FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Presented below is selected information for Sandhill Company.

Answer the questions asked about each of the factual situations. (Do not leave any answer field blank. Enter O for amounts.)

(a) On January 1, 2017, Sandhill incurred organization costs of $265,000. What amount of organization expense should be reported in

2017?

Amount to be reported

$

(b) Sandhill bought a franchise from Carla Vista Co. on January 1, 2016, for $190,000. The carrying amount of the franchise on Carla

Vista's books on January 1, 2016, was $238,00O. The franchise agreement had an estimated useful life of 10 years. Because Sandhill

must enter a competitive bidding at the end of 2018, it is unlikely that the franchise will be retained beyond 2025. What amount

should be amortized for the year ended December 31, 2017?

Amount to be amortized

$

%24

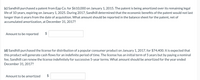

Transcribed Image Text:(c) Sandhill purchased a patent from Epp Co. for $610,000 on January 1, 2015. The patent is being amortized over its remaining legal

life of 10 years, expiring on January 1, 2025. During 2017, Sandhill determined that the economic benefits of the patent would not last

longer than 6 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of

accumulated amortization, at December 31, 2017?

Amount to be reported

$

(d) Sandhill purchased the license for distribution of a popular consumer product on January 1, 2017, for $74,400. It is expected that

this product will generate cash flows for an indefinite period of time. The license has an initial term of 5 years but by paying a nominal

fee, Sandhill can renew the license indefinitely for successive 5-year terms. What amount should be amortized for the year ended

December 31, 2017?

Amount to be amortized

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sarrow_forwardE5-8. Discontinued Operations. Elegant Homes Corporation provided the following statement of net income on December 31, 2022, before the disposal of a business segment. The income statement includes the results of operations of Elegant's mobile home division. The company made a commitment to dispose of the mobile home division on December 1, 2022. Elegant Homes Corporation Income Statement For the Year Ended December 31, 2022 Sales $500 Cost of Goods Sold (120) Gross Profit $380 Selling Expenses (80) General and Administrative Expenses (65) Other Revenues and Expenses (40) Loss on Asset Impairment (38) Income before Tax $157 Income Tax Expense (at 40%) (63) Net Income $ 94 The mobile home division accounts for 20% of sales, cost of goods sold, selling, and general and administra- tive expenses. Assume no gain or loss on remeasurement of the division. Prepare the multiple-step income statement for 2022 only, assuming that Elegant sells the segment on December 31 at a $130 pretax loss.…arrow_forwardAcute Company was incorporated on January 1, 2017. In preparing the financial statements for the year ended December 31, 2019, the entity used the following original cost and useful life for property, plant and equipment: Original cost Useful life Building 15,000,000 15 years Machinery 10,500,000 10 years Furniture 3,500,000 7 years On January 1, 2020, the entity determine that the remaining useful life is 10 years for the building, 7 years for the machinery and 5 years for the furniture. The entity will use the straight line method of depreciation with no residual value. What is the total depreciation for 2020? a. 2,650,000 b.3,700,000 c. 2,550,000 d. 3,500,000arrow_forward

- FDN Company earns revenue from rendering advertising services to various clients. FN Company received P28,000 for advertising services to be provided to clients and this was credited to a liability account. At year end, 20% of advertising services has been provided. How much is the advertising revenue for the year ended December 31, 2021?arrow_forwardFour Queens Corp. reports operating expenses in two categories: (1) Selling; and (2) General and Administrative. The adjusted trial balance at December 31, 2021 included the following expense and loss accounts: Accounting and Legal Fees - P120,000; Advertising - P150,000; Freight-out - P80,000; Depreciation Expense - Store Equipment Expense - P70,000; Loss on Sale of Equity Investment at fair Value Through Profit or Loss - P30,000; Officer's Salaries - P225,000; Rent Expense - P220,000; Sales Salaries and Commissions - P140,000. One-half of rented premises is occupied by the sales department. Four Queen shall report total selling expenses for 2021 of: a. P550,000 b. P480,000 c. P360,000 d. P370,000arrow_forwardthere are 11 total entries for this questionarrow_forward

- Dogarrow_forwardWhich one is the right answer ?arrow_forward(Accounting for Trade Name) In early January 2016, Outkast Corporation applied for a trade name, incurring legal costs of $16,000. In January 2017, Outkast incurred $7,800 of legal fees in a successful defense of its trade name.Instructions(a) Compute 2016 amortization, 12/31/16 book value, 2017 amortization, and 12/31/17 book value if the company amortizes the trade name over 10 years.(b) Compute the 2017 amortization and the 12/31/17 book value, assuming that at the beginning of 2017, Outkast determines that the trade name will provide no future benefits beyond December 31, 2020.(c) Ignoring the response for part (b), compute the 2018 amortization and the 12/31/18 book value, assuming that at the beginning of 2018, based on new market research, Outkast determines that the fair value of the trade name is $15,000. Estimated total future cash flows from the trade name is $16,000 on January 3, 2018.arrow_forward

- Please help mearrow_forwardZigzag Ltd has prepared its draft financial statements for the year ended 30 June 2022. It has included the following transactions in revenue at the amounts stated below. Which of these have been correctly in revenue according to IFRS 15 Revenue from Contracts with Customers? A Agency sales of £300,000 on which Zigzag is entitled to a commission of 10% B Sale proceeds of £40,000 for motor vehicles which were no longer required by Zigzag C Sales of £200,000 on 30June 2022. The amount invoiced to and received from the customer was £230,000, which includes £30,000 for ongoing servicing work to be done by Zigzag over the next two years D Sales of £250,000 on 1 July 2021 to an established customer who, with the agreement of Zigzag, will make full payment on 30 June 2023. Zigzag has a cost of capital of 10%arrow_forwardPlease Answer B, C and D from the screenshot.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education