FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

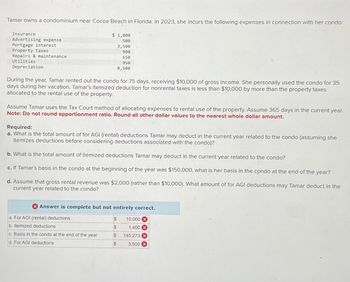

Transcribed Image Text:Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo:

Insurance

Advertising expense

Mortgage interest

Repairs & maintenance.

Property taxes

$ 1,000

500

3,500

900

650

Utilities

Depreciation

950

8,500

During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35

days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes

allocated to the rental use of the property.

Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year.

Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount.

Required:

a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she

itemizes deductions before considering deductions associated with the condo)?

b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo?

c. If Tamar's basis in the condo at the beginning of the year was $150,000, what is her basis in the condo at the end of the year?

d. Assume that gross rental revenue was $2,000 (rather than $10,000). What amount of for AGI deductions may Tamar deduct in the

current year related to the condo?

Answer is complete but not entirely correct.

a. For AGI (rental) deductions

$

10,000x

b. Itemized deductions

$

1,400 x

c. Basis in the condo at the end of the year

$

145,273

d. For AGI deductions

$

3,500 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Memanarrow_forwardSimon rents his cottage when he and his family are not using it. It qualifies as a vacation home rental. In 2021, he had rental income of $5,200. His deductible expenses were: Advertising $350 Commissions $775 Depreciation (rental portion) $1,500 Maintenance (rental portion) $750 Mortgage interest (rental portion) $1,250 Pest control (rental portion) $300 Prior-year carryover $500 Real estate tax $800 What amount of unallowed expense will Simon carry forward to next year? $0 $500 $1,025 $1,500arrow_forward[The following information applies to the questions displayed below.] Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance Utilities Depreciation $ 1,000 500 3,500 900 650 950 8,500 During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Assume Tamar uses the IRS method of allocating expenses to rental use of the property.arrow_forward

- If an individual itemizes deductions on his or her tax return, he or she may: a. deduct the gross unreimbursed medical expenses paid for the year b. deduct the net unreimbursed medical expenses paid for the year c. deduct 80% of the gross unreimbursed medical expenses paid for the year d. deduct 80% of the net unreimbursed medical expenses paid for the yeararrow_forwardRequired information [The following information applies to the questions displayed below.] Louis files as a single taxpayer. In April of this year he received a $900 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,400. (Leave no answer blank. Enter zero if applicable.) a. Last year Louis claimed itemized deductions of $12,650. Louis's itemized deductions included state income taxes paid of $1,750 and no other state or local taxes. Refund to be included in gross incomearrow_forwardRequired Information [The following information applies to the questions displayed below.] Lauren owns a condominium. In each of the following alternative situations, determine whether the condominium should be treated as a residence or a nonresidence for tax purposes. d. Lauren lives in the condo for 22 days and rents it out for 302 days. O Residence O Nonresidence Prev 12 of 15 Nextarrow_forward

- Which taxpayer would be able to deduct the entire amount of their investment interest expense on Schedule A (Form 1040), Itemized Deductions? o Jenny. She had an investment interest expense of $800 and taxable investment income of $900. o Mark. He had an investment interest expense of $1,200 and taxable investment income of $1,100. o Nancy. She had an investment interest expense of $1,900 and taxable investment income of $1,350. o Peter. He had an investment interest expense of $1,400. He had taxable investment income of $1,200 and nontaxable investment income of $300. (The $300 of nontaxable investment income was from municipal bond interest.)arrow_forwardIn the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income Real estate taxes Utilities Mortgage interest Depreciation Repairs and maintenance Required: What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value. Rental income Real estate taxes Utilities Mortgage interest Repairs and maintenance Depreciation Net rental income 15,900 2,700 2,475 4,700 7,600 1,260 Schedule E Schedule Aarrow_forwardIn the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income 11,400 Real estate taxes 1,200 Utilities 1,350 Mortgage interest 3,200 Depreciation 6,000 Repairs and maintenance 810 equired: What is Sandra’s net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value.arrow_forward

- Required Information (The following information applies to the questions displayed below.] Lauren owns a condominium. In each of the following alternative situations, determine whether the condominium should be treated as a residence or a nonresidence for tax purposes. b. Lauren lives in the condo for 11 days and rents it out for 16 days. O Residence O Nonresidence Next >arrow_forwardA) Suppose that Charles holds the land for appreciation. deductible taxes from AGI ( ) B) Suppose that Charles holds the land for rent. Suppose that Charles holds the land for rent.arrow_forwardCompute Sandee’s 2021 net rental incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education