FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

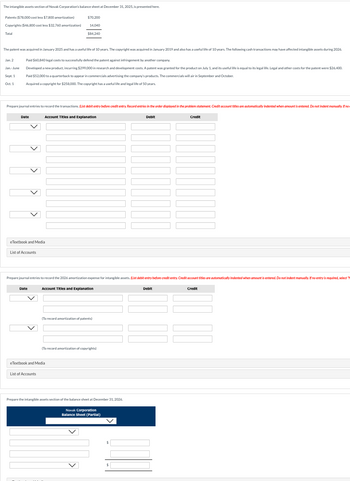

Transcribed Image Text:The intangible assets section of Novak Corporation's balance sheet at December 31, 2025, is presented here.

Patents ($78,000 cost less $7,800 amortization)

Copyrights ($46,800 cost less $32,760 amortization)

Total

$70,200

14,040

$84,240

The patent was acquired in January 2025 and has a useful life of 10 years. The copyright was acquired in January 2019 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2026.

Jan. 2

Jan.-June

Sept. 1

Oct. 1

Paid $60,840 legal costs to successfully defend the patent against infringement by another company.

Developed a new product, incurring $299,000 in research and development costs. A patent was granted for the product on July 1, and its useful life is equal to its legal life. Legal and other costs for the patent were $26,400.

Paid $52,000 to a quarterback to appear in commercials advertising the company's products. The commercials will air in September and October.

Acquired a copyright for $258,000. The copyright has a useful life and legal life of 50 years.

Prepare journal entries to record the transactions. (List debit entry before credit entry Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no

Date

Account Titles and Explanation

Debit

Credit

eTextbook and Media

List of Accounts

Prepare journal entries to record the 2026 amortization expense for intangible assets. (List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "

Date

Account Titles and Explanation

Debit

Credit

(To record amortization of patents)

(To record amortization of copyrights)

eTextbook and Media

List of Accounts

Prepare the intangible assets section of the balance sheet at December 31, 2026.

Novak Corporation

Balance Sheet (Partial)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Current Attempt in Progress On January 1, 2023 (the first day of its fiscal year) Swifty Ltd. acquired a patent which gave the company the right to use a production process. The process met the six criteria for capitalization as an intangible asset. Below is a listing of the events relating to the patent over the five fiscal years from 2023 through 2027: 2023: 2024: on January 1, acquired the patent for the production process for a cash payment of $18,600,000, and determined that the process had an indefinite useful life. on December 31, tested the patent for impairment and determined that its fair value was $19,800,000. 2026: on December 31, tested the patent for impairment and determined that its fair value was $17,500,000. 2025: on December 31, tested the patent for impairment and determined that its fair value was $18,000,000. on January 1, determined that the useful life of the patent was no longer indefinite, its carrying amount was recoverable, its estimated remaining useful…arrow_forwardD1.arrow_forwardWhat is the correct journal entry?arrow_forward

- Conrad Inc. purchased a patent for $2,900,000 for "a specialty line of patented switch plate covers and outlet plate covers specifically designed to light up automatically when the power fails." Assume the switch plate patent was purchased January 1, 2020, and it is being depreciated over a period of ten years. Assume that Conrad Inc. does not use an accumulated amortization account but instead charges amortization directly against the intangible asset account. Required: 1. This part of the question is not part of your Connect assignment. 2. Prepare the journal entries to record the purchase and amortization of the switch plate patent in 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No 1 2 Event No 1 a b Event Patent a Answer is complete but not entirely correct. Bad debt expense Amortization expense Patent Impairment loss Patent General Journal Debit 29,000,000 X 3. After a year of unsuccessful attempts to…arrow_forward112.arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- These are selected 2027 transactions for Pronghorn Corporation: Jan. 1 Mar. 1 Sept. 1 Purchased a copyright for $160,800. The copyright has a useful life of 6 years and a remaining legal life of 35 years. Purchased a patent with an estimated useful life of 5 years and a legal life of 20 years for $90,000. Purchased a small company and recorded goodwill of $150.200. Its useful life is indefinite. Indicate the amount of amortization expense on December 31, 2027. for Pronghorn Corporation. Amortization expense Sarrow_forwardPresented below is selected information for Sandhill Company. Answer the questions asked about each of the factual situations. (Do not leave any answer field blank. Enter O for amounts.) (a) On January 1, 2017, Sandhill incurred organization costs of $265,000. What amount of organization expense should be reported in 2017? Amount to be reported $ (b) Sandhill bought a franchise from Carla Vista Co. on January 1, 2016, for $190,000. The carrying amount of the franchise on Carla Vista's books on January 1, 2016, was $238,00O. The franchise agreement had an estimated useful life of 10 years. Because Sandhill must enter a competitive bidding at the end of 2018, it is unlikely that the franchise will be retained beyond 2025. What amount should be amortized for the year ended December 31, 2017? Amount to be amortized $ %24arrow_forwardMarigold Company purchases a patent for $504,000 on January 2, 2022. Its estimated useful life is 18 years. Prepare the journal entry to record amortization expense for the first year.arrow_forward

- Intangibles: Balance Sheet Presentation and Income Statement Effects Clinton Company has provided information on intangible assets as follows: A patent was purchased from Lou Company for $1,680,000 on January 1, 2018. Clinton estimated the remaining useful life of the patent to be 10 years. The patent was carried in Lou's accounting records at a net book value of $1,440,000 when Lou sold it to Clinton. During 2019, a franchise was purchased from Rink Company for $500,000. In addition, 6% of revenue from the franchise must be paid to Rink. Revenue from the franchise for 2019 was $1,800,000. Clinton estimates the useful life of the franchise to be 10 years and takes a full year's amortization in the year of purchase. Clinton incurred R&D costs in 2019 as follows: Materials and equipment $125,000 Personnel 162,000 Indirect costs 78,000 $365,000 Clinton estimates that these costs will be recouped by December 31, 2020. On January 1, 2019, Clinton estimates, based on new…arrow_forwardBennet Company purchased a patent from Arnold Company on January 1, 2021 for $450,000. Arnold Company had used the patent for five years prior to selling it to Bennet Company. Assuming Bennet Company plans to use the patent for its full useful life, what amount of amortization expense would Bennet Company record on its 2021 income statement? O $30,000 O $25,000 O $22,500 $37,500 O There is not enough information to answer the question.arrow_forwardBennet Company purchased a patent from Arnold Company on January 1, 2021 for $450,000. Arnold Company had used the patent for five years prior to selling it to Bennet Company. Assuming Bennet Company plans to use the patent for its full useful life, what amount of amortization expense would Bennet Company record on its 2021 income statement? $22,500 O $30,000 O $25.000 O $37,500 O There is not enough information to answer the question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education