FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

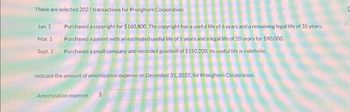

Transcribed Image Text:These are selected 2027 transactions for Pronghorn Corporation:

Jan. 1

Mar. 1

Sept. 1

Purchased a copyright for $160,800. The copyright has a useful life of 6 years and a remaining legal life of 35 years.

Purchased a patent with an estimated useful life of 5 years and a legal life of 20 years for $90,000.

Purchased a small company and recorded goodwill of $150.200. Its useful life is indefinite.

Indicate the amount of amortization expense on December 31, 2027. for Pronghorn Corporation.

Amortization expense S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Action, Inc. acquired the following assets and assumed the related liabilities of Slacker Corp. in a transaction completed on February 16, 2023: Accounts receivable, net Inventories Property, plant & equipment Non-amortizable intangible assets Carrying value for Slacker Current liabilities Noncurrent liabilities $ 11,000 $ 50,000 $ 100,000 $ 200,000 Fair Value $ 10,000 $ 50,000 $ 150,000 $ 225,000 $ (40,000) $(200,000) $ (40,000) $(200,000) Action paid $205,000 in cash for all of the above from Slacker. a) Determine if Action must record any goodwill. Show any calculations. b) Record the acquisition in Action's general journal on Feb. 16, 2023. Show: any calculations. c) Prepare any adjusting entry for amortization required as of the fiscal year end, December 31, 2023. If no amortization is required, explain why.arrow_forwardPresented below is selected information for Sandhill Company. Answer the questions asked about each of the factual situations. (Do not leave any answer field blank. Enter O for amounts.) (a) On January 1, 2017, Sandhill incurred organization costs of $265,000. What amount of organization expense should be reported in 2017? Amount to be reported $ (b) Sandhill bought a franchise from Carla Vista Co. on January 1, 2016, for $190,000. The carrying amount of the franchise on Carla Vista's books on January 1, 2016, was $238,00O. The franchise agreement had an estimated useful life of 10 years. Because Sandhill must enter a competitive bidding at the end of 2018, it is unlikely that the franchise will be retained beyond 2025. What amount should be amortized for the year ended December 31, 2017? Amount to be amortized $ %24arrow_forwardDynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items: Patent with 4 remaining years of legal life Goodwill Dynamo's financial condition just prior to the acquisition of these assets is shown in Required B. Required a. Compute the annual amortization expense for these items. b. Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model. Complete this question by entering your answers in the tabs below. Required A Required B Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model. (In the Cash Flo operating activities, FA for financing activities, or IA for investing activity. Leave the cell blank if there is no effect. Enter any decreases to accoun all cells will require entry.) Event Acquisition Amortization Cash + 86,400 + + + Balance Sheet Assets Patent + Goodwill $…arrow_forward

- in Reynolds buys building (10 year useful life) on January 1, 2019 for $1,000,000. Straight line depreciation is used. On the same day, Reynolds sells building to 90% owned subsidiary for $1,200,000. Subsidiary also uses a remaining useful life of 10 years. What is the appropriate worksheet entry for "excess depreciation" that must be prepared at December 31, 2019? shift O Dr. Depreciation Expense $120,000. Cr. Accumulated Depreciation $120,000 O Dr. Depreciation Expense $20,000. Cr. Accumulated Depreciation $20,000 tab O Dr. Accumulated Depreciation $20,000 Cr. Depreciation Expense $20,000 caps lock O Dr. Accumulated Depreciation $120,000. Cr. Depreciation Expense $120,000 esc 1 9,680 ! 1 Q A T control option Z 72 W S OCT 25 #3 X H command 80 F3 E D $ 4 с 160 000 000 F4 R tv F 175⁰ % F5 V T Garrow_forwardDo not give answer in imagearrow_forwardChaz Corporation has taxable income in 2022 of $312,600 for purposes of computing the $179 expense and acquired the following assets during the year: Asset Office furniture Computer equipment Delivery truck Qualified real property (MACRS, 15 year, 150% DB) Total Placed in Service September 12 February 10 August 21 September 30 Maximum total depreciation deduction What is the maximum total depreciation deduction that Chaz may deduct in 2022? (Use MACRS Table 1. Table 2. Table 3, Table 4 and Table 5.) Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Basis $ 786,000 936,000 74,000 1,505,000 $ 3,301,000 =arrow_forwardDanzerarrow_forwardBear Web Securities acquired a patent on January 1, 2022 for $68,000. The patent is expected to be of benefit to Bear for 6 years. After using the patent for two year it was determined that an advancement by a competitor would make the patent worthless in 3 years. Required: 1. Record the acquisition of the patent. 2. Record the patents amortization for 2022, 2023, and 2024.arrow_forwardChaz Corporation has taxable income in 2023 of $1,313,000 for purposes of computing the $179 expense and acquired the following assets during the year: Asset Office furniture Computer equipment Delivery truck Qualified real property (MACRS, 15 year, 150% DB) Placed in Service September 12 February 10 August 21 September 30 Basis $ 820,000 970,000 108,000 1,539,000 Total $ 3,437,000 What is the maximum total depreciation deduction that Chaz may deduct in 2023? (Use MACRS Table 1, Table 2, Table 3. Table 4, and Table 5.) Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Answer is complete but not entirely correct. Maximum total depreciation deduction $ 3,437,000arrow_forwardarrow_back_iosarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education