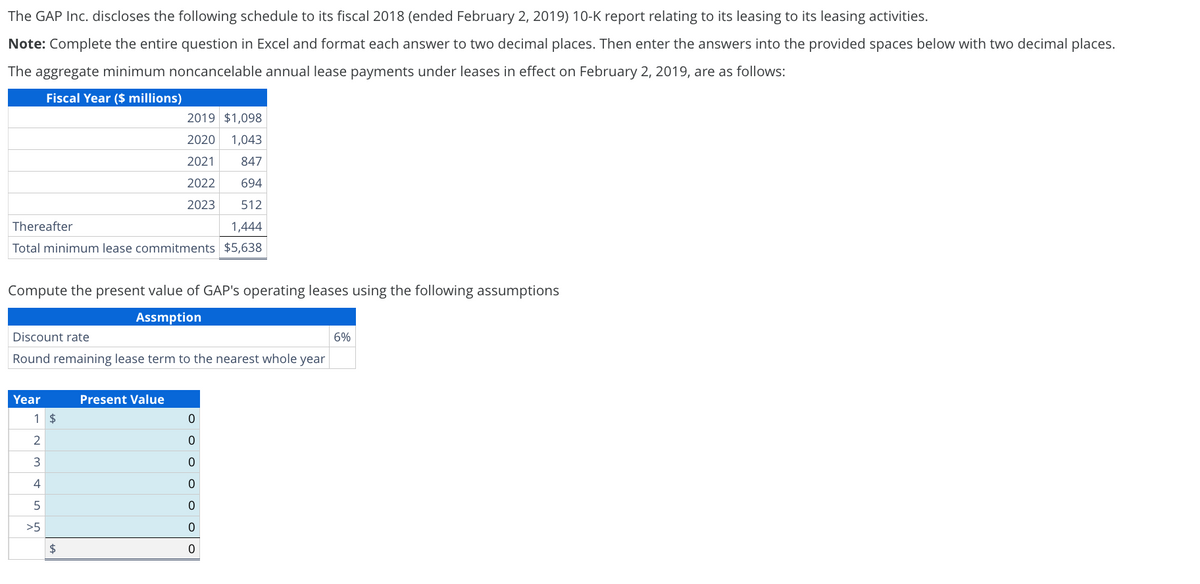

The GAP Inc. discloses the following schedule to its fiscal 2018 (ended February 2, 2019) 10-K report relating to its leasing to its leasing activities. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. The aggregate minimum noncancelable annual lease payments under leases in effect on February 2, 2019, are as follows: Fiscal Year ($ millions) 2019 $1,098 2020 1,043 2021 847 2022 694 2023 512 1,444 Thereafter Total minimum lease commitments $5,638 Compute the present value of GAP's operating leases using the following assumptions Discount rate Assmption Round remaining lease term to the nearest whole year 6% Year Present Value 1 $ 0 2 0 3 0 4 0 5 0 >5 0 $ 0

Q: You are considering the purchase of a property today for $300,000. You plan to finance it with an 80…

A: Real estate investment involves the purchase, ownership, management, rental, or sale of real estate…

Q: The standard deviation of the returns of a portfolio is the geometric average of the standard…

A: Portfolio standard deviation measures the fluctuations in a portfolio how volatile a portfolio is…

Q: Myers Business Systems is evaluating the introduction of a new product. The possible levels of unit…

A: Standard deviationStandard deviation is a statistical measure that quantifies the amount of…

Q: Use factors and a spreadsheet to determine the interest rate per period from the following equa…

A:

Q: Six years ago, I bought 200 shares of Disney at $26 per share. The stock had a 2:1 split followed by…

A: Number of years (n) = 6Initial number of shares = 200Initial stock price = $26 per shareFinal stock…

Q: Calculate the finance charge (in $) and the annual percentage rate for the installment loan by using…

A: Financial charges are the fees or charges on the loan amount for a given period of time. An APR is…

Q: Value of zero. The firm's tax rate is 21%, and the required rate of return is 125 a. What is…

A: The net present value can help determine whether or not an investment is a good idea. It considers…

Q: British government 7% perpetuities pay £7 interest each year forever. Another bond, 7% perpetuities,…

A: Perpetuity refers to lasting indefinitely or recurring continuously, often used in finance to…

Q: A Japanese company has a bond outstanding that sells for 86 percent of its ¥100,000 par value. The…

A: Yield to Maturity (YTM) represents the expected return of a bond when held until its maturity. This…

