FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

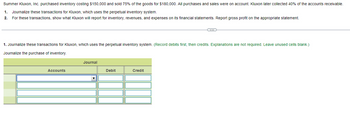

Transcribed Image Text:Summer Kluxon, Inc. purchased inventory costing $150,000 and sold 75% of the goods for $180,000. All purchases and sales were on account. Kluxon later collected 40% of the accounts receivable.

1. Journalize these transactions for Kluxon, which uses the perpetual inventory system.

2. For these transactions, show what Kluxon will report for inventory, revenues, and expenses on its financial statements. Report gross profit on the appropriate statement.

1. Journalize these transactions for Kluxon, which uses the perpetual inventory system. (Record debits first, then credits. Explanations are not required. Leave unused cells blank.)

Journalize the purchase of inventory.

Accounts

Journal

Debit

CO

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sarrow_forwardnces Levine Company uses the perpetual inventory system. April 8 Sold merchandise for $8,500 (that had cost $6,282) and accepted the customer's Suntrust Bank Card. Suntrust charges a 4% fee. April 12 Sold merchandise for $9,800 (that had cost $6,350) and accepted the customer's Continental Card. Continental charges a 2.5% fee. Prepare journal entries to record the above credit card transactions of Levine Company. Note: Round your answers to the nearest whole dollar amount. View transaction list View journal entry worksheet i No 1 2 3 4 Date April 08 April 08 April 12 April 12 Cash Credit card expense Sales Cost of goods sold Merchandise inventory Cash Credit card expense Sales Cost of goods sold Merchandise inventory General Journal Debit 8,160 340 6,000 9,555 245 6,350 Credit 8,500 6,000 9,800 6,350 Ⓒarrow_forwardCrane Corporation uses the perpetual inventory system and began business on April 1. During the month Crane made inventory purchases of $84,200 on terms of 3/10, n/30. Crane returned $4,500 worth of goods during the month. Crane made all payments in time to take advantage of the offered cash discounts during the month. Crane sold inventory on account with a value of $72,200 and a markup of 30% on the cost. These were the only inventory transactions during the month. Leo uses the gross method in accounting for cash discounts. Prepare the journal entries related to: (a) Prepare the journal entry related to the purchase of goods. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forward

- The Comet Company, Inc. uses the perpetual inventory system. Their credit terms are 2/10, n/30. They sell one product at a price of $500 and it costs Comet $300. Requirement: Prepare journal entries for the Comet Company, Inc. for the transactions listed below. On May 1, Comet sold 10 items of merchandise inventory to J. Miller on account. On May 2, Comet collected $23,520 cash from customer sales on credit in the prior month, all within the discount period. On May 3, Comet sold 5 items of merchandise to S. Wendell on account. On May 9, Comet receives payment from S. Wendell on the May 3 sale. On May 12, Comet receives payment from J. Miller on the May 1 sale. On May 14, S. Wendell returns one of the items purchased on May 3 for a cash refund because it was defective.arrow_forwardThe following T-accounts are from the ledger of Hall Company. Inventory Accounts Payable 6,000 6,000 The accounts indicate that Hall Group of answer choices paid its supplier for the inventory at the time of purchase. returned $6,000 of merchandise to a supplier. is entitled to a purchase discount if payment is made within ten days. purchased inventory using credit,arrow_forwardYou have the following information for Swifty Inc. Swifty Inc. uses the periodic method of accounting for its inventory transactions. March March March 1 Beginning inventory 2,200 liters at a cost of 70¢ per liter. 3 Purchased 2,500 liters at a cost of 74¢ per liter. Sold 2,300 liters for $1.05 per liter. Purchased 4,000 liters at a cost of 81¢ per liter. Purchased 2,300 liters at a cost of 89¢ per liter. Sold 5,200 liters for $1.25 per liter. (a1) 5 March 10 March March 30 20 Calculate the value of ending inventory that would be reported on the balance sheet, under each of the following cost flow assumptions. (Round answers to 2 decimal places, e.g. 125.50.) (1) Specific identification method assuming: (i) The March 5 sale consisted of 1,000 liters from the March 1 beginning inventory and 1,300 liters from the March 3 purchase; and (ii) The March 30 sale consisted of the following number of units sold from beginning inventory and each purchase: 450 liters from March 1; 550 liters from…arrow_forward

- Larkspur, Inc. uses a perpetual inventory system. Its beginning inventory consists of 210 units that cost $210 each. During August, the company purchased 310 units at $210 each, returned 6 units for credit, and sold 410 units at $ 360 each. Journalize the August transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record purchase of inventory) (To record purchase return of inventory) (To record sales)arrow_forwardSwisher Company sold inventory with a selling price of $5,000 to customers for cash.It also collected sales taxes of $250. The journal entry to record this information includes aa. credit to Sales Tax Expense $250.b. credit to Sales Revenue $5,250.c. debit to Sales Tax Payable $250.d. debit to Cash of $5,250.arrow_forwardLevine Company uses the perpetual inventory system. April 8 Sold merchandise for $3,400 (that had cost $2,513) and accepted the customer's Suntrust Bank Card. Suntrust charges a 4% fee. April 12 Sold merchandise for $8,400 (that had cost $5,443) and accepted the customer's Continental Card. Continental charges a 2.5% fee. Prepare journal entries to record the above credit card transactions of Levine Company. Note: Round your answers to the nearest whole dollar amount. View transaction list Journal entry worksheet 1 2 3 4 Sold merchandise for $8,400 and accepted the customer's Continental Card. Continental charges a 2.5% fee. Note: Enter debits before credits. General Journal Debit Credit Date April 12 Cash Credit card expense Salesarrow_forward

- Novak Company buys merchandise on account from Bramble Corp.. The selling price of the goods is $1,350, and the cost of the goods is $940. Both companies use perpetual inventory systems.Journalize the transaction on the books of both companies.arrow_forwardJordache Corp. uses a perpetual inventory system and sells merchandise on account to Polo Limited for $2.000 on February 2, terms n/10. Management expects returns of 10%. The goods cost Jordache $800. On February 5, Polo returns merchandise worth $500 to Jordache. This merchandise costs $300 and is still in saleable condition; therefore, it was put back into inventory. On February 9, Jordache receives payment from Polo for the balance due. Identify the journal entry that Jordache needs to record for the sale of the merchandise on February 2. Accounts Receivable Sales Refund Liability Cash Accounts Receivable Accounts Receivable Sales Accounts Receivable Sales 2,000 1,800 1.800 2,000 1,800 200 1,800 1,800 2,000arrow_forwardplease enter the journal entriesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education