ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

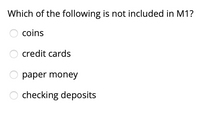

Transcribed Image Text:Which of the following is not included in M1?

coins

credit cards

paper money

checking deposits

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Billions $ Small time deposits 1014 Money-market mutual funds held by businesses 1190 Savings deposits, including money-market deposit accounts 3649 Money-market mutual funds held by individuals 744 Checkable deposits 633 Currency 743 (a) What is the value of M1? (b) What is the value of M2?arrow_forwardUse the following table to determine the levels of M1 and M2 In the United States. Money Categories in the United States Asset Currency Demand deposits Money market funds other checkable deposits Savings deposits Small time deposits Traveler's checks $ Instructions: Enter your answers as a whole number. a. Calculate the M1 money supply. billion b. Calculate the M2 money supply. Amount (billions of dollars) $89 86 47 40 481 billion 6arrow_forwardGive correct typing answer with explanation and conclusionarrow_forward

- “Money not backed by gold or silver is worthless paper and is a fraud committed against the people of the United States.” Critically evaluate this statement.arrow_forwardStop dropping wrong answerarrow_forwardWhich items from the list is considered M1? Checking Accounts Coins Money market Account Paper Money (bills) Saving Accounts Time deposits Travelers chequesarrow_forward

- Give correct typing answer with explanation and conclusionarrow_forwardNo written by hand solutionarrow_forwardAssume that the currency-deposit ratio is 0.5, the required reserve ratio is 0.1, and the excess reserves to deposit ratio is 0.15. If the monetary base is $2 trillion, fınd (a) the amount of currency in circulation in billions of dollars (b) required reserves in billions of dollars (c) excess reserves in billions of dollars.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education