Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Problem 10-9 Scenario Analysis (LO3) The most likely outcomes for a particular project are estimated as follows: \table[[Unit price:,$70

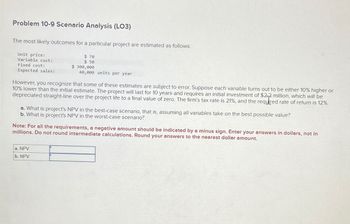

Transcribed Image Text:Problem 10-9 Scenario Analysis (LO3)

The most likely outcomes for a particular project are estimated as follows:

Unit price:

Variable cost:

Fixed cost:

Expected sales:

$ 70

$ 50

$ 300,000

40,000 units per year

However, you recognize that some of these estimates are subject to error. Suppose each variable turns out to be either 10% higher or

10% lower than the initial estimate. The project will last for 10 years and requires an initial investment of $2-2 million, which will be

depreciated straight-line over the project life to a final value of zero. The firm's tax rate is 21%, and the required rate of return is 12%.

a. What is project's NPV in the best-case scenario, that is, assuming all variables take on the best possible value?

b. What is project's NPV in the worst-case scenario?

Note: For all the requirements, a negative amount should be indicated by a minus sign. Enter your answers in dollars, not in

millions. Do not round intermediate calculations. Round your answers to the nearest dollar amount.

a. NPV

b. NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following two projects: Cash flows Project A Project B C0�0 −$ 240 −$ 240 C1�1 100 123 C2�2 100 123 C3�3 100 123 C4�4 100 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h. If the opportunity cost of capital is 8%, what is the profitability index for each project? i. Is the project with the highest profitability index also the one with the highest NPV? j. Which measure should you use to choose between the projects?arrow_forwardConsider the following figure. If firm A were to use the average or composite WACC it would Rate of Return 13.0 (5) 11.0 10.0 90 Project L 70 70 Division L's WACC О Riskov Division H's WACC WACC Project H Composite WACC Firm A Risk Riskov O accept Project L and reject Project H O be making the right decisions on acceptance or rejection of both projects O accept both Project L and Project H O reject both Project L and Project H O accept Project H and reject Project Larrow_forward3. A. B. C. time Capital Budgeting Project S Project L D. 0 -1000 -1000 1 500 100 2 400 200 3 300 300 4 200 400 5 100 500 USE NPV METHOD, assuming the WACC is 10%. Which project will you invest? Use IRR method, which project will you invest? Assuming WACC is 10%, use MIRR, which project will you invest? Use payback period method, which project will you invest?arrow_forward

- Problem 13-6 (Algo) Coefficient of variation [LO13-1] Possible outcomes for three investment alternatives and their probabilities of occurrence are given next. Failure Acceptable Successful Alternative 1 Alternative 2 Outcomes Probability Outcomes Probability 0.10 80 0.20 0.50 195 0.40 0.40 250 0.40 Alternative 1 Alternative 2 Alternative 3 30 70 105 Coefficient of Variation Alternative 3 Using the coefficient of variation, rank the three alternatives in terms of risk from lowest to highest. Note: Do not round intermediate calculations. Round your answers to 3 decimal places. Rank Outcomes 110 350 400 Probability 0.30 0.50 0.20arrow_forwardHelparrow_forwardData Using Incremental with EUAW analysis find the best alternative, MARR = %10. You should use Excel and show your equations separately, see below example: [A Benefit - [IC (A/P, i%, n) - Salvage (A/F, i, n)] + A Cost+ G Cost (A/G, i, n)] First Cost Salvage Value Annual Benefit M&O M&O Gradient Useful Life, Years A $2,300,000 $85,000 $580,000 $65,000 $10,000 10 B $2,750,000 $125,000 $670,000 $78,000 $15,000 10 с $2,550,000 $95,000 $650,000 $72,000 $12,500 10arrow_forward

- Exercise 14-7 (Algo) Net Present Value Analysis of Two Alternatives [LO14-2] Perit Industries has $110,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives are: Cost of equipment required Working capital investment required Annual cash inflows Salvage value of equipment in six years Life of the project Project A $ 110,000 $0 $ 20,000 $ 8,600 1. Net present value project A 2. Net present value project B 3. Which investment alternative (if either) would you recommend that the company accept? 6 years Project B $0 $ 110,000 $ 68,000 $0 6 years The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries' discount rate is 16%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign. Round your final answer to the nearest…arrow_forwardNonearrow_forwardPlease answer fast i give upvotearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education