ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

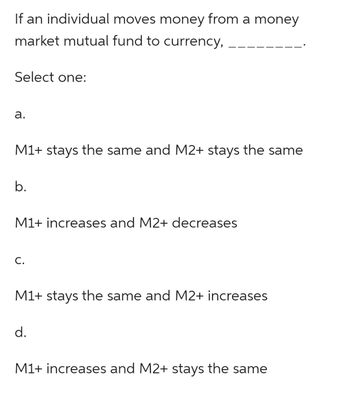

Transcribed Image Text:If an individual moves money from a money

market mutual fund to currency,

Select one:

a.

M1+ stays the same and M2+ stays the same

b.

M1+ increases and M2+ decreases

C.

M1+ stays the same and M2+ increases

d.

M1+ increases and M2+ stays the same

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- By how much has the following US money aggregates grown between January 2018 (i.e. the month-end amount for Jan. 2018) and September 2022 (i.e. the month-end amount for Sept. 2022)? Tip: You need to download monthly data for both M1 and M2 money aggregates in the US. a. US M1 = b. US M2 = % %arrow_forwardNote. Don't use Ai botarrow_forward7. John transfers $150 from his money market fund to his checking account. This transaction will: decrease M2 and increase M1. increase M1, but leave M2 unchanged. decrease M1 and increase M2. decrease both M1 and M2.arrow_forward

- K In Maldonia in 2019, M1 was $2,523 billion; currency held by individuals and businesses was $1,122 bilion; traveler's checks in circulation were $5 billion; savings deposits were $6,857 billion; smaltime deposits were $568; and money market funds and other deposits were $652 bilion Calculate checkable deposits owned by individuals and businesses in Maldonia in 2019. Calculate M2 in Maldonia in 2019. GLEED In Maldonia in 2010, checkable deposts owned by individuals and businesses were bision M2 in Maldonia in 2010 was billionarrow_forwardUsing money to pay debts in the future appeals to its ability to function as a a. medium of exchange b. store of value c. unit of account d. all of the above. e. none of the above.arrow_forwardRefer to the following table to answer the questions that follow. Checkable deposits Currency Traveler's checks Money market mutual funds Small time deposits Savings deposits Using the table, what is the value of M2? a. $57,500,000 b. $46,500,000 c. $65,000,000 d. $47,500,000 e. $13,500,000 $12,500,000 $34,000,000 $1,000,000 $10,000,000 $7,000,000 $500,000arrow_forward

- John Antonio transfers $5000 from his checking account to his savings account. How are M1 and M2 affected by this decision? a.M1 increases and M2 decreases b.M1 and M2 remain the same c.M1 decreases and M1 increases d.M1 increases and M2 increases e.M1 decreases and M2 decreasesarrow_forwardAnswer the question below using the following information (all figures in billions of dollar) Given the data below Currency held outside banks $1000 Demand Deposit $2000 Saving deposit $1200 Money market fund Time deposit $700 $800 1 - The value of M1 equal 2 - The value of M2 equal В I III !!arrow_forwardMoney serves 4 functions. Which of the following is incorret a- money serving b-unit of account c- medium of exchange d- store of valuearrow_forward

- If you transfer all of your currency to your checking account, then initially, M1 will and M2 will O increase; not change O not change; increase O not change; not change decrease; increasearrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardThe measure of the money stock called M1 includes a. wealth held by people in their checking accounts. b. wealth held by people in their savings accounts. c. wealth held by people in money market mutual funds. d. everything that is included in M2 plus some additional itemsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education