FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Powell Company began the Year 3 accounting period with $44,000 cash, $90,000 inventory. $64,000 common stock, and $70,000

retained earnings. During Year 3, Powell experienced the following events:

1. Sold merchandise costing $60,000 for $103,500 on account to Prentise Furniture Store.

2. Delivered the goods to Prentise under terms FOB destination. Freight costs were $1,100 cash.

3. Received returned goods from Prentise. The goods cost Powell $4,400 and were sold to Prentise for $6,600.

4. Granted Prentise a $3,400 allowance for damaged goods that Prentise agreed to keep.

5. Collected partial payment of $84,500 cash from accounts receivable.

Required:

a. Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of

cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify

the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA).

b. Prepare an income statement, a balance sheet, and a statement of cash flows.

c. Why would Prentise agree to keep the damaged goods?

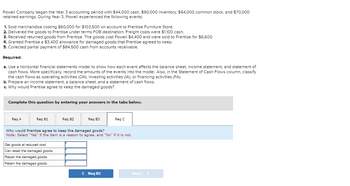

Complete this question by entering your answers in the tabs below.

Req A

Req B1

Req B2

Req B3

Req C

Why would Prentise agree to keep the damaged goods?

Note: Select "Yes" if the item is a reason to agree, and "No" if it is not.

Get goods at reduced cost.

Can resell the damaged goods.

Repair the damaged goods.

Retain the damaged goods.

< Req B3

Req C >

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The following events occurred at Moore's Hobbies and Crafts store during the most recent fiscal year: Purchased merchandise costing $114,000. Had sales revenue for the year totaling $160,000; the merchandise sold was purchased for $92,500. Paid $10,000 transportation-in costs. Incurred selling and administrative costs equal to 10 percent of sales revenue. All transactions, sales and purchases, were for cash. An inventory account at the end of the year indicated merchandise costing $107,000 was on hand. Required: Give the amounts for the following items in the Merchandise Inventory account: A. Ending Balance B. Transfers-out C. Transfers- in D. Beginning Balancearrow_forwardPlum Corporation began the month of May with $700,000 of current assets, a current ratio of 2.50:1, and an acid-test ratio of 1.10:1. During the month, it completed the following transactions (the company uses a perpetual inventory system). May 2 Purchased $50,000 of merchandise inventory on credit. May 8 Sold merchandise inventory that cost $55,000 for $110,000 cash. May 10 Collected $20,000 cash on an account receivable. May 15 Paid $22,000 cash to settle an account payable. May 17 Wrote off a $5,000 bad debt against the Allowance for Doubtful Accounts account. May 22 Declared a $1 per share cash dividend on its 50,000 shares of outstanding common stock. May 26 Paid the dividend declared on May 22. May 27 Borrowed $100,000 cash by giving the bank a 30-day, 10% note. May 28 Borrowed $80,000 cash by signing a long-term secured note. May 29 Used the $ 180,000 cash proceeds from the notes to buy new machinery. Required: Complete the table below showing Plum's (1) current ratio, (2)…arrow_forwardpalace made sales of merchandise inventory of $10,000 in 20Y5. The cost of sales for the year was $1,200. Administrative expenses included depreciation on office equipment, $850; insurance expense, $690; and utilities at office, $750. Selling expenses included sales salaries, $2,200; advertising expense, $890; depreciation on store equipment, $1,200; and store rental expense, $3,570. The company also had interest revenue of $3,250. Prepare a multi-step income statement for the company’s fiscal year, which ends September 30.arrow_forward

- Riley Kilgo Inc. purchased inventory costing $100,000 and sold 80% of the goods for $240,000. All purchases and sales were on account. Kilgo later collected 20% of the accounts receivable. Journalize these transactions for Kilgo, which uses the perpetual inventory system. For these transactions, show what Kilgo will report for inventory, revenues, and expenses on its financial statements. Report gross profit on the appropriate statement.arrow_forwardWhispering Winds Corporation uses a perpetual inventory system and had inventory worth $88,500 at the beginning of the year. Purchases were made during the year for $393,000; however, 10% of these goods were returned to the supplier, and a 3% discount was taken on the remaining balance owing. Whispering Winds paid $3,500 cash for freight to ship the inventory to its location during the year. Whispering Winds reported cost of goods sold for the year of $295,000. Whispering Winds has a calendar year end. What is the balance in the inventory account at the end of the year? Balance If Whispering Winds counted its actual inventory balance as $118,000 at the end of the year, what adjusting entry, if any, would be made? (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles and…arrow_forwardViet Stores recorded the following events involving a recent purchase of merchandise: Received goods for $60,000, terms 2/10, n/30. Returned $1,200 of the shipment for credit. Paid $300 freight on the shipment. Paid the invoice within the discount period. ● As a combined result of these events, the company's inventory: Select one: A. Increased by $57,624 B. Increased by $57,900 C. Increased by $57,918 D. Increased by $57,924arrow_forward

- Ace Company reported the following information for the current year: Sales $ 416,000 Cost of goods sold: Beginning inventory $ 141,000 Cost of goods purchased 279,000 Cost of goods available for sale 420,000 Ending inventory 150,000 Cost of goods sold 270,000 Gross profit $ 146,000 The beginning inventory balance is correct. However, the ending inventory figure was overstated by $26,000. Given this information, the correct gross profit would be:arrow_forwardAt the beginning of Year 2, the Redd Company had the following balances in its accounts: Cash $ 8,400 Inventory 2,400 Common stock 7,900 Retained earnings 2,900 During Year 2, the company experienced the following events: Purchased inventory that cost $5,900 on account from Ross Company under terms 2/10, n/30. The merchandise was delivered FOB shipping point. Freight costs of $540 were paid in cash. Returned $400 of the inventory that it had purchased because the inventory was damaged in transit. The seller agreed to pay the return freight cost. Paid the amount due on its account payable to Ross Company within the cash discount period. Sold inventory that had cost $6,400 for $9,400 on account, under terms 2/10, n/45. Received merchandise returned from a customer. The merchandise originally cost $540 and was sold to the customer for $840 cash. The customer was paid $840 cash for the returned merchandise. Delivered goods FOB destination…arrow_forwardApply the COGS equation used on the bottom of page 6-3 of the VLN to the following data set to answer the question: The company had $20,000 in beginning inventory and during the year purchased $200,000 worth of inventory. Ending inventory at the end of the period was $10,000, what was the cost of goods sold for the year? ____arrow_forward

- Metlock's Market recorded the following events involving a recent purchase of inventory: Received goods for $78200, terms 2/9, n/30. Returned $1700 of the shipment for credit. Paid $700 freight on the shipment. Paid the invoice within the discount period. As a result of these events, the company's inventory increased by $74970. increased by $75670. increased by $77200. O increased by $75656. O Oarrow_forwardHenderson Company uses the gross profit method to estimate ending inventory and cost of goods sold when preparing monthly financial statements required by its bank. Inventory on hand at the end of July was $124,000. The following information for the month of August was available from company records: Purchases Freight-in Sales. Sales returns Purchases returns $ 222,000 5,500 353,000 9,300 4,600 In addition, the controller is aware of $10,000 of inventory that was stolen during August from one of the company's warehouses. Required: 1. Calculate the estimated inventory at the end of August, assuming a gross profit ratio of 30%. 2. Calculate the estimated inventory at the end of August, assuming a markup on cost of 25%. 1. Estimated ending inventory 2. Estimated ending inventoryarrow_forward7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education