FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

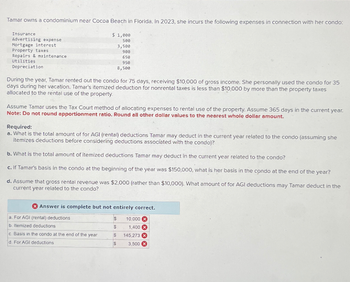

Transcribed Image Text:Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo:

Insurance

Advertising expense

Mortgage interest

Property taxes

Repairs & maintenance

$ 1,000

500

3,500

900

650

Utilities

Depreciation

950

8,500

During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35

days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes

allocated to the rental use of the property.

Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year.

Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount.

Required:

a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she

itemizes deductions before considering deductions associated with the condo)?

b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo?

c. If Tamar's basis in the condo at the beginning of the year was $150,000, what is her basis in the condo at the end of the year?

d. Assume that gross rental revenue was $2,000 (rather than $10,000). What amount of for AGI deductions may Tamar deduct in the

current year related to the condo?

Answer is complete but not entirely correct.

a. For AGI (rental) deductions

$

10,000

b. Itemized deductions

$

1,400 x

c. Basis in the condo at the end of the year

$ 145,273

d. For AGI deductions

S

3,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 15 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Saved Dillon rented out his home for 9 days during the year for $6,400. He resided in the home for the remainder of the year. Expenses associated with use of the home for the entire year were as follows: $ 3,150 Real property taxes Mortgage interest 12,375 Repairs 1,375 Insurance 1,570 Utilities 5,280 Depreciation 12,800 Dillon's AGI is $134,436 before considering the effect of the rental activity. His AGI after considering the tax effect of the rental use of his home is $arrow_forwardSally purchased a home in Georgia for $167,500. She took out a mortgage for 80% of the purchase price at a 7.75% interest rate and put up a 20% down payment. The sale closed on March 16. What is the total dollar amount of the prepaid interest? Select one: a. $452.08 b. $461.55 C. $455.23 d. $576.94arrow_forwardSubject : Accountingarrow_forward

- A taxpayer acquires office equipment for $10,000. Which one of the following choices is not an acceptable cost recovery period under either MACRS (regular or alternate) or ADS? O Straight-line for 7 years O straight-line for 10 years O 150% declining balance for 7 years O 150% declining balance for 10 yearsarrow_forwardAmy financed the purchase of her living room suite over two years. Her monthly payments are $231.02 and she is charged an interest rate of 19.6% compounded semiannually. What was the purchase price of Amy’s furniture? ____________ b. How much is the cost of financing? _____________arrow_forwardYou have an HO policy with the following limits: A $75,000 (dwelling) B-$ 7,500 (other structures) C-$25,000 (personal property). A tornado strikes your property. You lose your house, which is worth $65,000 at the time of the loss. You also lose an unattached shed worth $8,000, and personal property worth $30,000. You will collect? (assume $0 deductible, ignore the ACV calculation and assume there is no fraud or other unusual circumstances surrounding the loss.) OA$107,500 OB. $97,500 OC.$103,000arrow_forward

- Knowing the 14 day personal use on rental property rule, your client has the following days that she is concerned about. How many days personal use do you calculate? 10 days of vacation at the rental property for her and her spouse 9 days of her and her spouse working on the property to make repairs. Her brother used the property for 7 days (but paid full rental to the rental company) Her sister used the property for 4 days but deadbeat her on the rent she rented to strangers for 140 days a. 10 days O b. 14 days O c. 23 days d. 17 days O e. 26 days O f. 21 days g. 30 days Oh. 19 daysarrow_forwardPatty, Inc purchases equipment for $52670. The equipment will be depreciated over 8 years with no residual value. Patty's annual cash flow for the year will be $69730. Patty's annual net income will be $arrow_forwardHello. I'm stuck on this problem please help.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education