Q: You are making $200 monthly deposits into a savings account that pays interest at a nominal rate of…

A: The concept of time value of money will be used here. As per the concept of time value of money the…

Q: Required: You manage an equity fund with an expected risk premium of 10.4% and a standard deviation…

A: The Portfolio consist of different source of investment with different expected returns and…

Q: Alexander buys AXP for $20 per share. Two years later, Alex sells AXP for $25 per share. In the…

A: Holding period return:Holding Period Return (HPR) is a measure used to assess the performance of an…

Q: Duo Corporation is evaluating a project with the following cash flows: Year Cash Flow -$ 30,000…

A: MIRR stands for modified internal rate of return. It should be higher than the cost of capital to…

Q: son.3

A: The objective of the question is to calculate the present value of the 27 annual payments of $22,500…

Q: Carl is the beneficiary of a $ 20,000 trust fund set up for him by his grandparents. Under the terms…

A: Present Value =$20,000Period = 5 yearsInterest rate = 5% per annum compouned annually

Q: Johnson & Johnson, Inc., a U.S.-based MNC, will need 15 million Brazilian Reals on December 1. It is…

A:

Q: Suppose Compco Systems pays no dividends but spent $5.16 billion on share repurchases last year. If…

A: The price of a share equals the current value of all future dividends and potential capital gains…

Q: Which of the following statements is CORRECT? a. The SML shows the relationship between companies'…

A: The objective of the question is to identify the correct statement among the given options related…

Q: Your client decides to invest $60 million in Flama and $40 million in Blanca stocks. The risk-free…

A: The objective of the question is to calculate the weights of the stocks in the portfolio, the…

Q: You estimate that your sheep farm will generate 1.5 million of profits on sales of 4.4 million under…

A: The degree of operating leverage is an important financial metric or ratio. This metric or ratio is…

Q: Alpha Ltd is contemplating an investment in a new piece of machinery. Based on the details given…

A: The objective of the question is to calculate the cash flows and perform the capital budgeting…

Q: Econo-Cool air conditioners cost $340 to purchase, result in electricity bills of $190 per year, and…

A: Equivalent Annual Cost (EAC) is the annualized cost of an investment, considering all relevant…

Q: Consider the following portfolio of assets: Loan Weight 1 0.30 2 0.70 Expected returni ம σ2 13% 11%…

A: Portfolio variance, determined by asset weights, individual asset volatilities, and correlations,…

Q: Consider a project to supply Detroit with 20,000 tons of machine screws annually for automobile…

A: Net present value is computed by deducting the initial cost from the current value of cash flows. It…

Q: A health insurance policy pays 75 percent of physical therapy costs after a deductible of $240. In…

A: The health insurance policy will pay 75% of the cost after a deductible of $240.It means out of…

Q: During the last accounting period, Sheridan Corporation sold 92000 units at $45 each. The variable…

A: Degree of operating leverage is a financial measure that helps to determine the impact on the net…

Q: Esfandiari Enterprises is considering a new three-year expansion project that requires an initial…

A: NPV is defined as the sum of the present values of all future cash inflows less the sum of the…

Q: Stock A's stock has a beta of 1.30, and its required return is 12.00%. Stock B's beta is 0.80. If…

A: The objective of this question is to find the required rate of return on Stock B given its beta, the…

Q: 7.1. Given the cash flows described in table below. Determine the ROR. Year 0 1-2 3-5 Cash flow…

A: ROR or Rate of return can be calculated in excel by using the excel formula ''=IRR''Note : IRR…

Q: Trans-Atlantic Quotes. Separated by more than 3,000 nautical miles and five time zones, money and…

A: The International Fisher Effect posits that investors would seek a bigger return on investments made…

Q: The common shares of Twitter, Incorporated (TWTR) recently traded on the NYSE for $83 per share. You…

A: Stock price = $83Strike price = $88Interest rate = 3.4%Volatility = 73%

Q: An investor believes that a particular stock's beta changes over time. To investigate the investor…

A: To predict the beta for the coming year using the regression equation provided (ẞt = 0.35 +…

Q: Cooperton Mining just announced it will cut its dividend from $3.88 to $2.68 per share and use the…

A: Common stock or shares of the company is the security that offers the ownership rights to the…

Q: At an output level of 18,000 units, you have calculated that the degree of operating leverage is…

A: Part 1: Answer:a. Fixed costs are $23,214.b. The operating cash flow will be $48,942.00 if output…

Q: A stock just paid an annual dividend of $6.6. The dividend is expected to grow by 4% per year for…

