FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

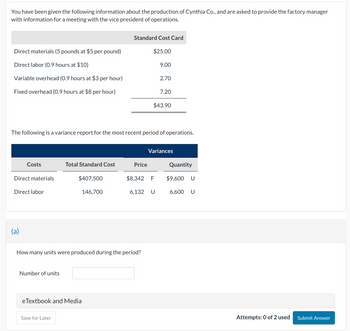

Transcribed Image Text:You have been given the following information about the production of Cynthia Co., and are asked to provide the factory manager

with information for a meeting with the vice president of operations.

Standard Cost Card

Direct materials (5 pounds at $5 per pound)

Direct labor (0.9 hours at $10)

$25.00

9.00

Variable overhead (0.9 hours at $3 per hour)

2.70

Fixed overhead (0.9 hours at $8 per hour)

7.20

$43.90

The following is a variance report for the most recent period of operations.

Variances

Costs

Total Standard Cost

Price

Quantity

Direct materials

$407,500

$8,342 F

$9,600 U

Direct labor

146,700

6,132 U

6,600 U

(a)

How many units were produced during the period?

Number of units

eTextbook and Media

Save for Later

Attempts: 0 of 2 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mabry Organics manufacturers organic fruit snacks. They use a departmental method of allocating manufacturing overhead. Department A's predetermined overhead rate is $5.67 per direct labor hour. Department B's predetermined overhead rate is $14.88 per machine hour. Actual cost driver information per department is provided below. Department A Department B Actual direct labor hours 50,200 DL hours 23,400 DL hours Actual machine hours 48,900 machine hours 17,500 machine hours What is the total applied manufacturing overhead?arrow_forwardSingle Plantwide Factory Overhead Rate Scrumptious Snacks Inc. manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. The company has budgeted the following costs for the upcoming period: Factory depreciation Indirect labor Factory electricity Indirect materials Selling expenses Tortilla chips Potato chips Pretzels Administrative expenses Total costs Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: I Budgeted Volume (Cases) Total If required $20,857 51,690 5,894 3,300 2,400 5,700 11,400 12,243 29,019 16,323 $136,026 Processing Hours Per Case 0.10 0.15 0.12arrow_forwardstep in overhead planning and control. After much effort and analysis, you estimated the following cost formulas and gathered the following actual cost data for March: Utilities Maintenance Supplies Indirect labor Depreciation Cost Formula $16,100 + $0.15 per machine-hour $38,100 + $1.60 per machine-hour $0.50 per machine-hour $94,500 + $2.10 per machine-hour $67,700 Actual Cost in March $ 20,450 $ 59,100 $ 8,300 $ 131,100 $ 69,400 During March, the company worked 15,000 machine-hours and produced 9,000 units. The company originally planned to work 17,000 machine-hours during March. Required: 1. Calculate the activity variances for March. 2. Calculate the spending variances for March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the spending variances for March. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive…arrow_forward

- BettaFish Inc. applies factory overhead as follows: * Department Per Machine Hour Fabricating Spreading Packaging PI0 P20 P30 Actual machine hours are: Fabricating- 2,000 hours Spreading - 1,500 hours Packaging - 3,000 hours The following additional data are provided: a. The actual factory overhead expense for the period is P100,000. b. The ending balances of the inventories and cost of goods sold after the application of overhead are as follows: Raw Materials Work in Process Finished Goods Cost of goods sold c. The over/(under) applied overhead during the period is considered material if at least 30% of actual factory overhead, 200,000 100,000 400,000 500,000 What is the adjusted cost of goods sold after closing the under/ over application of factory overhead?arrow_forwardBlue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Overhead DirectLabor Hours (dlh) Product A B Painting Dept. $374,640 11,200 dlh 16 dlh 2 dlh Finishing Dept. 100,440 8,100 7 17 Totals $475,080 19,300 dlh 23 dlh 19 dlh The overhead from both production departments allocated to each unit of Product A if Blue Ridge Marketing Inc. uses the multiple production department factory overhead rate method is a.$622.00 per unit b.$33.45 per unit c.$277.70 per unit d.$12.40 per unitarrow_forwardFickel Company has two manufacturing departments-Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $22.00 per direct labor-hour and $18.00 per direct labor-hour, respectively. The company's direct labor wage rate is $24.00 per hour. The following information pertains to Job N-60: Direct materials Direct labor Assembly $ 390 $ 228 1. Total manufacturing cost 2. Unit product cost Testing & Packaging Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job? (Do not round intermediate calculations. Round your answer to 2 decimal places.) $45 $ 132 Answer is complete but not entirely correct. $ $ 971 X 97.10 X per unitarrow_forward

- ces Mickley Company's plantwide predetermined overhead rate is $20.00 per direct labor-hour and its direct labor wage rate is $15.00 per hour. The following information pertains to Job A-500: Direct materials Direct labor $ 230 $ 75 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 40 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unitarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardBlue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Overhead DirectLabor Hours (dlh) Product A B Painting Dept. $259,500 10,600 dlh 12 dlh 7 dlh Finishing Dept. 72,700 8,000 2 16 Totals $332,200 18,600 dlh 14 dlh 23 dlh The factory overhead allocated per unit of Product B in the Painting Department if Blue Ridge Marketing Inc. uses the multiple production department factory overhead rate method is a.$63.61 per unit b.$125.02 per unit c.$24.48 per unit d.$171.36 per unitarrow_forward

- Rex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $157,850 4,100 $ Machine Hours 324,622 14,114 2$ Inspections 119,000 3,400arrow_forwardParearrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education