Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

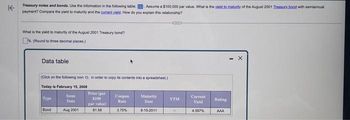

Transcribed Image Text:**Treasury Notes and Bonds Analysis**

Use the information in the following table. Assume a $100,000 par value.

**Yield to Maturity and Current Yield Analysis**

- What is the yield to maturity of the August 2001 Treasury bond with semiannual payments?

- Compare the yield to maturity and the current yield. How do you explain this relationship?

**Task**

What is the yield to maturity of the August 2001 Treasury bond? (Round to three decimal places.)

---

**Data Table**

*(Click on the following icon to copy its contents into a spreadsheet.)*

**Date:** February 15, 2008

| Type | Issue Date | Price (per $100 face value) | Coupon Rate | Maturity Date | YTM | Current Yield | Rating |

|------|------------|-----------------------------|-------------|---------------|-----|---------------|--------|

| Bond | Aug 2001 | 81.58 | 3.75% | 8-15-2011 | - | 4.597% | AAA |

**Explanation:**

- **Type:** The financial instrument in question is a bond.

- **Issue Date:** The bond was issued in August 2001.

- **Price (per $100 face value):** The current price of the bond is $81.58, meaning it's trading below its face value.

- **Coupon Rate:** This bond has an annual coupon rate of 3.75%.

- **Maturity Date:** The bond is set to mature on August 15, 2011.

- **Current Yield:** The yield based on the bond's current price is 4.597%, which indicates a higher return compared to the coupon rate due to its discount price.

- **Rating:** The bond holds a rating of AAA, signifying a high level of creditworthiness.

This data table facilitates the analysis of Treasury bond yields, enabling users to compare the yield to maturity and the current yield effectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A Treasury bill that settles on May 18, 2022, pays $100,000 on August 21, 2022. Assuming a discount rate of 3.87 percent, what are the price and bond equivalent yield? Use Excel to answer this question. Note: Round your price answer to 2 decimal places. Enter your yield answer as a percent rounded to 3 decimal places.arrow_forwardBond prices. Price the bonds from the following table with monthly coupon payments Hint: make sure to round all intermediate calculations to at least seven decimal places.arrow_forwardPlease answer all parts with explanations thxarrow_forward

- A Treasury bill that settles on May 18, 2022, pays $100,000 on August 21, 2022. Assuming a discount rate of 5.23 percent, what are the price and bond equivalent yield? Use Excel to answer this question. Note: Round your price answer to 2 decimal places. Enter your yield answer as a percent rounded to 3 decimal places. Price Bond equivalent yield %arrow_forwardThe prices of several bonds with face values of $1,000 are summarized in the following table: state whether it trades at a discount, at par, or at a premium. Bond A is selling at (Select from the drop-down menu.) . For each bond,arrow_forward(Round to the nearest cent.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Today is February 15, 2008 Issue Date Coupon Rale Maturity Date Current Type Price YTM Rating Yield Note Feb 2006 7.25% 2-15-2016 5.722% AAA Print Done %24arrow_forward

- V5 2. Go to the CANSIM database and download monthly data, from January 1976 to January 2021, on the three-month T-bill rate (series V122531) and the interest rate on long-term Canada bonds (Government of Canada benchmark bond yields, long term )(series V122544). (Note these are daily rates – convert it into monthly rates) a) Construct a yield curve by creating a line graph for January 2021 and for the same month in 2020, across all the maturities. (on excel) b) How do the yield curves compare? What does the changing slope say about potential changes in economic conditions?arrow_forwardWhat is the total cost of borrowing over the life of the bond? (Round answer to 0 decimal places, e.g. - Total cost of borrowing over the life of the bond $ Save for Later Attempts lipiarrow_forwardApplying Time Value of Money Concepts Complete the missing information in the table below. Assume that all bonds pay interest semiannually. Do not use negative signs with answer. Round percentages to one decimal place (ex. 0.0345 = 3.5%). Round all other values to the nearest whole number. Annual Yield Years to Coupon Issue Maturity Rate Face value Proceeds Firm 1 8.00% 15 7.00% $500,000 $ Firm 2 3.00% 10 0.00% $ $705,347 Firm 3 6.50% 5.00% $500,000 $458,353 Firm 4 % 12 3.50% $1,000,000 $1,114,103 Firm 5 0.80% 20 2.00% $700,000 $arrow_forward

- 6. Below is a list of daily Treasury note and bond listings from Wall Street Journal. Treasury bonds make semiannual payments. First column is the maturity date. Second column is the coupon rate. Third and Fourth columns show the bid and ask prices. Treasury prices are quoted as a percentage of face value. So on the 2025/10/31 bond, the bid price is shown to be 106.212. With $1000 face value, this quote represents $1062.12. The Fifth column shows the change in the ask price from the previous day, measured as percentage of face value. So the 2025/10/31 bond's ask price decreased by 0.002%, or $0.02 with face value of $1000, from previous day's value. The last column shows the yield to maturity, based on the ask price. Locate the Treasury bond in Figure 7.5 maturing in November 2026. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread in dollars? Assume a par value of $10,000. Maturity 10/31/2025 11/15/2026 Coupon…arrow_forwardUse the following data on bond yield: Yield on top-rated corporate bonds Yield on intermediate-grade corporate bonds Required: a. Calculate the change in the confidence index from last year to this year. b. Is the confidence index rising or falling? Required A Required B Complete this question by entering your answers in the tabs below. This Year 4.3% 6.3 This year Last year Calculate the change in the confidence index from last year to this year. Note: Round your answers to 3 decimal places. Confidence Index X Answer is not complete. (0.400) X Last Year 8.6% 10.2arrow_forwardPlease see attached. Definitions: Coupon is the regular interest payment of a bond. Coupon rate is the interest rate for the bond coupons, expressed in annual percentage terms. Par value is the principal amount to be repaid at the maturity of the bond. Yield to maturity (YTM) is the return the bond holder receives on the bond if held to maturity. Maturity date is the expiration date of the bond on which the final interest payment is made as well as the principal repayment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education