ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

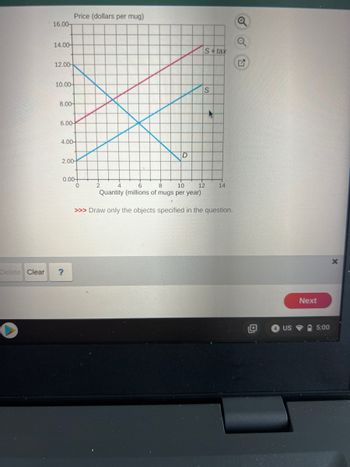

Transcribed Image Text:The graph shows the market for mugs in which the government has imposed a tax of $4 per mug.

Draw a point to show the price paid by buyers and the quantity bought.

Draw shapes that represent the following:

1) consumer surplus. Label it CS.

2) producer surplus. Label it PS.

3) the tax revenue received by the government. Label it TR.

4) the deadweight loss created by the tax. Label it DWL.

>>> A label can be repositioned by clicking on the edge of the label box and dragging it onto the shape.

esc

↑.

C

Selected:

none

$

▸

0

Transcribed Image Text:Delete Clear

16.00-

14.00-

12.00-

10.00-

8.00-

Price (dollars per mug)

6.00-

4.00

2.00

0.00

?

0

2

S+tax

S

4

6

8

10

12

Quantity (millions of mugs per year)

>>> Draw only the objects specified in the question.

14

Next

US 5:00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Case II: Attached is a graph diagram depicting the market for soft drinks. If an excise tax equal to $1 per liter is levied on soft drink sellers, please answer the following questions: a. The new equilibrium quantity of soft drinks bought and sold would be ___________ million soft drinks. b. The new equilibrium price paid by buyers of soft drinks would be $___________ per liter. c. The new equilibrium price received by sellers (after-tax) would be $___________ per liter.arrow_forwardSuppose the following graph depicts the supply and demand for a good after a tax is imposed. How much surplus is lost because of the tax? Price None Pi P₁ An amount equal to the tax. 9 Demand Curve Tax Supply Curve plus tax Supply Curve Quantity both producers and consumer lose all surplus. Othere is no way to tell since the demand curve is odd looking.arrow_forwardA government intervenes in a market and as a result the demand curve shifts to the right. Which government measure could cause this effect? Pick a,b,c, or d a. A subsidy granted to producers of the product b. A subsidy granted to consumers of the product c. The imposition of an indirect tax d. The imposition of a direct taxarrow_forward

- The figure below shows that the imposition of an indirect tax shifts the supply curve to the left. What is the total tax revenue received by the government? Pick a,b,c, or d a. $300 b. $500 c. $650 d. $200 arrow_forwardSuppose the current equilibrium price of cheese pizzas is $10.00, and 11 million pizzas are sold per month. After the federal government imposes a $3.00 per pizza tax, the equilibrium price of pizzas rises to $12.00, and the equilibrium quantity falls to 9 million. Compare the economic surplus in this market when there is no tax to when there is a tax on pizza. With the tax, the change in economic surplus is O A. the new surplus equal to the area under the demand curve and above the supply curve for the market equilibrium quantity. B. the deadweight loss equal to the area under the demand curve and above the supply curve for units between the quantity with the tax and market equilibrium quantity. O C. the deadweight loss equal to the area under the demand curve and above the supply curve for the quantity with the tax. D. the new surplus equal to the area under the demand curve and above the supply curve for units between the quantity with the tax and market equilibrium quantity. New…arrow_forwardAccording to Graph 8-1, after the tax is levied, producer surplus is represented by area:arrow_forward

- CHECK OUT IMAGE PLSarrow_forward1. Consider the market for candy bars given below. Suppose that the government imposes a tax of $2 per candy bar in this market. Show on the graph and calculate the following: Price 5 $4.50 $4 $3.50 Supply 53 $2.50 $2 $1.50 $1 Demand S0.50 400 800 1200 1600 2000 2400 2800 3200 3600 4000 Candy Bars A. The quantity the market will produce with the tax. B. The government revenue from the tax. C. The deadweight loss from the tax. D. The consumer surplus with the tax. E. The producer surplus with the tax.arrow_forwardtax on buyersarrow_forward

- Consumer and Producer surplus Stax P $100 $70 $50 $45 $X $5 D 40 60 Assume an excise tax that has caused a decrease in Supply as shown on the graph above Show all work. а. How much is the tax per- unit b. How much is the value of X (intercept of the green line). How do you describe what that value is? C. How much is the consumer surplus before the tax? d. How much is producer surplus before the tax? е. How much is the consumer surplus after the tax? f. How much is producer surplus after the tax? g. How much is the deadweight loss as a result of the taxarrow_forwardquestions and images attached! Thank you (:arrow_forwardut of 60 Submit All < Question 21 of 60 (Figure: Effects of Excise Tax) Based on the graph, after the excise tax is placed on the product, the producer surplus is + tax Do G. Do O CFD. ACFG. О ВЕFC. O АЕВ. Activate Windows Go to Seings t ateWzco m.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education