Concept explainers

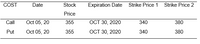

Costco (NASDAQ: COST) proving its strength as a consumer staples stalwart and has seen its share price strongly outperform the S&P 500 over the last month. Suppose you have purchased a Costco stock, which type of option should be chosen for hedging? Based on the option you selected, choose the appropriate strike price to calculate the option price, assuming the Costco is on a non-dividend-paying stock and the current stock price and strike price are given in the question, the risk-free interest rate is 3% per annum, the volatility is 30% per annum, and the time to maturity is four months.

Information provided:

Risk free rate = 3%

Volatility = 30%

Time to maturity = 4 months

Stock price = $355

Strike price 1 = $340

Strike price 2 = $380

Step by stepSolved in 2 steps

- Assume a stock with an option with the information as follows. • Stock purchased price was $113.• Call option on the stock was purchased at $4. • Call option has strike price at $115.• the stock price is $117on expiration date Please explain the Call Options Payoff Diagrams below, why it plot like this (please explain step by step) . Thank you for your answeringarrow_forwardWant the Correct answer of what is correct optionarrow_forwardOptions2. Construct profit diagrams at expiration time to show what position in META puts, calls and/or underlying stock best expresses the investor’s objectives described below. META currently sells for $210 so that profit diagrams between $150 and $250 in $10 increments are appropriate. Assume that at-the-money puts and calls currently cost$30 each. The call with strike $190 costs $40 and the call with strike $230 costs $20. (a) An investor wants to benefit from META price drops but does not want to lose more than $30 on the investment. (b) An investor wants to have a positive payoff if the upcoming META earnings announcement is close to market expectations—meaning that the price will not move by more than $20 dollars.arrow_forward

- Pls show Every step and conceptarrow_forwardPlease show step by step work (not in excel): What is the call option premium given the following information? What would happen to the call price if the company initiated and paid a dividend before the expiration of the option? What would happen to the call premium if the expiration of the option expanded beyond the current 9 months? Stock price $36.00 Strike price $30.00 Volatility 16% Dividend Yield 0.00 Time 0.75 Riskfree Rate 2.70%arrow_forward3 You are given the following information on some company's stock, as well as the risk- free asset. Use it to calculate the price of the call option written on that stock, as well as the price of the put option. (HINT: You should use the Black-Scholes formula!) (Do not round intermediate calculations and round your final answers to 2 decimal places, e.g., 32.16.) Today's stock - $77 price = Exercise price = $75 Risk-free rate = Option maturity = 5 months Standard deviation of annual stock returns Call price Put price $ $ 3.4% per year, compounded continuously = 59% per year 3.61 x 0.56 X 1arrow_forward

- The returns on small company stocks are 10.7%, U.S. Treasury bill offer a 1.5% return and a bank savings account offers an 1.3% return. What is the risk premium on small company stocks?arrow_forwardUse the Black-Scholes formula to find the value of a call option based on the following inputs. (Round your final answer to 2 decimal places. Do not round intermediate calculations.) Stock price Exercise price Interest rate Dividend yield Time to expiration Standard deviation of stock's returns Call value GA $ $ $ 48 60 0.07 0.04 0.50 0.26arrow_forwardNingbo Industrial Concepts Incorporated Initial stock price $115.00 Exercise price $115.00 Call price $4.75 Put Price $4.50 Required: Using the information in the table above, please calculate dollar value of the following option strategies. Use this calculated dollar value to determine the profit of each strategy at various stock prices. (Use cells A3 to B6 from the given information to complete this question. Negative answer should be input and displayed as a negative value. All other answers should be input and displayed as positive values.) Ningbo Industrial Concepts Incorporated Dollar Value of Strategy as a Function of Current Stock Price Strategy $95.00 $105.00 $115.00 $125.00 $135.00 Straddle Strip Strap Ningbo Industrial Concepts Incorporated Rate of Return…arrow_forward

- Use the Black-Scholes formula to find the value of a call option based on the following inputs. Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Stock price Exercise price Interest rate Dividend yield Time to expiration Standard deviation of stock's returns Call value $ 54 $ 63 0.082 0.04 0.50 0.260arrow_forwardAssume that if M launches a new e-trading platform, its price will go up to $261. Else, M price will go down to $62. You are aware that M shares are being traded at $162. You also know that the risk-free rate is 5%.What is the probability that M price will go down?***Please round your answer to the nearest three decimals (i.e. 0.512)arrow_forwardA stock is currently trading for $25 per share and an investor is interested in the following two options with a one year expiration term. Options Call Put Strike Price $28 $24 Quoted Price $2 $4 a) Calculate the intrinsic values of the call and put. b) Draw the profit diagram for a short position in the put option described above. Label the diagram well. Show all the critical points on the diagram. For example, the intercepts on axes, maximum profit or maximum loss. What price movements are required for the investor to have a positive profit? c) Draw the profit diagram for a long position in the call option. And label the diagram well. d) Suppose one month later, the stock price moves up to $30 per share, how will the prices of the call and put change? Why? Briefly explain. e) Suppose an investor purchased 10 contracts of the 28 calls and sold 10 contracts of the 24 puts. If the stock price turns out to be $30 per share in one month, what is the total profit for this investor?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education