A: The stock value can be thought of as an estimate of its current market value based on the predicted…

Q: Agnes is 40 years old. She wants to know how much she should be saving each year for retirement.…

A: The objective of the question is to calculate the amount Agnes will have saved by the time she is 60…

Q: Megan Ross holds the following portfolio: Stock Investment Beta A $150,000 1.40…

A: The portfolio's beta is approximately `1.17`.Explanation:Certainly. The calculation of the…

Q: Gillette Corporation will pay an annual dividend of $ 0.63 one year from now. Analysts expect this…

A: Current Stock Price = Value that a particular stock would fetch in the open market, It is calculated…

Q: Consider two mutually exclusive projects A and B: Cash Flows (dollars) Project Co A B -39,000…

A: Internal Rate of Return (IRR) means the discount rate at which the present value of cash inflows is…

Q: You have won a state lottery prize quoted as "$12 million dollar lottery", what this really mean is…

A: Cahs payout refers to an amount that is borrowed in total by the borrower from the lender at a…

Q: The management of Unter Corporation, an architectural design firm, is considering an investment with…

A: Payback period is the period of time in which the investment amount will be recovered by cash flows.…

Q: 1. You are buying a new vehicle and trying to determine what payment option you want. The…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: What is the present value of $175,493 received 20 years from today when interest rate is 6% per…

A: Present value shall be computed by discounting the cash flows at the required rate. Future value…

Q: Which of the following is NOT a potential problem when estimating and using betas, i.e., which…

A: The objective of the question is to identify the statement that is not a potential problem when…

Q: Hanmi Group, a consumer wireless technology. It is c develop wireless communica independent projects…

A: Net present value refers to the method of capital budgeting used for evaluating the viability of the…

Q: If the number of workers in auto assembly in Canada declined by 32% from its peak at the end of 1999…

A: Compound annual rate of return is a measure of an investment's annual growth rate over multiple…

Q: You find a certain stock that had returns of 16 percent, −23 percent, 24 percent, and 9 percent for…

A:

Q: Solve for the stock price, P0, using the following information: D1: $3.31 D2: $3.94 D3: $4.76 D4:…

A: The objective of the question is to calculate the current stock price (P0) using the given dividends…

Q: Suppose GDL just paid a dividend of $2 and the required return on the stock is 10%. What growth rate…

A: Gordon growth model is a measure to calculate the intrinsic value of stock using the dividend growth…

Q: a. What is the sensitivity of the project OCF to changes in the quantity supplied? (Do not round…

A: Net present value is computed by deducting the initial cost from the current value of cash flows. It…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)

- Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. However, assume that Garvey is now required to make the 65,949.37 payments on January 1 each year and that the fair value at the lease inception is now 275,000 (65,949:37 4:169865).Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.

- Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. Assume that Garvey is required to make payments on December 31 each year.On October 1, 2019, Grahams WeedFeed Inc. signs a contract to maintain the grounds for BigData Corp. The contract ends on March 31, 2020, and has a monthly payment of 3,200. The contract does not include any stipulations for additional periods. On June 1, Grahams WeedFeed and BigData sign a new 12-month contract that is retroactive to April 1, 2020. The monthly fee for the new contract is 4,000 per month and is also retroactive to April 1, 2020. During April and May of 2020, while the new contract was being negotiated, Grahams Weed Feed continued to maintain the grounds, and BigData continued to pay 3,200 per month. BigData was satisfied with Grahams WeedFeeds performance, and the only issue during negotiations was the monthly fee. Required: Determine if a valid contract exists between Grahams WeedFeed and BigData during April and May 2020.Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.

- Koolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and the company determined that its performance obligation was satisfied over time. Other information relating to the contract is as follows: Required: 1. Compute the gross profit or loss recognized in 2019 and 2020. 2. Prepare the appropriate sections of the income statement and ending balance sheet for each year.Lessee and Lessor Accounting Issues The following information is available for a noncancelable lease of equipment entered into on March 1, 2019. The lease is classified as a sales-type lease by the lessor (Anson Company) and as a finance lease by the lessee (Bullard Company). Assume that the lease payments are nude at the beginning of each month, interest and straight-line depreciation are recognized at the end of each month, and the residual value of the leased asset is zero at the end of a 3-year life. Required: 1. Record the lease (including the initial receipt of 2,000) and the receipt of the second and third installments of 2,000 in Ansons accounts. Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of 2,000), the payment of the second and third installments of 2,000, and monthly depreciation in Bullards accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar.Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.