Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

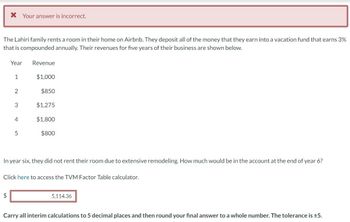

Transcribed Image Text:* Your answer is incorrect.

The Lahiri family rents a room in their home on Airbnb. They deposit all of the money that they earn into a vacation fund that earns 3%

that is compounded annually. Their revenues for five years of their business are shown below.

Year

$

1

2

3

4

5

Revenue

$1,000

$850

$1,275

$1,800

$800

In year six, they did not rent their room due to extensive remodeling. How much would be in the account at the end of year 6?

Click here to access the TVM Factor Table calculator.

5,114.36

Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Several years ago, Junior acquired a home that he vacationed in part of the time and rented out part of the time. During the current year, Junior: Personally stayed in the home for 22 days. Rented it to his favorite brother at a discount for 10 days. Rented it to his least-favorite brother for 8 days at the full market rate. Rented it to his friend at a discounted rate for 4 days. Rented the home to third parties for 58 days at the market rate. Did repair and maintenance work on the home for 2 days. Marketed the property and made it available for rent for 150 days during the year (but did not rent it out). How many days of personal use and how many days of rental use did Junior experience on the property during the year? Days of personal use: Days of rental use:arrow_forwarda mother earned $15000.00 from royalties on her cookbook. She set aside 20% of this for a down payment for a new home. The balance will be used for her son's future education. She invested a portion of the money in a bank certificate of a deposit (cd account) that earns 4% and the remainder in a savings bond that earns 7%. IF the total interest earned after one year is $720.00, how much money was invested at each rate?arrow_forwardJanet and James purchased their personal residence 15 years ago for $412,500. For the current year, they have an $103,125 first mortgage on their home, on which they paid $5,156 in interest. They also have a home equity loan to pay for the children's college tuition secured by their home with a balance throughout the year of $144,250. They paid interest on the home equity loan of $14,425 for the year. Calculate the amount of their deduction for interest paid on qualified residence acquisition debt and qualified home equity debt for the current year. a. Qualified residence acquisition debt interest b. Qualified home equity debt interestarrow_forward

- Ms. Suzanne Morphy is a full time architect. She is also sells vegetables on the side from a small farm she runs in her backyard. In 2018, the first year of operation, she had a loss of $43500 and deducted the maximum allowable amount. What is the amount of her farm loss carryover to future years that can be applied against future farm income?arrow_forwardJanet and James purchased their personal residence 15 years ago for $262,500. For the current year, they have an $65,625 first mortgage on their home, on which they paid $3,281 in interest. They also have a home equity loan to pay for the children's college tuition secured by their home with a balance throughout the year of $121,750. They paid interest on the home equity loan of $12,175 for the year. Calculate the amount of their deduction for interest. paid on qualified residence acquisition debt and qualified home equity debt for the current year. It an amount is zero, enter "0". a. Qualified residence acquisition debt interest $ b. Qualified home equity debt interest. $arrow_forwardMartha bought a home in 1988 at a cost of $100,000.00. She put 20% down and financed the remainder by way of a mortgage. She paid the mortgage off in 20 years. Over the years, she spent $45,000 improving and updating the house. Martha sold her home last year for $310,000.00 What was the value of Martha's equity in her home?arrow_forward

- Larry purchased an annuity from an insurance company that promises to pay him $9,000 per month for the rest of his life. Larry paid $946,080 for the annuity. Larry is in good health, and he is 72 years old. Larry received the first annuity payment of $9,000 this month. Use the expected number of payments in Exhibit 5-1 for this problem. a. How much of the first payment should Larry include in gross income? b. If Larry lives more than 15 years after purchasing the annuity, how much of each additional payment should he include in gross income? c. What are the tax consequences if Larry dies just after he receives the 100th payment?arrow_forwardBriana owns a second home that he rents to others. During the year, she used the second home for 50 days for personal use and for 100 days for rental use. She collected $20,000 of rental receipts during the year. Based on the number of rental and personal days, she allocated $7,000 of interest expense and property taxes, $10,000 of other expenses, and $4,000 of depreciation expense to the rental use. What is her net rental income this year?arrow_forwardTamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance Advertising expense Mortgage interest Repairs & maintenance. Property taxes $ 1,000 500 3,500 900 650 Utilities Depreciation 950 8,500 During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year. Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she itemizes deductions before considering deductions…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education