FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

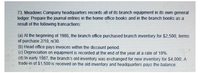

Transcribed Image Text:73. Meadows Company headquarters records all of its branch equipment in its own general

ledger. Prepare the journal entries in the horne office books and in the branch books as a

result of the following transactions:

(a) At the beginning of 1986, the branch office purchased branch inventory for $2,500, terms

of purchase 2/10, n/30.

(b) Head office pays invoices within the discount period.

(c) Depreciation on equipment is recorded at the end of the year at a rate of 10%.

(d) In earty 1987, the branch's old inventory was exchanged for new inventory for $4,000; A

trade-in of $1,500 is received on the old inventory and headquarters pays the balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company establishes a petty cash fund for $480. By the end of the month, employees had made the following expenditures from the fund: supplies, $132; fuel for deliveries, $121; postage, $72; miscellaneous, $40. Required: Record the entry to recognize employee expenditures from the petty cash fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet > A Record the entry to recognize expenditures from the petty cash fund. Note: Enter debits before credits. Transaction General Journal Debit Creditarrow_forwardDuring May, the last month of the fiscal year, the following transactions were completed: Record the following transactions on page 20 of the journal. May 1 Paid rent for May, $5,000. 3 Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000. 4 Paid freight on purchase of May 3, $600. 6 Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, $68,500. The cost of the merchandise sold was $41,000. 7 Received $22,300 cash from Halstad Co. on account. 10 Sold merchandise for cash, $54,000. The cost of the merchandise sold was $32,000. 13 Paid for merchandise purchased on May 3. 15 Paid advertising expense for last half of May, $11,000. 16 Received cash from sale of May 6. 19 Purchased merchandise for cash, $18,700. 19 Paid $33,450 to Buttons Co. on account. 20 Paid Korman Co. a cash refund of $5,000 for damaged merchandise from sale of May 6. Korman Co. kept the merchandise.arrow_forwardRaj Department store has one cash register. On a recent day, the cash register tape reported sales in theamount of $12,675.12. Actual cash in the register (after deducting and removing the opening change of$100) was $12,649.81, which was deposited in the firm’s account.Required:Prepare a journal entry to record these cash sales.arrow_forward

- 73. Meadows Company headquarters records all of its branch equipment in its own general ledger. Prepare the journal entries in the home office books and in the branch books as a result of the following transactions: (a) At the beginning of 1986, the branch office purchased branch inventory for $2,500, terms of purchase 2/10, n/30. (b) Head office pays invoices within the discount period. (c) Depreciation on equipment is recorded at the end of the year at a rate of 10%. (d) in earty 1987, the branch's old inventory was exchanged for new inventory for $4,000; A trade-in of $1,500 is received on the old inventory and headquarters pays the balance.arrow_forwardOn March 15, Drexel Corp. provides goods to a retailer through consignment where Drexel Corp. retains ownership of the goods until the goods are sold to the retailer’s customer. Sale to the final customer is documented when the goods are scanned at the cash register of the retailer. Drexel Corp. receives a daily report on the number of units sold by the retailer to the end customer. Any unsold product can be returned to Drexel Corp. at any time. Drexel Corp. has the right through the contract to recall any goods shipped and to transfer the goods to another retailer as a way to increase the rate of sales to the final customer. After the sale of the products to the final customer, the retailer cannot return the items to Drexel Corp. During March, Drexel Corp. transferred 600 units to the retailer, and the retailer sold 500 units. The product cost Drexel Corp. $80 per unit and the product was sold for $115 per unit to the end customer. The retailer sent a payment to Drexel Corp. for the…arrow_forwardDigital World is a retail store that sells cameras and photography supplies. The firm’s credit purchases and purchases returns and allowances transactions for June 20X1 appear below, along with the general ledger accounts used to record these transactions. The balance shown in Accounts Payable is for the beginning of June. June 1 Purchased instant cameras for $1,850 plus a freight charge of $130 from Pro Photo Equipment, Invoice 4241, dated May 27; the terms are 60 days net. 8 Purchased film for $1,374 from Photo Supplies, Invoice 1102, dated June 3, net payable in 45 days. 12 Purchased lenses for $896 from Nano Glass, Invoice 7282, dated June 9; the terms are 1/10, n/60. 18 Received Credit Memorandum 110 for $300 from Pro Photo Equipment for defective cameras that were returned; they were originally purchased on Invoice 4241, dated May 27. 20 Purchased color film for $1,000 plus freight of $55 from Photo Supplies, Invoice 1148, dated June 15, net…arrow_forward

