Concept explainers

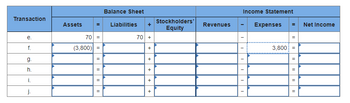

The following transactions are July activities of Bennett’s Bowling, Incorporated, which operates several bowling centers, offering customers lanes for games, snack bar service, and merchandise for sale from the pro shop.

-

Bennett’s purchased $780 in food supplies for the snack bar; paid $710 in cash and owed the rest on account with the supplier.

-

Bennett’s paid $3,800 on the electricity bill for June (recorded as an expense in June).

-

Bennett’s paid $3,100 to employees for work in July.

-

Bennett’s purchased $3,600 in insurance for coverage from August 1 to November 1.

-

Bennett’s paid $2,100 to plumbers for repairing a broken pipe in the restrooms.

-

Bennett’s received the July electricity bill for $3,800 to be paid in August.

For each of the above transactions, complete the tabulation, indicating the amount and effect of each transaction. (Remember that Assets = Liabilities +

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- During December, Far West Services makes a $3,600 credit sale. The state sales tax rate is 6% and the local sales tax rate is 2.5%. (Note: the sales tax amount is in addition to the credit sale amount.) Record sales and sales tax payable. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardDuring the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for $7,700 from Diamond Incorporated with terms 2/10, n/30. June 5 Returned goods costing $2,900 to Diamond Incorporated for credit on account. June 6 Purchased goods from Club Corporation for $2,800 with terms 2/10, n/30. June 11 Paid the balance owed to Diamond Incorporated. June 22 Paid Club Corporation in full. Required: Prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list No 1 2 3 4 5 Date June 03 June 05 June 06 June 11 June 22 View journal entry worksheet Inventory Accounts Payable Accounts Payable Inventory Inventory Accounts Payable Accounts Payable Cash Accounts Payable Cash General Journal Debit 7,700 2,900 2,800 7,546…arrow_forwardGriswold's, Incorporated (GI), began operations in January, selling inexpensive sunglasses to large retailers like Walgreens and other smaller stores. Assume the following transactions occurred during its first six months of operations. January 1 Sold merchandise to Walgreens for $29,000; the cost of these goods to GI was $20,100. February 12 Received payment in full from Walgreens. March 1 Sold merchandise to Bravis Pharmaco on account for $3,900; the cost of these goods to GI was $1,850. April 1 Sold merchandise to Tony's Pharmacy on account for $8,900. The cost to GI was $4,850. May 1 Sold merchandise to Anjuli Stores on account for $2,900; the cost to GI was $1,650. June 17 Received $6,950 on account from Tony's Pharmacy. Required: 1. Complete the following aged listing of customer accounts at June 30. 2. Estimate the Allowance for Doubtful Accounts required at June 30 assuming the following uncollectible rates: one month, 1 percent; two months, 5 percent; three months, 20 percent;…arrow_forward

- The following transactions were selected from among those completed by Bennett Retallers in November and December: November 20 November 25 Sold 20 items of merchandise to Customer 8 at an invoice price of $6,400 (total); terms 2/10, n/30. Sold two items of merchandise to Customer C, who charged the $700 (total) sales price on her Visa credit card. Visa charges Bennett Retailers a 1 percent credit card fee. Sold 10 identical items of merchandise to Customer D at an invoice price of $9,600 (total); terms 2/10, n/38. Customer D returned one of the items purchased on the 28th; the item was defective and credit was given to the customer. December 6 Customer D paid the account balance in full. December 20 Customer 8 paid in full for the invoice of November 20. November 28 November 29 Required: Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net sales for the two months ended December 31. Note: Do not round your…arrow_forwardPrepare the journal entriesarrow_forwardPresented below is information from Culver Computers Incorporated. July 1 Sold $14,100 of computers to Larkspur Company with terms 3/15, n/60. Culver uses the gross method to record cash discounts. 10 Culver received payment from Larkspur for the full amount owed from the July 1 transaction. 17 Sold $108,100 in computers and peripherals to The Clark Store with terms of 3/10, n/30. 30 The Clark Store paid Culver for its purchase of July 17. Prepare the necessary journal entries for Culver Computers. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.)arrow_forward

- Listed below are selected transactions of Schultz Department Store for the current year ending December 31. 1. On December 5, the store received $500 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 2. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. 3. 4. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax. The store sold 25 gift cards for $100 per card. At year-end, 20 of the gift cards are redeemed. Schultz expects three of the cards to expire unused. Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the transactions that would be required to present fair financial statements at December 31. Date each entry.…arrow_forwardes Texas Roadhouse opened a new restaurant in October. During its first three months of operation, the restaurant sold gift cards in various amounts totaling $2,500. The cards are redeemable for meals within one year of the purchase date. Gift cards totaling $728 were presented for redemption during the first three months of operation prior to year-end on December 31. The sales tax rate on restaurant sales is 4%, assessed at the time meals (not gift cards) are purchased. Texas Roadhouse will remit sales taxes in January. Required: 1. & 2. Record (in summary form) the $2,500 in gift cards sold (keeping in mind that, in actuality, the company would record each sale of a gift card individually) and the $728 in gift cards redeemed. (Hint: The $728 includes a 4% sales tax of $28.) 3. Determine the balance in the Deferred Revenue account (remaining liability for gift cards) Texas Roadhouse will report on the December 31 balance sheet. Complete this question by entering your answers in the…arrow_forwardThe following transactions occurred over the months of September to December at Nicole's Getaway Spa (NGS). September Sold spa merchandise to Ashley Welch Beauty for $1,850 on account; the cost of these goods to NGS was $920. October Sold merchandise to Kelly Fast Nail Gallery for $478 on account; the cost of these goods to NGS was $210. November Sold merchandise to Raea Gooding Wellness for $320 on account; the cost of these goods to NGS was $200. December Received $1,230 from Ashley Welch Beauty for payment on its account. Required: 1. Prepare journal entries for each of the transactions. Assume a perpetual inventory system. 2. Estimate the Allowance for Doubtful Accounts required at December 31, assuming the only receivables outstanding at December 31 arise from the transactions listed above. NGS uses the aging of accounts receivable method with the following uncollectible rates: one month, 3%; two months, 5%, three months, 20%; more than three months, 30%. 3. The Allowance for…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education