Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Follow the table & give solution

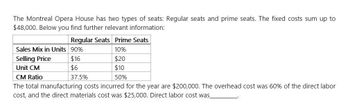

Transcribed Image Text:The Montreal Opera House has two types of seats: Regular seats and prime seats. The fixed costs sum up to

$48,000. Below you find further relevant information:

Regular Seats Prime Seats

Sales Mix in Units 90%

10%

Selling Price

Unit CM

CM Ratio

$16

$6

37.5%

$20

$10

50%

The total manufacturing costs incurred for the year are $200,000. The overhead cost was 60% of the direct labor

cost, and the direct materials cost was $25,000. Direct labor cost was

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Crystal Pools estimates overhead will utilize 250,000 machine hours and cost $750,000. It takes 2 machine hours per unit, direct material cost of $14 per unit, and direct labor of $20 per unit. What is the cost of each unit produced?arrow_forwardRemarkable Enterprises requires four units of part A for every unit of Al that it produces. Currently, part A is made by Remarkable, with these per-unit costs in a month when 4,000 units were produced: Variable manufacturing overhead is applied at $1.60 per unit. The other $0.50 of overhead consists of allocated fixed costs. Remarkable will need 8,000 units of part A for the next years production. Altoona Corporation has offered to supply 8,000 units of part A at a price of $8.00 per unit. If Remarkable accepts the offer, all of the variable costs and $2,000 of the fixed costs will be avoided. Should Remarkable accept the offer from Altoona Corporation?arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forward

- Bobcat uses a traditional cost system and estimates next years overhead will be $800.000, as driven by the estimated 25,000 direct labor hours. It manufactures three products and estimates the following costs: If the labor rate is $30 per hour, what is the per-unit cost of each product?arrow_forwardColonels uses a traditional cost system and estimates next years overhead will be $480,000, with the estimated cost driver of 240,000 direct labor hours. It manufactures three products and estimates these costs: If the labor rate is $25 per hour, what is the per-unit cost of each product?arrow_forwardJay-Zee Company makes an in-car navigation system. Next year, Jay-Zee plans to sell 16,000units at a price of $320 each. Product costs include: Direct materials $68Direct labor $40Variable overhead $12Total fixed factory overhead $500,000 Variable selling expense is a commission of 5 percent of price; fixed selling and administrativeexpenses total $116,400.Required:1. Calculate the sales commission per unit sold. Calculate the contribution margin per unit.2. How many units must Jay-Zee Company sell to break even? Prepare an income statementfor the calculated number of units.3. Calculate the number of units Jay-Zee Company must sell to achieve target operatingincome (profit) of $333,408.4. What if the Jay-Zee Company wanted to achieve a target operating income of $322,000?Would the number of units needed increase or decrease compared to your answer inRequirement 3? Compute the number of units needed for the new target operating income.arrow_forward

- Wyckam Manufacturing Inc. has provided the following information concerning its manufacturing costs: Fixed Cost per Month Direct materials Direct labor $ 42,600 Supplies Utilities Depreciation Insurance $ 1,800 $ 14,600 $ 11,400 Required: Cost per Machine-Hour $ 5.40 $0.30 $ 0.10 For example, utilities should be $1,800 per month plus $0.10 per machine-hour. The company expects to work 4,100 machine-hours in June. Note that the company's direct labor is a fixed cost. Complete the company's planning budget for manufacturing costs for June.arrow_forwardLandor Appliance Corporation makes and sells electric fans. Each fan regularly sells for $42. The following cost data per fan is based on a full capacity of 150,000 fans produced each period. Direct materials Direct labor Manufacturing overhead (70% variable and 30% unavoidable fixed) $8 $9 $10 A special order has been received by Landor for a sale of 25,000 fans to an overseas customer. The only selling costs that would be incurred on this order would be $4 per fan for shipping. Landor is now selling 120,000 fans through regular channels each period. Assume that direct labor is an avoidable cost in this decision. What should Landor use as a minimum selling price per fan in negotiating a price for this special order?arrow_forwardHead-First Company plans to sell 4,200 bicycle helmets at $67 each in the coming year. Product costs include: Direct materials per helmet $29 Direct labor per helmet 8.00 Variable factory overhead per helmet 5.00 Total fixed factory overhead 19,000 Variable selling expense is a commission of $4.00 per helmet, fixed selling and administrative expense totals $29,900. Required: 1. Calculate the total variable cost per unit 2. Calculate the total fixed expense for the year. 3. Prepare a contribution margin income statement for Head-First Company for the coming yeararrow_forward

- Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,850 rackets and sold 5,830. Each racket was sold at a price of $90. Fixed overhead costs are $102, 050 per year, and fixed selling and administrative costs are $69,000 per year. The company also reports the following per unit variable costs for the year. Direct materials $ 12 Direct labor 8 Variable overhead 5 Variable selling and administrative expenses 2 Prepare an income statement under variable costing. Answer is complete but not entirely correct. ACES INCORPORATED Income Statement (Variable Costing) Sales Less: Cost of goods sold Variable cost of goods sold Variable selling and administrative expenses Fixed overhead Gross profit Less: Fixed expenses Variable selling and administrative expenses Fixed selling and administrative expenses Variable cost of goods sold Income x X X $ 69,960 46,640 X 75,790 X $ 11,660 X 69,000 $ 524,700 192,390 303,160 80,660 $ 222,500Xarrow_forwardJay-Zee Company makes an in-car navigation system. Next year, Jay-Zee plans to sell 19,000 units at a price of $340 each. Product costs include: Direct materials $71.00 Direct labor $41.00 Variable overhead $10.00 Total fixed factory overhead $584,800 Variable selling expense is a commission of 4 percent of price; fixed selling and administrative expenses total $98,600.arrow_forwardAndretti Company has a single product called a Dak. The company normally produces and sells 60,000 Daks each year at a selling price of $32 per unit. The company’s unit costs at this level of activity are given below: Direct materials $ 10.00Direct labor 4.50Variable manufacturing overhead 2.30Fixed manufacturing overhead 5.00 ($300,000 total)Variable selling expenses 1.20Fixed selling expenses 3.50 ($210,000 total)Total cost per unit $ 26.50 A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andretti Company has sufficient capacity to produce 90,000 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its sales by 25% above the present 60,000 units each year if it were willing to increase the fixed selling expenses by $80,000. Calculate the incremental net operating income. Increased sales in units:___________Contribution margin per…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College