Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

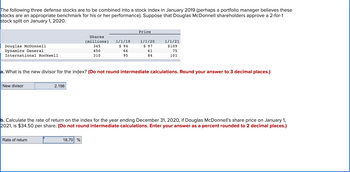

Transcribed Image Text:The following three defense stocks are to be combined into a stock index in January 2019 (perhaps a portfolio manager believes these

stocks are an appropriate benchmark for his or her performance). Suppose that Douglas McDonnell shareholders approve a 2-for-1

stock split on January 1, 2020.

Douglas McDonnell

Dynamics General

International Rockwell

New divisor

2.198

Rate of return

Shares

(millions)

345

450

310

1/1/19

$ 94

66

95

What is the new divisor for the index? (Do not round intermediate calculations. Round your answer to 3 decimal places.)

18.70 %

Price

1/1/20

$ 97

61

84

1/1/21

$109

75

101

b. Calculate the rate of return on the index for the year ending December 31, 2020, if Douglas McDonnell's share price on January 1,

2021, is $34.50 per share. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following three defense stocks are to be combined into a stock index in January 2022 (perhaps a portfolio manager belleves these stocks are an appropriate benchmark for his or her performance). Suppose that Douglas McDonnell shareholders approve a 3-for-1 stock split on January 1, 2023. Douglas McDonnell Dynamics General International Rockwell New divisor Shares (millions) 1/1/22 Rate of return 340 458 % 45 Price 1/1/23 a. What is the new divisor for the index? Note: Do not round intermediate calculations. Round your answer to 3 decimal places. $ 106 39 63 1/1/24 $ 118 53 79 b. Calculate the rate of return on the index for the year ending December 31, 2023, if Douglas McDonnell's share price on January 1, 2024, is $39.33 per share. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.arrow_forwardRefer to Figure 15.1, which lists the prices of various Microsoft options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following November 2019 expiration options on a single share, assuming that the stock price on the expiration date is $143. (Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.)arrow_forwardAn investor is considering purchasing shares in Unicorn plc & has asked for your advice. On April 1st, 2020 the share price was 662p. In the June 2020 an interim dividend of 12p was paid and in January 2021, a final dividend of 32p was paid. On March 31st, 2021 the share price was 724p. What was the TSR for the year for Unicorn Ordinary shares?arrow_forward

- Am. 12.arrow_forward(please use Excel) Preferred stock B sells for $45 in the market and pays an annual dividend of $4.60.a) If the market required yield is 10 percent, what is the value of the stock to investors?b) Should investors buy the shares? Include reasonsarrow_forwardA preferred stock is expected to pay a constant quarterly dividend of $1.75 per quarter into the future. The required rate of return, Rs, on the preferred stock is 12.0 percent. What is the fair value (or price) of this stock? Group of answer choices a. $18.65 b. None of the above c. $37.04 d. $24.36 e. $58.33arrow_forward

- In its 10Q dated February 4, 2022, LLL, Incorporated, had outstanding employee stock options representing over 285 million shares of its stock. LLL accountants estimated the value of these options using the Black - Scholes - Merton formula and the following assumptions:S = current stock price = $28.89K = option strike price = $31.32r = risk-free interest rate = 0.057 = stock volatility = 0.29T = time to expiration = 3.5 yearsWhat was the estimated value of these employee stock options per share of stock? (Note: LLL pays no dividends.) Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardConsider a December 310 call and a December 310 put, both on a stock that is currently selling for $340/share. Calculate how much these options are in or out of the money.arrow_forwardes The following three defense stocks are to be combined into a stock index in January 2022 (perhaps a portfolio manager believes these stocks are an appropriate benchmark for his or her performance): Douglas McDonnell Dynamics General International Rockwell Index value Shares (millions) 420 450 250 2022 return 2023 return a. Calculate the initial value of the index if a price-weighting scheme is used. 1/1/22 $ 63 53 82 Price 1/1/23 $ 67 47 71 % % b. What is the rate of return on this index for the year ending December 31, 2022? For the year ending December 31, 2023? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. 1/1/24 $ 84 61 87arrow_forward

- Consider 2 stocks in the following table. We create a stock index of companies that make stuff for Spring Break. stocks PO Q0 P1 Q1 ABC, Inc. $850P0 150Q0 $ 830P1 150Q1 XYZ, Inc. $510P0 400Q0 $550P1 400Q1 What is the initial portfolio weight for stock ABC in a Price - weighted index of these two stocksarrow_forwardo The following information is available concerning the price evolution of Microsoft stocks between 2016-2019 and the dividends paid by them. Date March 1, 2016 April 1, 2016 July 1, 2016 March 1, 2017 March 1, 2019 Close price 55.23 49.87 56.68 65.86 117.94 Total Dividends - 0.36 1.50 4.88 o Requirements: Considering that you bought Microsoft shares on March 1, 2016, compute the holding-period return for each maturity • Annualize the holding-period returns using EAR and APR • Comment on the resultsarrow_forwardCalculate the price weighted index value for 31 Dec 2020, prior to the splits. Shares W and X had 2 for 1 splits after the close on 31 Dec 2020. The pre-split divisor was 4. Share W X Y Z Select one: O A. 121.25 O B. 72.5 O C. 81.69 O D. 100.0 31-Dec-20 Closing Price $ 75.00 $ 150.00 $ 25.00 $ 40.00 31-Dec-20 Shares 10,000 5,000 20,000 25,000 31-Dec-21 Closing Price $50.00 $65.00 $35.00 $50.00 31-Dec-21 Shares 20,000 10,000 20,000 25,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education