Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting Question no 78

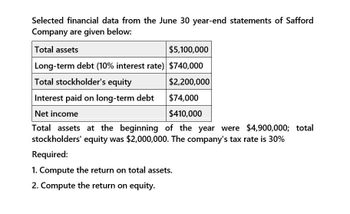

Transcribed Image Text:Selected financial data from the June 30 year-end statements of Safford

Company are given below:

Total assets

$5,100,000

Long-term debt (10% interest rate) $740,000

Total stockholder's equity

$2,200,000

Interest paid on long-term debt

$74,000

Net income

$410,000

Total assets at the beginning of the year were $4,900,000; total

stockholders' equity was $2,000,000. The company's tax rate is 30%

Required:

1. Compute the return on total assets.

2. Compute the return on equity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardKlynveld Companys balance sheet shows total liabilities of 94,000,000, total stockholders equity of 75,000,000, and total assets of 169,000,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forwardErnst Companys balance sheet shows total liabilities of 32,500,000, total stockholders equity of 8,125,000, and total assets of 40,625,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forward

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardSelected financial data from the June 30 year-end statements of Safford Company are given below: Total assets $5,300,000 Long-term debt (9% interest rate) $ 730, 000 Total stockholders' equity $ 2,500,000 Interest paid on long-term debt $ 65,700 Net income $ 400,000 Total assets at the beginning of the year were $5, 100,000; total stockholders' equity was $2,300,000. The company's tax rate is 40%. Required: 1. Compute the return on total assets. (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) 2. Compute the return on equity. (Round your percentage answer to 1 decimal place (i. e., 0.1234 should be entered as 12.3).) 3. Is financial leverage positive or negative?arrow_forwardGeneral Financearrow_forward

- Financial Accountingarrow_forwardThe following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: Line Item Description CurrentYear PreviousYear Accounts payable $184,000 $162,000 Current maturities of serial bonds payable 240,000 240,000 Serial bonds payable, 10% 1,190,000 1,430,000 Common stock, $1 par value 60,000 60,000 Paid-in capital in excess of par 590,000 600,000 Retained earnings 2,040,000 1,630,000 The income before income tax expense was $400,400 and $350,400 for the current and previous years, respectively. a. Determine the ratio of liabilities to stockholders' equity at the end of each year. Round your answers to one decimal place. Line Item Description Ratio Current year fill in the blank 1 Previous year fill in the blank 2 b. Determine the times interest earned ratio for both years. Round your answers to one decimal place. Line Item Description Ratio Current year fill in the blank 3 Previous year…arrow_forwardNeed To the Correct answer of this Accounting Questionarrow_forward

- Given the following information, what is the ratio of liabilities to stockholders’ equity?arrow_forwardThe balance sheet for Fanning Corporation follows: Current assets $ 247,000 Long-term assets (net) 752,000 Total assets $ 999,000 Current liabilities $ 144,000 Long-term liabilities 452,000 Total liabilities 596,000 Common stock and retained earnings 403,000 Total liabilities and stockholders’ equity $ 999,000 RequiredCompute the following. (Round "Ratios" to 1 decimal place.) Working capital Current ratio Debt-to-assets ratio Debt-to-equity ratioarrow_forwardProvide Answer of this one please need Correct Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning