Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

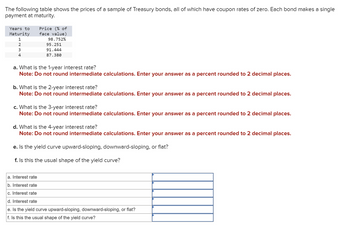

Transcribed Image Text:The following table shows the prices of a sample of Treasury bonds, all of which have coupon rates of zero. Each bond makes a single

payment at maturity.

Price (% of

face value)

98.752%

Years to

Maturity

1

2

95.251

3

91.444

4

87.380

a. What is the 1-year interest rate?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

b. What is the 2-year interest rate?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

c. What is the 3-year interest rate?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

d. What is the 4-year interest rate?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

e. Is the yield curve upward-sloping, downward-sloping, or flat?

f. Is this the usual shape of the yield curve?

a. Interest rate

b. Interest rate

c. Interest rate

d. Interest rate

e. Is the yield curve upward-sloping, downward-sloping, or flat?

f. Is this the usual shape of the yield curve?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A plot of the yields on bonds with different terms to maturity but the same risk, liquidity, and tax considerations is known as O A. a yield curve. B. a risk-structure curve. OC. a term-structure curve. 5- O D. an interest-rate curve. Suppose people expect the interest rate on one-year bonds for each of the next four years to be 3%, 6%, 5%, and 6%. If the expectations theory of the term structure of interest rates is correct, then the implied interest rate on bonds with a maturity of four years is nearest whole number). %. (Round your response to the 2- Refer to the figure on your right. Suppose the expected interest rates on one-year bonds for each of the next four years are 4%, 5%, 6%, and 7%, respectively. 1. 1.) Use the line drawing tool (once) to plot the yield curve generated. 3 Term to Maturity in Years 2.) Use the point drawing tool to locate the interest rates on the next four years. 5. 3- Interest Rate .....arrow_forwardThe following information about bonds A, B, C, and D are given. Assume that bond prices admit noarbitrage opportunities. What is the convexity of Bond D?Cash Flow at the end ofBond Price Year 1 Year 2 Year 3A 91 100 0 0B 86 0 100 0C 78 0 0 100D ? 5 5 105arrow_forwardA bond sells for $894.17 and has a coupon rate of 6.20 percent. If the bond has 13 years until maturity, what is the yield to maturity of the bond? Assume semiannual compounding. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

- A bond has a semi-annual coupon payment of $32.4. What is the coupon RATE? Convert to a percent. Round to 2 decimal places. Include a dollar sign ($) or percent (%) as appropriate. (NOTE: the coupon RATE is given annually, yet the coupon PAYMENT is semi-annual.) Answer:arrow_forwardThe following table summarizes current prices of various zero-coupon bonds (expressed as a percentage of face value): Bond A B C D Maturity (years) 1 2 3 4 Price (per $100 face value) 96.62 82.56 82.69 83.26 E.G for bond A it will mature in 1 year and has a current bond price of $96.62. For bond B, it will mature in 2 years and had a current bond price of $82.56 Assume the YTM for each bond doesn't change over time. After two years, what is the price for bond D? 1. bond A 2. bond B 3. bond C 4. Bond Darrow_forwardUsing the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. (Input your answers as a percent rounded to 2 decimal places.) 1-year T-bill at beginning of year 1 1-year T-bill at beginning of year 2 1-year T-bill at beginning of year 3 1-year T-bill at beginning of year 4 2-year security 3-year security 4-year security Expected Return % % % Interest Rate 61 98 7% 108arrow_forward

- Compute the price of a 6.1 percent coupon bond with 15 years left to maturity and a market interest rate of 9.0 percent. (Assume interest payments are semiannual.) (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Is this a discount or premium bond?arrow_forwardA Treasury bond with the longest maturity (30 years) has an ask price quoted at 101.9375. The coupon rate is 4.10 percent, paid semiannually. What is the yield to maturity of this bond? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Yield to maturity %arrow_forwardBond j has a coupon of 6.2 percent. Bond k has a coupon of 10.2 percent. Both bonds have 20 years to maturity and have a YTM of 6.9 percent. a. If interest rates suddenly rise by 1 percent, what is the percentage price change of these bonds? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. \table[[,%delta in Price],[Bond j,,%arrow_forward

- If the YTM on a bond is 11.1 %, what will be the periodic rate assuming the bond is paying coupons semi-annually? (Write this number as a decimal and not as a percentage, e.g. 0.11 not 11%. Round your answer to three decimal places. For example 1.23450 or 1.23463 will be rounded to 1.235 while 1.23448 will be rounded to 1,234).arrow_forwardWhat is the Macaulay duration of a bond with a coupon of 5.8 percent, eleven years to maturity, and a current price of $1,060.10? What is the modified duration? (Do not round intermediate calculations. Round your answers to 3 decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education