FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I don't really know how to do this one either.

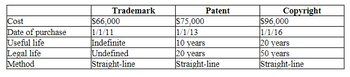

17. For each of the following intangible assets, indicate the amount of amortization expense that should be recorded for the year 2018 and the amount of accumulated amortization on the balance sheet as of December 31, 2018.

Transcribed Image Text:Cost

Date of purchase

Useful life

Legal life

Method

Trademark

$66,000

1/1/11

Indefinite

Undefined

Straight-line

$75,000

1/1/13

Patent

10 years

20 years

Straight-line

Copyright

$96,000

1/1/16

20 years

50 years

Straight-line

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The purpose of the depreciation adjustment is to: -spread the cost invested in an asset over its useful life. -show the current market value of the asset. -set up a reserve fund for purchasing a new asset. -expense the full amount of the asset in the year purchased.arrow_forwardH1. Accountarrow_forward1) What is the "Net Investment in Fixed Assets" Ending Net Fixed Assets = Question 1 of 19 -Beginning Net Fixed Assets = Question 2 of 19 +Depreciation = Question 3 of 19 Net Investment in Fixed Assets = Question 4 of 19 2) Please Calculate the "Chante in Net Working Capital" 2019 2018 Ending NWC Question Blank 5 of 19 - Question 6 of 19 = Question 7 of 19 -Beg NWC Question Blank 8 of 19 - Question Blank 9 of 19 = Question Blank 10 of 19 Change in NWC = Question Blank 11 of 19 3) Please Calculate the "Operating Cash Flow" EBIT = Question Blank 12 of 19 +Depreciation =…arrow_forward

- Which of the following is true? O The book value at the end of an asset's useful life will be the same under all the depreciation methods allowed under generally accepted accounting principles. The annual depreciation expense will usually differ under the various depreciation methods. The total depreciation in the accumulated depreciation account will be the same at the end of the asset's useful life under all the methods allowed under generally accepted accounting principles. O All are true.arrow_forwardWhat categories of property, plant, equipment, and intangible assets does Targetreport in its January 30, 2016, balance sheet?arrow_forwardIFRS requires annual reviews of long-lived assets (other than goodwill) for reversal indicators. A loss may be reversed up to the newly estimated recoverable amount, not to exceed the initial carrying amount adjusted for depreciation. This is a significant departure from GAAP, so what are the financial statement implications? Is it a good thing or bad?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education