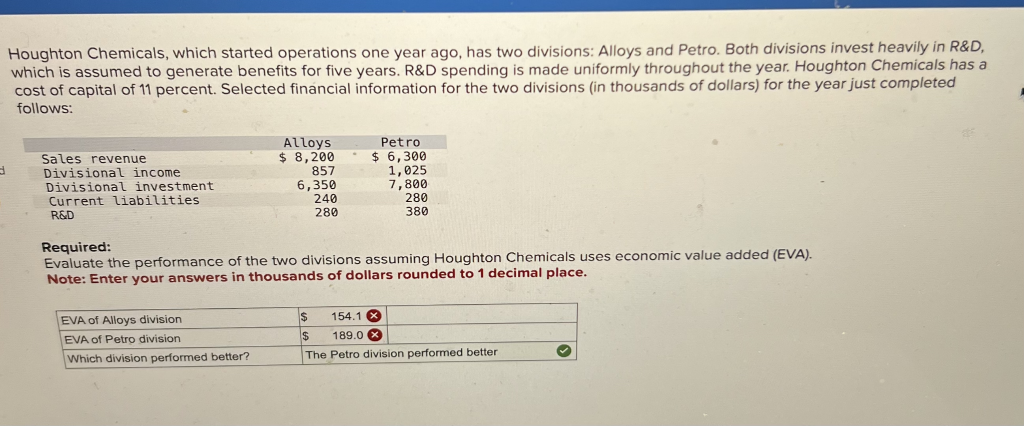

d Houghton Chemicals, which started operations one year ago, has two divisions: Alloys and Petro. Both divisions invest heavily in R&D, which is assumed to generate benefits for five years. R&D spending is made uniformly throughout the year. Houghton Chemicals has a cost of capital of 11 percent. Selected financial information for the two divisions (in thousands of dollars) for the year just completed follows: Sales revenue Divisional income Divisional investment Current liabilities R&D Alloys $ 8,200 857 380 280 LE Petro $ 6,300 1,025 7,800 280 6,350 240 Required: Evaluate the performance of the two divisions assuming Houghton Chemicals uses economic value added (EVA). Note: Enter your answers in thousands of dollars rounded to 1 decimal place. EVA of Alloys division $ 154.1 x EVA of Petro division $ 189.0 x Which division performed better? The Petro division performed better

d Houghton Chemicals, which started operations one year ago, has two divisions: Alloys and Petro. Both divisions invest heavily in R&D, which is assumed to generate benefits for five years. R&D spending is made uniformly throughout the year. Houghton Chemicals has a cost of capital of 11 percent. Selected financial information for the two divisions (in thousands of dollars) for the year just completed follows: Sales revenue Divisional income Divisional investment Current liabilities R&D Alloys $ 8,200 857 380 280 LE Petro $ 6,300 1,025 7,800 280 6,350 240 Required: Evaluate the performance of the two divisions assuming Houghton Chemicals uses economic value added (EVA). Note: Enter your answers in thousands of dollars rounded to 1 decimal place. EVA of Alloys division $ 154.1 x EVA of Petro division $ 189.0 x Which division performed better? The Petro division performed better

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 1CE: Forchen, Inc., provided the following information for two of its divisions for last year: Required:...

Related questions

Question

Transcribed Image Text:d

Houghton Chemicals, which started operations one year ago, has two divisions: Alloys and Petro. Both divisions invest heavily in R&D,

which is assumed to generate benefits for five years. R&D spending is made uniformly throughout the year. Houghton Chemicals has a

cost of capital of 11 percent. Selected financial information for the two divisions (in thousands of dollars) for the year just completed

follows:

Sales revenue

Divisional income

Divisional investment

Current liabilities

R&D

Alloys

$ 8,200

857

380

280

LE

Petro

$ 6,300

1,025

7,800

280

6,350

240

Required:

Evaluate the performance of the two divisions assuming Houghton Chemicals uses economic value added (EVA).

Note: Enter your answers in thousands of dollars rounded to 1 decimal place.

EVA of Alloys division

$

154.1 x

EVA of Petro division

$

189.0 x

Which division performed better?

The Petro division performed better

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning