Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

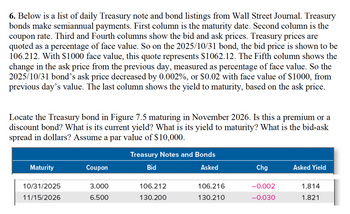

Transcribed Image Text:6. Below is a list of daily Treasury note and bond listings from Wall Street Journal. Treasury

bonds make semiannual payments. First column is the maturity date. Second column is the

coupon rate. Third and Fourth columns show the bid and ask prices. Treasury prices are

quoted as a percentage of face value. So on the 2025/10/31 bond, the bid price is shown to be

106.212. With $1000 face value, this quote represents $1062.12. The Fifth column shows the

change in the ask price from the previous day, measured as percentage of face value. So the

2025/10/31 bond's ask price decreased by 0.002%, or $0.02 with face value of $1000, from

previous day's value. The last column shows the yield to maturity, based on the ask price.

Locate the Treasury bond in Figure 7.5 maturing in November 2026. Is this a premium or a

discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask

spread in dollars? Assume a par value of $10,000.

Maturity

10/31/2025

11/15/2026

Coupon

3.000

6.500

Treasury Notes and Bonds

Bid

Asked

106.212

130.200

106.216

130.210

Chg

-0.002

-0.030

Asked Yield

1.814

1.821

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An analyst observes a GUI & Co 6.625%, 5 year semi-annual pay bond trading at 103.164% of par (where par = $1,000). The bond is callable at 102.5 in 3 years and putable at 99 in 3 years. #3: what are the bond's current yield and yield to maturity? #4. What's the bond's yield to call and put? EC: Do you expect that the bond would be called and/or put? Why or Why not?arrow_forwardPlease answer all parts with explanations thxarrow_forwardA U.S. Treasury bill with 93 days to maturity is quoted at a discount yield of 1.65 percent. What is the bond equivalent yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Omit the "%" sign in your response.) Bond equivalent yield %arrow_forward

- 1 Given below is information about three RM10000 par value bonds, each of which pays coupon annually. The required rate of return on each bond is 12%. Calculate the value of the bonds and determine whether the bond is selling at discount, premium or par value. Bond 1 . 2 3 Coupon Rate (%) 10 12 14 Maturity (years) 5 10 15 b. Calculate the Yield to Maturity (YTM)/ RRR for the example given below Bond par value RM10000 Coupon Rate 10% every year Maturity period 10 years Market Value of bond RM11800.00arrow_forwardThe prices of several bonds with face values of $1,000 are summarized in the following table: state whether it trades at a discount, at par, or at a premium. Bond A is selling at (Select from the drop-down menu.) . For each bond,arrow_forwardA company issues a bond with a par value of $500,000 and a contract rate of 5%. Explain the concept of market rate. Why would a company issue a bond at a discount or a premium? How is bond price impacted? If the bond is issued at a discount or a premium, does it impact the interest or principal paid? Why or why not? (Answer in 5-10 sentences)arrow_forward

- Please help answer this question.arrow_forwardCalculate the purchase price of the $1,000 face value bond using the information given below. (Do not round the intermediate calculations. Round your final answer to 2 decimal places.) Issue date Maturity date Purchase date Coupon rate (%) Market rate (%) Dec 15, 1992 Dec 15, 2022 June 15, 2010 5.40 7.2 Assume that Bond interest is paid semiannually. The bond was originally issued at its face value. Bonds are redeemed at their face value at maturity. Market rates of return are compounded semiannually. Bond price $arrow_forwardAccounting A bond has an annual coupon of 67%, which makes semiannual payments. The next payment is 2 months away. The bonds quoted price is 102.0 with par of $1000, what is the bond's clean price? (Please use at least 5 decimal places and do not use $ symbol in the answer)arrow_forward

- I need help using the present value of a bond calculator at https://www.thecalculator.co/finance/Bond-Price-Calculator-606.html. Approximate the present value for the following $1,000 bonds. Note: Round answers to 2 decimal places.arrow_forwardA Treasury bond that settles on August 10, 2022, matures on November 5, 2029. The coupon rate is 6.8 percent and the 11811 32 quoted price is What is the bond's yield to maturity? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Yield to maturity A Treasury bond that settles on August 10, 2022, matures on November 5, 2029. The coupon rate is 6.8 percent and the quoted price is 118 11/32. What is the bond's yield to maturity? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Yield to maturityarrow_forwardThe following table gives the prices of bonds Bond Principal ($) Time to maturity Annual coupon ($) Bond Price ($) 100 (years) 0.5 100 1 100 100 1.5 2 The bonds provide coupon are semiannual coupon bond a. Calculate 6-month, 12-month, 18-month and 24-month zero rates. 1567 0 98 100 100 101 b. What is the forward rate for the six-month period beginning in 12 months. c. Estimate the price of a two-year bond providing annual coupon of 7% annually.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education