FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

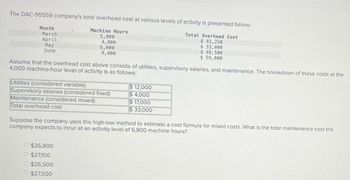

Transcribed Image Text:The DAC-95559 company's total overhead cost at various levels of activity is presented below:

Month

March

April

May

June

Machine Hours

5,000

4,000

6,000

8,000

Total Overhead Cost

$ 41,250

$ 33,000

$ 49,500

$ 59,000

Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the

4,000 machine-hour level of activity is as follows:

Utilities (considered variable)

$12,000

Supervisory salaries (considered fixed)

$4,000

$17,000

$33,000

Maintenance (considered mixed)

Total overhead cost

Suppose the company uses the high-low method to estimate a cost formula for mixed costs. What is the total maintenance cost the

company expects to incur at an activity level of 6,800 machine hours?

$26,800

$27,100

$26,500

$27,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stargate Corporation has established the following standards for the costs of one unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows: Std Cost Std Qty Std Price/Rate Direct Material $ 14.40 6.00 kg $ 2.40 per kg Direct Labor $ 3.00 0.40 hour $ 7.50 per hour Variable Overhead $ 4.00 0.40 hour $ 10.0 per hour Fixed Overhead $ 4.80 0.40 hour $ 12.0 per hour Total $ 26.20 *based on practical capacity of 2,500 direct-labor hour per month During December 2020, Henry purchased 30,000 kg of direct material at a total cost of $75,000. The total wages for December were $20,000, 75% of which were for direct labor. Henry manufactured 4,500 units of product during December 2020, using 28,000kg of the direct material purchased in December and 2,100 direct-labor hours. Actual variable and fixed overhead cost were $23,100…arrow_forwardRex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Rex Industries data Activity Machine setups Machine hours Inspections Overhead per Activity $155,000 352,800 120,750 Annual Usage 4,000 14,112 3,500 Overhead Rate per Activity $ Complete the chart and compute the overhead rate for each activity. Round to the nearest penny, two decimal places.arrow_forwardSpates, Inc., manufactures and sells two products: Product H2 and Product EO. Data concerning the expected production of each product and the expected total direct labor-hours (DLHS) required to produce that output appear below: Direct Total Labor- Direct Expected Production Hours Per Labor- Unit Hours Product H2 100 6.0 600 Product E0 100 5.0 500 Total direct labor-hours 1,100 The company's expected total manufacturing overhead is $266,468. If the company allocates all of its overhead based on direct labor-hours, the overhead assigned to each unit of Product H2 would be closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forward

- Company has gathered the following information: Variable manufacturing overhead costs $12,240 Fixed manufacturing overhead costs $9,270 Normal production level in labour hours 9,000 Standard labour hours 9,500 During the year, 3,230 units were produced, 10,600 hours were worked, and the actual manufacturing overhead was $20,200. Actual fixed overhead totalled $9,290. Bonita applies overhead based on direct labour hours. (a) Calculate the total, fixed, and variable predetermined overhead rates. (Round calculations and final answer to 2 decimal places, e.g. 15.25.) Fixed predetermined ovehead rate $ per DL hour Variable predetermined ovehead rate $ per DL hour Total predetermined ovehead rate $ per DL hourarrow_forwardam. 122.arrow_forwardHenry Company has established the following standards for the costs of one unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows: Std Cost Std Qty Std Price/Rate Direct Material $ 14.40 6.00 kg $ 2.40/kg Direct Labor $ 3.00 0.40 hour $ 7.50/hour Variable Overhead $ 4.00 0.40 hour $ 10.00/hour Fixed Overhead* $ 4.80 0.40 hour $ 12.00/hour Total $ 26.20 *based on practical capacity of 2,500 direct-labor hour per month During December 2020, Henry purchased 30,000 kg of direct material at a total cost of $75,000. The total wages for December were $20,000, 75% of which were for direct labor. Henry manufactured 4,500 units of product during December 2020, using 28,000kg of the direct material purchased in December and 2,100 direct-labor hours. Actual variable and fixed overhead cost were $23,100 and $25,000, respectively.…arrow_forward

- The following are standard costs related to a product of Jacobs, SRL: Inputs: Unit of Input Units per item Price or rate Direct Materials: square feet 80 $22/square foot Direct Labor: direct labor hours 24 $38/direct labor hour Variable Overhead: direct labor hours $49/direct labor hour The company applies variable overhead on the basis of direct labor hours. In April, the following results were reported: Actual output: 506 items Raw Materials used: 45,684 square feet Raw Material purchased: 42,335 square feet Actual direct labor hours: 14,168 hours Actual cost of raw materials purchased: $973,705 Actual direct labor cost: $609,224 Actual variable overhead cost: $665,896 The direct material purchases variance is computed when the materials are purchased. Determine each of the following variances and whether they are favorable or unfavorable: Part 1: Direct Material quantity variance: 114,488 Unfavorable 114,488 Favorable 83,145 Favorable 83, 145…arrow_forwardKesterson Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense Cost per Unit $ 6.30 $ 3.30 $ 1.25 $ 1.30 $ 0.60 Cost per Period $ 15,000 $ 4,200 If 7,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:arrow_forwardKropf Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours. Inputs Standard Quantity or Hours per Unit of Output Standard Price or Rate Direct materials 8.80 liters $ 8.40 per liter Direct labor 0.40 hours $ 28.70 per hour Variable manufacturing overhead 0.40 hours $ 7.30 per hour The company has reported the following actual results for the product for September: Actual output 11,000 units Raw materials purchased 98,400 liters Actual cost of raw materials purchased $ 854,500 Raw materials used in production 96,830 liters Actual direct labor-hours 4,000 hours Actual direct labor cost $ 120,302 Actual variable overhead cost $ 25,414 Required: a. Compute the materials price variance for September. b. Compute the materials quantity variance for September. c. Compute the labor rate…arrow_forward

- Manjiarrow_forwardMultiple Choice $685 per order $675 per order $544 per order $665 per orderarrow_forwardAssume (1) actual machine-hours worked during the period of 54,000 hours, (2) manufacturing overhead applied to production during the period of $432,000, (3) estimated fixed manufacturing overhead of $329,400, and (4) estimated variable manufacturing overhead cost per machine-hour of $2.00. The estimated amount of the allocation base (machine-hours) is closest to: 56,900. 54,900. 54,200. 52,900.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education