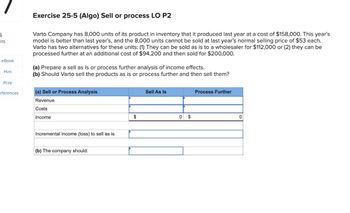

Exercise 25-5 (Algo) Sell or process LO P2

Varto Company has 8,000 units of its product in inventory that it produced last year at a cost of $158,000. This year's

model is better than last year's, and the 8,000 units cannot be sold at last year's normal selling price of $53 each.

Varto has two alternatives for these units: (1) They can be sold as is to a wholesaler for $112,000 or (2) they can be

processed further at an additional cost of $94,200 and then sold for $200,000.

eBook

Hint

(a) Prepare a sell as is or process further analysis of income effects.

(b) Should Varto sell the products as is or process further and then sell them?

Print

eferences

(a) Sell or Process Analysis

Sell As Is

Process Further

Revenue

Costs

Income

Incremental income (loss) to sell as is

(b) The company should:

$

0 $

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Exercise 10-5 (Algo) Sell or process LO P2 Varto Company has 8,000 units of its product in inventory that it produced last year at a cost of $157,000. This year's model is better than last year's, and the 8,000 units cannot be sold at last year's normal selling price of $42 each. Varto has two alternatives for these units: (1) They can be sold as is to a wholesaler for $80,000 or (2) they can be processed further at an additional cost of $207,800 and then sold for $280,000. (a) Prepare a sell as is or process further analysis of income effects. (b) Should Varto sell the products as is or process further and then sell them? (a) Sell or Process Analysis Revenue Costs Income Incremental income (loss) to sell as is (b) The company should: Sell As Is Process Furtherarrow_forwardDo not give image formatarrow_forwardgeneral account questionsarrow_forward

- Solve this question and accounting questionarrow_forward24.2 Jabu manufactures and sells Product X. During the most recent financial period, he sold 500 units at R750 each. There were no units of Product X in opening or closing inventory. Sales people are paid a commission of 5% on sales. The following additional information is available for this sales level: Fixed administrative cost per unit R90.00 Total fixed manufacturing overhead R120 000 Total fixed marketing cost R50 000 Direct material usage per product 2 kg Direct material price per kilogram R14.50 Total direct labour cost R47 500 Required: All manufacturing cost increases with 10%. The marketing director estimates that sales volume will increase with 5% if an advertising campaign of R10 000 is undertaken. What is the operating income for Jabu? Refer to above. Do you think that it is viable for Jabu to…arrow_forwardGive me correct answer for this questionarrow_forward

- Provide answer of this questionarrow_forwardExercise 23-5 (Algo) Sell or process LO P2 Varto Company has 12.200 units of its product in inventory that it produced last year at a cost of $156,000. This year's model is better than last year's, and the 12.200 units cannot be sold at last year's normal selling price of $41 each. Varto has two alternatives for these units ( They can be sold as is to a wholesaler for $109.800 or (2) they can be processed further at an additional cost of $312.100 and then sold for $414,800 (e) Prepare a sell as is or process further analysis of income effects (b) Should Varto sell the products as is or process further and then sell them? Sell or Process Analysis Cests Incremental income foss) to sell as is (b) The company should $ Sell Ass Sell as i 05 Process Fortherarrow_forwardNeed answer of what is the right answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT