FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

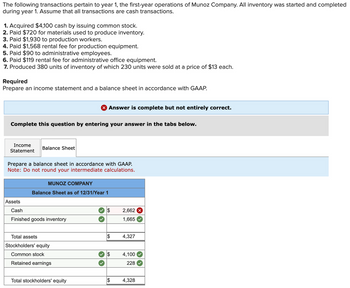

Transcribed Image Text:The following transactions pertain to year 1, the first-year operations of Munoz Company. All inventory was started and completed

during year 1. Assume that all transactions are cash transactions.

1. Acquired $4,100 cash by issuing common stock.

2. Paid $720 for materials used to produce inventory.

3. Paid $1,930 to production workers.

4. Paid $1,568 rental fee for production equipment.

5. Paid $90 to administrative employees.

6. Paid $119 rental fee for administrative office equipment.

7. Produced 380 units of inventory of which 230 units were sold at a price of $13 each.

Required

Prepare an

Income

Statement

me statement and a balance sheet in accordance with AP.

Complete this question by entering your answer in the tabs below.

Assets

Balance Sheet

Prepare a balance sheet in accordance with GAAP.

Note: Do not round your intermediate calculations.

X Answer is complete but not entirely correct.

MUNOZ COMPANY

Balance Sheet as of 12/31/Year 1

Cash

Finished goods inventory

Total assets

Stockholders' equity

Common stock

Retained earnings

Total stockholders' equity

$

$

$

$

2,662 X

1,665

4,327

4,100

228

4,328

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An operation's Beginning Inventory for an accounting period equaled $15,000. Ending Inventory for the period equaled $14,000, Purchases equaled $21,500 and Total Cost of Sales was $21,000. What was the amount of this operation's Employee Meals in the period?arrow_forwardUsing the following information: a. Beginning cash balance on March 1, $80,00. b. Cash receipts from sales, $306,000. c. Cash payments for direct materials, $135,000. d. Cash payments for direct labor, $73,000. e. Cash payments for overhead, $41,000. f. Cash payments for sales commissions, $7,000 g. Cash payments for interest, $110 (1% of beginning loan balance of $11,000) h. Cash repayment of loan, $11,000. Prepare a cash budget for March for Gado Company. GADO COMPANY Cash Budget March Total cash available Less: Cash payments for Total cash payments Loan activity Loan balance, end of month D-pptx A Presentation3.pptx 1 Jarvis CST 141.00...pptx A Musical Theatre Hi...ppt re to searcharrow_forwardHenderson Company uses the gross profit method to estimate ending inventory and cost of goods sold when preparing monthly financial statements required by its bank. Inventory on hand at the end of July was $124,000. The following information for the month of August was available from company records: Purchases Freight-in Sales. Sales returns Purchases returns $ 222,000 5,500 353,000 9,300 4,600 In addition, the controller is aware of $10,000 of inventory that was stolen during August from one of the company's warehouses. Required: 1. Calculate the estimated inventory at the end of August, assuming a gross profit ratio of 30%. 2. Calculate the estimated inventory at the end of August, assuming a markup on cost of 25%. 1. Estimated ending inventory 2. Estimated ending inventoryarrow_forward

- Powell Company began the Year 3 accounting period with $44,000 cash, $90,000 inventory. $64,000 common stock, and $70,000 retained earnings. During Year 3, Powell experienced the following events: 1. Sold merchandise costing $60,000 for $103,500 on account to Prentise Furniture Store. 2. Delivered the goods to Prentise under terms FOB destination. Freight costs were $1,100 cash. 3. Received returned goods from Prentise. The goods cost Powell $4,400 and were sold to Prentise for $6,600. 4. Granted Prentise a $3,400 allowance for damaged goods that Prentise agreed to keep. 5. Collected partial payment of $84,500 cash from accounts receivable. Required: a. Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or…arrow_forwardnces Blooming Flower Company was started in Year 1 when it acquired $60,500 cash from the issue of common stock. The following data summarize the company's first three years' operating activities. Assume that all transactions were cash transactions. Purchases of inventory Sales Cost of goods sold Selling and administrative expenses Income Statements Required: Prepare an income statement (use multistep format) and balance sheet for each fiscal year. (Hint: Record the transaction data for each accounting period in the accounting equation before preparing the statements for that year.) Complete this question by entering your answers in the tabs below. Balance Sheets Assets Cash Merchandise inventory Prepare a balance sheet for each fiscal year. (Hint: Record the transaction data for each accounting period in the accounting equation before preparing the statements for that year.) Total assets Liabilities Stockholders' equity Common stock Retained earnings Year 1 $ 22,200 26,400 12,500…arrow_forwardSims company reports beginning raw materials inventory of $900 and ending raw materials inventory of $1,100. Assume the company purchased $5,200 of raw materials and used $5,000 of raw materials during the year. Compute raw materials inventory turnover and the number of days' sales in raw materials inventory. Complete this question by entering your answers in the tabs below. Raw Materials Days Sales In Raw Materials Inventory Inventory turnover Compute the number of days' sales in raw materials inventory. Numerator: Days' Sales In Raw Materials Inventory. 1 Denominator: 1arrow_forward

- 6arrow_forward73. Meadows Company headquarters records all of its branch equipment in its own general ledger. Prepare the journal entries in the horne office books and in the branch books as a result of the following transactions: (a) At the beginning of 1986, the branch office purchased branch inventory for $2,500, terms of purchase 2/10, n/30. (b) Head office pays invoices within the discount period. (c) Depreciation on equipment is recorded at the end of the year at a rate of 10%. (d) In earty 1987, the branch's old inventory was exchanged for new inventory for $4,000; A trade-in of $1,500 is received on the old inventory and headquarters pays the balance.arrow_forward4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education