Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

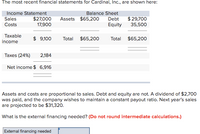

Transcribed Image Text:The most recent financial statements for Cardinal, Inc., are shown here:

Income Statement

Balance Sheet

$27,000

17,900

$29,700

35,500

Sales

Assets $65,200

Debt

Costs

Equity

Тахable

$ 9,100

Total

$65,200

Total

$65,200

income

Taxes (24%)

2,184

Net income $ 6,916

Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2,700

was paid, and the company wishes to maintain a constant payout ratio. Next year's sales

are projected to be $31,320.

What is the external financing needed? (Do not round intermediate calculations.)

External financing needed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The most recent financial statements for Bradley, Inc., are shown here (assuming no income taxes): Sales Costs Income Statement. Net income Assets: Total EFN $6,800 -4,080 $2,720 Balance Sheet. $20,400 Debt $20,400 Equity Total $10,600 9,800 $20,400 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $7,752. What is the external financing needed? (A negative value should be indicated by a minus si Do not round intermediate calculations. Round your answer to the nearest whole number.)arrow_forwardces The most recent financial statements for Bradley, Inc., are shown here (assuming no income taxes): Sales Costs Income Statement Net income Assets Total EFN $9,200 -5,520 $3,680 Balance Sheet Debt Equity $26,680 $26,680 Total $10,800 15,880 $26,680 Check my Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $10,212. What is the external financing needed? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number.)arrow_forwardThe most recent financial statements for Kerch, Inc., are shown here (assuming no income taxes): Income Statement Balance Sheet Sales Costs $9,300 7,330 Assets $20,000 Debt Equity $ 8,000 12,000 Net income $ 1,970 Total $20,000 Total $20,000 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $10,788. What is the external financing needed? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) External financing neededarrow_forward

- The most recent financial statements for Mixton, Incorporated, are shown here: INCOME STATEMENT Sales Costs Taxable income Taxes (22%) Net income $ 52,000 Assets 42,400 $ 9,600 2,112 $ 7,488 Total BALANCE SHEET Debt Equity Total Answer is complete but not entirely correct. External financing needed s 11,990 X $ 115,700 $ 115,700 $ 34,500 81,200 $ 115,700 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2,900 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $61,360. What is the external financing needed? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.arrow_forwardConsider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATIONIncome Statement Sales $ 47,600 Costs 35,600 Taxable income $ 12,000 Taxes (25%) 3,000 Net income $ 9,000 Dividends $ 3,000 Addition to retained earnings 6,000 The balance sheet for the Heir Jordan Corporation follows. Based on this information and the income statement, supply the missing information using the percentage of sales approach. Assume that accounts payable vary with sales, whereas notes payable do not. (Leave no cells blank - be certain to enter "0" whenever the item is not a constant percentage of sales. Enter each answer as a percent rounded 2 decimal places, e.g., 32.16.) HEIR JORDAN CORPORATION Balance Sheet Percentage of Sales Percentage of Sales Assets…arrow_forwardIncome Statement Balance Sheet Sales $ 29,300 Assets $ 22,500 Debt $ 6,000 Costs 22,870 Equity 16,500 Net income $ 6,430 Total $ 22,500 Total $ 22,500 The company has predicted a sales increase of 6 percent. Assume the company pays out half of net income in the form of a cash dividend. Costs and assets vary with sales, but debt and equity do not. Prepare the pro forma statements. (Input all amounts as positive values. Do not round intermediate calculations and round your answers to the nearest whole dollar amount.) Pro forma income statement Pro forma balance sheet Sales Assets Debt Costs Equity Net income Total Total What is the external financing needed?arrow_forward

- You are given the following income statement and balance sheet: Income Statement Sales EBT Taxes (40%) Net Income Cash A/R Inventories Total CA Fixed Assets Total Assets $15,000 $800 $320 $480 Balance Sheet $100 $2,000 $4.000 Accounts Payable Debt Common Stock Retained Eamings $6,100 $1,900 $8,000 Total Claims $1,000 $4,000 $2,000 $1,000 $8,000 Now make the following forecast and assumptions for the upcoming year: Sales are expected to increase by $5.400 over the coming year. All assets and accounts payable can be expressed as a percentage of sales. The firm's profit margin will remain at 3.2 percent. The firm has a dividend payout rate of 75 percent. Using the equation method, determine the additional funds needed for the coming yeaarrow_forwardg. operating profit margin h. long -term debt ratio i. total debt ratioarrow_forwardThe most recent financial statements for Cardinal, Inc., are shown here: Income Statement Sales Costs Taxable income $30,600 18,350 Balance Sheet Assets $72,400 Debt $36,000 Equity 36,400 $12,250 Total $72,400 Total $72,400 Taxes (22%) 2,695 Net income $ 9,555- Assets and costs are proportional to sales. Debt and equity are not. A dividend of $3,600 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $34,272. What is the external financing needed? (Do not round intermediate calculations.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education