- Big Oak Lumber is a lumber yard on Angel Island. Some of Big Oak’s transactions during the current year are as follows: Apr. 15 Sold lumber on account to Hard Hat Construction, $19,700. The inventory subsidiary ledger shows the cost of this merchandise was $10,300. Apr. 19 Purchased lumber on account from LHP Company, $3,700. May 10 Collected in cash the $19,700 account receivable from Hard Hat Construction. May 19 Paid the $3,700 owed to LHP Company. Dec. 31 Big Oak’s personnel counted the inventory on hand and determined its cost to be $114,000. The accounting records, however, indicate inventory of $116,500 and a cost of goods sold of $721,000. The physical count of the inventory was observed by the company’s auditors and is considered correct. Instructions Prepare journal entries to record these transactions and events in the accounting records of Big Oak Lumber. (The company uses a perpetual inventory system.) Prepare a partial income statement showing the company’s gross profit…arrow_forwardPrepare a journal entry to record these cash sales.arrow_forwardDuring May, the last month of the fiscal year, the following transactions were completed: Record the following transactions on page 20 of the journal. May 1 Paid rent for May, $5,000. 3 Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000. 4 Paid freight on purchase of May 3, $600. 6 Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, $68,500. The cost of the merchandise sold was $41,000. 7 Received $22,300 cash from Halstad Co. on account. 10 Sold merchandise for cash, $54,000. The cost of the merchandise sold was $32,000. 13 Paid for merchandise purchased on May 3. 15 Paid advertising expense for last half of May, $11,000. 16 Received cash from sale of May 6. 19 Purchased merchandise for cash, $18,700. 19 Paid $33,450 to Buttons Co. on account. 20 Paid Korman Co. a cash refund of $5,000 for damaged merchandise from sale of May 6. Korman Co. kept the merchandise.…arrow_forward

- Childers Company, which uses a perpetual inventory system, has an established petty cash fund in the amount of $400. The fund was last reimbursed on November 30. At the end of December, the fund contained the following petty cash receipts: December 4 Merchandise purchased December 7 Delivery expense December 12 Purchase of office supplies December 18 Miscellaneous expense $62 $46 $30 $51 If, in addition to these receipts, the petty cash fund contains $201 of cash, the Journal entry to reimburse the fund on December 31 will include:arrow_forwardYou are maintaining a subsidiary ledger account for Firefighter-Training Expenditures for 2018. The following columns are used: Encumbrances Date Item Dr. Cr. Bal. Expenditures Unobligated Balance Inventory purchases are initially recorded as expenditures (purchases method). Record the following 2018 transactions in the police-training expenditures subsidiary ledger account:Jan. 1 The budget includes $25,000 for police-training expenditures.15 Equipment and supplies, estimated at $16,000 cost, are ordered.Feb. 1 Vouchers for $5,000 are approved for items not encumbered.15 Items encumbered for $12,000 on January 15 are received with invoices totaling $12,300. Supplies are expended when purchased; however, an inventory is taken at year-end, and expenditures are adjusted at that time.June 3 The remaining encumbered expenditures arrive. The invoice totals $6,300, including items not included in the encumbered amount.Dec. 31 An inventory of training supplies is…arrow_forwardCedar Springs Company completed the following selected transactions during June:June 1. Established a petty cash fund of $1,000.12. The cash sales for the day, according to the cash register records, totaled $9,440. The actual cash received from cash sales was $9,506.30. Petty cash on hand was $46. Replenished the petty cash fund for the following disbursements, each evidenced by a petty cash receipt:June 2. Store supplies, $375.10. Express charges on merchandise purchased, $105 (MerchandiseInventory).14. Office supplies, $85.15. Office supplies, $90.18. Postage stamps, $33 (Office Supplies).20. Repair to fax, $100 (Miscellaneous Administrative Expense).21. Repair to office door lock, $25 (Miscellaneous Administrative Expense).22. Postage due on special delivery letter, $9 (MiscellaneousAdministrative Expense).28. Express charges on merchandise purchased, $110 (MerchandiseInventory).30. The cash sales for the day, according to the cash register records, totaled $13,390. The actual cash…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education