FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

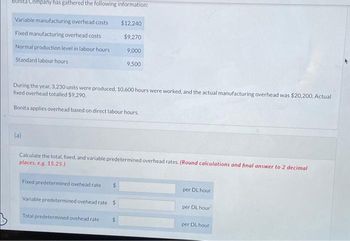

Transcribed Image Text:Company has gathered the following information:

Variable manufacturing overhead costs

$12,240

Fixed manufacturing overhead costs

$9,270

Normal production level in labour hours

9,000

Standard labour hours

9,500

During the year, 3,230 units were produced, 10,600 hours were worked, and the actual manufacturing overhead was $20,200. Actual

fixed overhead totalled $9,290.

Bonita applies overhead based on direct labour hours.

(a)

Calculate the total, fixed, and variable predetermined overhead rates. (Round calculations and final answer to 2 decimal

places, e.g. 15.25.)

Fixed predetermined ovehead rate

$

per DL hour

Variable predetermined ovehead rate $

per DL hour

Total predetermined ovehead rate

$

per DL hour

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Osborn Manufacturing uses a predetermined overhead rate of $18.60 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $230,640 of total manufacturing overhead for an estimated activity level of 12,400 direct labor-hours. The company actually incurred $225,000 of manufacturing overhead and 11,900 direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? 1. Manufacturing overhead by 2. The gross margin would byarrow_forwardRex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Rex Industries data Activity Machine setups Machine hours Inspections Overhead per Activity $155,000 352,800 120,750 Annual Usage 4,000 14,112 3,500 Overhead Rate per Activity $ Complete the chart and compute the overhead rate for each activity. Round to the nearest penny, two decimal places.arrow_forwardAssume the following: 1. Estimated fixed manufacturing overhead for the coming period of $220,000 2. Estimated variable manufacturing overhead of $2.00 per direct labor hour 3. Actual manufacturing overhead for the period of $320,000 4. Actual direct labor-hours worked of 54,000 hours 5. Estimated direct labor-hours to be worked in the coming period of 55,000 hours. The amount of overhead applied to production during the period is closest to: Note: Round your intermediate value of "Predetermined overhead rate" to two decimal places. Multiple Choice $325,926. $324,000. $336,004.arrow_forward

- Luthan Company uses a plantwide predetermined overhead rate of $23.90 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $286,800 of total manufacturing overhead cost for an estimated activity level of 12,000 direct labor- hours. The company incurred actual total manufacturing overhead cost of $267,000 and 10,500 total direct labor-hours during the period. Required: Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period.arrow_forwardSpates, Inc., manufactures and sells two products: Product H2 and Product EO. Data concerning the expected production of each product and the expected total direct labor-hours (DLHS) required to produce that output appear below: Direct Total Labor- Direct Expected Production Hours Per Labor- Unit Hours Product H2 100 6.0 600 Product E0 100 5.0 500 Total direct labor-hours 1,100 The company's expected total manufacturing overhead is $266,468. If the company allocates all of its overhead based on direct labor-hours, the overhead assigned to each unit of Product H2 would be closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forwardShoes Wisely, Inc. allocates overhead using machine hours as the allocation base. The following information was estimated at the beginning of the year: Estimated Manufacturing Overhead $73,000 Estimated Machine Hours 19,000 Actual overhead totaled $72,000. During the year, the company produced 8,500 units of product using 14,000 machine hours and 60,000 direct labor hours. How much manufacturing overhead was allcoated to the product during the year? Round your answer to whole dollars.arrow_forward

- Luthan Company uses a plantwide predetermined overhead rate of $22.50 per direct labor-hour. This predetermined rate was basec on a cost formula that estimated $270,000 of total manufacturing overhead cost for an estimated activity level of 12,000 direct labor- hours. The company Incured actual total manufacturing overhead cost of $267,000 and 12,600 total direct labor-hours during the period. Required: Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period.arrow_forwardOsborn Manufacturing uses a predetermined overhead rate of $19.70 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $265,950 of total manufacturing overhead for an estimated activity level of 13,500 direct labor-hours. The company actually incurred $260,000 of manufacturing overhead and 13,000 direct labor-hours during the period. Can you please help me with the following: Determine the amount of underapplied or overapplied manufacturing overhead for the period, then assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company’s gross margin? By how much?arrow_forwardConsider the following production and cost data for two products, X and Y, manufactured by Company. Product X Product Y Sales price per unit $52 $40 Direct materials cost per unit $18 $8 Direct labor hours per unit 1.5 1.0 Machine hours per unit 3.0 2.0 The labor rate is $10 per hour. Variable overhead is $2 per direct labor hour. The company can hire sufficient labor for any production level. The company has 15,000 machine hours available each period. There is unlimited demand for each product. Assuming a company has achieved a reasonable level of cost accuracy, what is the most important determinant of whether cost information should be even more accurate?arrow_forward

- Luthan Company uses a plantwide predetermined overhead rate of $23.40 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $257,400 of total manufacturing overhead cost for an estimated activity level of 11,000 direct labor- hours. The company incurred actual total manufacturing overhead cost of $249,000 and 10,800 total direct labor-hours during the period. Required: Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period. Manufacturing overhead appliedarrow_forwardCrosshill Company's total overhead costs at various levels of activity are presented below: Month April May June July Machine-Hours 70,000 60,000 80,000 90,000 Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 60,000-machine-hour level of activity in May is as follows: Utilities (variable) Supervisory salaries (fixed) Maintenance (mixed) Total overhead cost Total Overhead Cost $200,200 $177,300 $223,100 $246,000 $ 48,000 21,000 108,300 $177,300 The company wants to break down the maintenance cost into its variable and fixed cost elements. Maintenance cost in July Required: 1. Estimate how much of the $246,000 of overhead cost in July was maintenance cost. (Hint: To do this, first betermine how much of the $246,000 consisted of utilities and supervisory salaries. Think about the behaviour of variable and fixed costs within the relevant range.) (Round the "Variable cost per unit" to 2 decimal places.)arrow_forwardLuthan Company uses a plantwide predetermined overhead rate of $23.40 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $280,800 of total manufacturing overhead cost for an estimated activity level of 12,000 direct labor-hours. The company incurred actual total manufacturing overhead cost of $266,000 and 11,300 total direct labor-hours during the period. Required: Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period. Manufacturing overhead appliedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education