FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

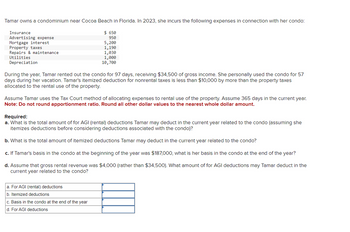

Transcribed Image Text:Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo:

$ 650

950

5,200

1,190

1,030

1,000

10,700

Insurance

Advertising expense

Mortgage interest

Property taxes

Repairs & maintenance

Utilities

Depreciation

During the year, Tamar rented out the condo for 97 days, receiving $34,500 of gross income. She personally used the condo for 57

days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes

allocated to the rental use of the property.

Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year.

Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount.

Required:

a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she

itemizes deductions before considering deductions associated with the condo)?

b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo?

c. If Tamar's basis in the condo at the beginning of the year was $187,000, what is her basis in the condo at the end of the year?

d. Assume that gross rental revenue was $4,000 (rather than $34,500). What amount of for AGI deductions may Tamar deduct in the

current year related to the condo?

a. For AGI (rental) deductions

b. Itemized deductions

c. Basis in the condo at the end of the year

d. For AGI deductions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the following. 1. Total gain. 2. Contract price. 3. Payments received in the year of sale. 4. Recognized gain in the year of sale and the character of such gain. а. (Hint: Think carefully about the manner in which the property taxes are han- dled before you begin your computations.) b. Same as parts (a)(2) and (3), except that Kay's basis in the property was $35,000.arrow_forwardSanan. If a servicemember receives reimbursement for moving expenses, how much will the amount be reported to them? Using Form DD 214. On a separate Form W-2 with code P in box 12. The amount is not reported as it is not taxable income. Using Form DD 2058.arrow_forward4.arrow_forward

- 4. Deductible education expenses include all of the following except: A. Tuition. B. Books. C. Travel. D. Room and board.arrow_forwardMm.2.arrow_forwardWhich of the following are deducted from gross taxable income todetermine net taxable income? a - Severance payments b - Registered Retirement Savings Plan contributions c - Health carepremiums d - Charitable donationsarrow_forward

- What would be the tax treatment of a superficial loss? a. Permanently denied. b. Immediately deductible. c. Deducted from the adjusted cost base (ACB) of the reacquired property. d. Added to the ACB of the reacquired property for the purposes of determining the future capital gain or loss when the property was sold.arrow_forwardSubject: accountingarrow_forwardwhere did you get $1150/12 for the depreciaition expensearrow_forward

- 10. Calculate the assessed value (in $) and the property tax due (in $) on the property. (Round your answers to the nearest cent.) Fair MarketValue AssessmentRate AssessedValue PropertyTax Rate PropertyTax Due $342,900 72 $ 5.1% $arrow_forwardCalculating Social Security and Medicare Taxes Assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128,400 and a Medicare tax rate of 1.45% is applied to all earnings. Calculate the Social Security and Medicare taxes for the following situations: If required, round your answers to the nearest cent. Cumul. Pay Amount Amount Medicare Before Current Current Year-to-Date Soc. Sec. Over Max. Subject to Soc. Sec. Tах Тax Weekly Payroll Gross Pay Earnings Maximum Soc. Sec. Soc. Sec. Withheld Withheld $ 21,600 $1,720 $128,400 2$ $ 54,600 4,180 128,400 127,600 3,985 128,400 127,900 4,700 128,400arrow_forwardTheme: Adjusted Gross Income as determined by the IRS of USA. Examine the case below and do the following:1.Indicates the income items that are part of the gross income.2.Indicates the salary exclusions.3.Identify the deductions to which the taxpayer is entitled to calculate the adjusted gross income.4.Calculate adjusted gross income.5.Indicates the status that the taxpayer must file.6.Fill out Form 1040.Case 2 Carlos Martínez was born on January 9, 1967, is a teacher and is married. He had a salary of $50,000 and a tax withheld of $5,000. Carlos pays an individual retirement account (IRA) for himself of $7,000. His wife, Carmen Flores, was born on April 22, 1971, she works from home selling clothes, from which she had an income of $12,000. The couple have no children and have a joint bank account from which she earned $2,500 in interest from the bank.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education