ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

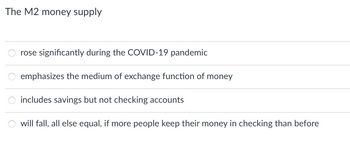

Transcribed Image Text:The M2 money supply

rose significantly during the COVID-19 pandemic

emphasizes the medium of exchange function of money

includes savings but not checking accounts

will fall, all else equal, if more people keep their money in checking than before

Expert Solution

arrow_forward

Step 1

M2 measure of money supply includes all currency in hand with the people, checking deposits, and other types of deposits that can be readily convertible to cash.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- State all the components of the M2 money supply (you may not list M1 as a component, rather you must list the components of M1 individually.)arrow_forwardAssume no change in currency holdings as deposits change. A banking system with target reserve ratio 0.20 starts with no excess reserves. If the central bank purchases $210 in government bonds from commercial banks, what will be the ultimate change in money supply (when banks return to having no excess reserves)? Round to two decimal places and do not enter the $ sign. If your answer is $6.114, enter 6.11. If your answer is $6.115, enter 6.12. If appropriate, remember to enter the - sign.arrow_forwardWhich items from the list is considered M1? Checking Accounts Coins Money market Account Paper Money (bills) Saving Accounts Time deposits Travelers chequesarrow_forward

- The following data represents money from a small Island economy near Fuji. Cash in the hands of the public = $402 Public credit limit on all credit cards= 136 Demand deposits and all other checkable deposits= 693 Money market mutual funds = 618 Travelers check = 8 Large time deposits = 512 Small time deposits= 971 Public stock market holdings = 1,069 Savings-type account = 256 What is the value of M1 for this economy using data above? What is the value of M2 for this economy using data above?arrow_forwardGive correct typing answer with explanation and conclusionarrow_forwardKk.290.arrow_forward

- If people decide to increase the ratio of currency they hold relative to the amount of transactions accounts they hold, the M2 multiplier will: a. increase slightly b. increase substantially c. not change d. decreasearrow_forwardK In Maldonia in 2019, M1 was $2,523 billion; currency held by individuals and businesses was $1,122 bilion; traveler's checks in circulation were $5 billion; savings deposits were $6,857 billion; smaltime deposits were $568; and money market funds and other deposits were $652 bilion Calculate checkable deposits owned by individuals and businesses in Maldonia in 2019. Calculate M2 in Maldonia in 2019. GLEED In Maldonia in 2010, checkable deposts owned by individuals and businesses were bision M2 in Maldonia in 2010 was billionarrow_forwardConsider an individual who immigrates to Canada and deposits $5,000 into the Canadian banking system. Suppose that all commercial banks have a target reserve ratio of 10 percent and that individuals do not hold any cash from the loans borrowed from the banking system. The eventual total change in deposits of the banking system after this impact is $ 50000. The eventual total change in reserves of the banking system after this impact is $ The eventual total change in loans of the banking system after this impact is $arrow_forward

- 8:30 1 19) Which of the following is a function that money serves? A) medium of exchange B) unit of value C) store of account D) All of the above are correct.arrow_forwardIf an individual moves money from a money market mutual fund to currency, Select one: a. M1+ stays the same and M2+ stays the same b. M1+ increases and M2+ decreases C. M1+ stays the same and M2+ increases d. M1+ increases and M2+ stays the samearrow_forwardIf the actual reserve ratio is 16%, what is the money multiplier? Include up to two decimal places, if needed.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education