Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

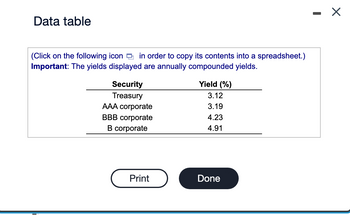

The following table summarizes the yields to maturity on several one-year, zero-coupon securities:

- What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating?

- What is the credit spread on AAA-rated corporate bonds?

- What is the credit spread on B-rated corporate bonds?

- How does the credit spread change with the bond rating? Why?

(Round to three decimal places.)

Transcribed Image Text:Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Important: The yields displayed are annually compounded yields.

Security

Treasury

AAA corporate

BBB corporate

B corporate

Print

Yield (%)

3.12

3.19

4.23

4.91

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:d. How does the credit spread change with the bond rating? Why? (Select the best choice below.)

A. The credit spread increases as the bond rating falls because lower-rated bonds are riskier.

B. The credit spread decreases as the bond rating rises because higher-rated bonds are riskier.

C. The credit spread increases as the bond rating rises because higher-rated bonds are riskier.

D. The credit spread decreases as the bond rating falls because lower-rated bonds are riskier.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:d. How does the credit spread change with the bond rating? Why? (Select the best choice below.)

A. The credit spread increases as the bond rating falls because lower-rated bonds are riskier.

B. The credit spread decreases as the bond rating rises because higher-rated bonds are riskier.

C. The credit spread increases as the bond rating rises because higher-rated bonds are riskier.

D. The credit spread decreases as the bond rating falls because lower-rated bonds are riskier.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the price of the bond given the information below. The bond makes semiannual interest payments. (Do not round intermediate calculations, round answer to two decimals, i.e. 32.16) Coupon Rate:8.5% YTM:9.5% Maturity (years):8 Par value: $2,000arrow_forwardThe following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate b AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate t AAA rating? The price of this bond will be ☐ %. (Round to three decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Important: The yields displayed are annually compounded yields. Security Treasury Yield (%) 3.14 AAA corporate 3.28 BBB corporate 4.27 B corporate 4.95 Print Donearrow_forwardUsing the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. (Input your answers as a percent rounded to 2 decimal places.) 1-year T-bill at beginning of year 1 1-year T-bill at beginning of year 2 1-year T-bill at beginning of year 3 1-year T-bill at beginning of year 4 2-year security 3-year security 4-year security Expected Return Interest Rate 58 78 10% 128arrow_forward

- 6. Below is a list of daily Treasury note and bond listings from Wall Street Journal. Treasury bonds make semiannual payments. First column is the maturity date. Second column is the coupon rate. Third and Fourth columns show the bid and ask prices. Treasury prices are quoted as a percentage of face value. So on the 2025/10/31 bond, the bid price is shown to be 106.212. With $1000 face value, this quote represents $1062.12. The Fifth column shows the change in the ask price from the previous day, measured as percentage of face value. So the 2025/10/31 bond's ask price decreased by 0.002%, or $0.02 with face value of $1000, from previous day's value. The last column shows the yield to maturity, based on the ask price. Locate the Treasury bond in Figure 7.5 maturing in November 2026. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread in dollars? Assume a par value of $10,000. Maturity 10/31/2025 11/15/2026 Coupon…arrow_forwardUse the following data on bond yield: Yield on top-rated corporate bonds Yield on intermediate-grade corporate bonds Required: a. Calculate the change in the confidence index from last year to this year. b. Is the confidence index rising or falling? Required A Required B Complete this question by entering your answers in the tabs below. This Year 4.3% 6.3 This year Last year Calculate the change in the confidence index from last year to this year. Note: Round your answers to 3 decimal places. Confidence Index X Answer is not complete. (0.400) X Last Year 8.6% 10.2arrow_forwardA BBB-rated corporate bond has a yield to maturity of 10.4 % . AU.S. Treasury security has a yield to maturity of 8.6 % . These yields are quoted as APRs with semi-annual compounding. Both bonds pay semi- annual coupons at a rate of 8.7 % and have five years to maturity. . What is the price (expressed as a percentage of the face value) of the Treasury bond? b. What is the price ( expressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds? aarrow_forward

- (Related to Checkpoint 9.3) (Bond valuation) Doisneau 18-year bonds have an annual coupon interest of 11 percent, make interest payments on a semiannual basis, and have a $1,000 par value. If the bonds are trading with a market's required yield to maturity of 12 percent, are these premium or discount bonds? Explain your answer. What is the price of the bonds? a. If the bonds are trading with a yield to maturity of 12%, then (Select the best choice below.) C O A. the bonds should be selling at par because the bond's coupon rate is equal to the yield to maturity of similar bonds. O B. the bonds should be selling at a premium because the bond's coupon rate is greater than the yield to maturity of similar bonds. O C. there is not enough information to judge the value of the bonds. O D. the bonds should be selling at a discount because the bond's coupon rate is less than the yield to maturity of similar bonds.arrow_forwardA BBB-rated corporate bond has a yield to maturity of 7.4%. A U.S. Treasury security has a yield to maturity of 5.7%. These yields are quoted as APRs with semiannual compounding. Both bonds pay semi-annual coupons at a rate of 6.1% and have five years to maturity. a. What is the price (expressed as a percentage of the face value) of the Treasury bond? b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds? *round to three decimal places*arrow_forwardThe YTMs on benchmark one-year, two-year, and three - year annual pay bonds that are priced at par are listed in the table below. Bond Yield 1 - year 1.74 2 - year 3.37 3 - year 3.98 What is the correct no - arbitrage price for a 3 year risk free bond with a 5.35% coupon, per $100 of par value?arrow_forward

- If the YTM on a bond is 17.5 %, what will be the periodic rate assuming the bond is paying coupons semi-annually? (Write this number as a decimal and not as a percentage, e.g. 0.11 not 11%. Round your answer to three decimal places. For example 1.23450 or 1.23463 will be rounded to 1.235 while 1.23448 will be rounded to 1.234).arrow_forwardUsing the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. Note: Input your answers as a percent rounded to 2 decimal places. 1-year T-bill at beginning of year 1 1-year T-bill at beginning of year 21 1-year T-bill at beginning of year 3 1-year T-bill at beginning of year 4 2-year security 3-year security 4-year security Expected Return % % % Interest Rate 7% 9% 10% 12%arrow_forwardShow all workings. Complete the following table and draw a graph showing how bond pricefor each bond changes over time as they move towards their maturitydates. Describe the relationship between bond prices and timeremaining for maturity.YearsreminingtomaturityBOND ACoupon rate = 8% p.a.Market interest rate =6% p.a.BOND BCoupon rate = 6% p.a.Market interest rate =6% p.a.BOND CCoupon rate = 4% p.a.Market interest rate =6% p.a.109876543210arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education