FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

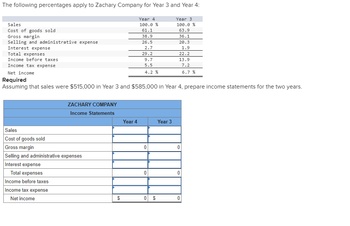

Transcribed Image Text:The following percentages apply to Zachary Company for Year 3 and Year 4:

Sales

Cost of goods sold

Gross margin

Selling and administrative expense

Interest expense

Total expenses

Income before taxes

Income tax expense

Net income

ZACHARY COMPANY

Income Statements

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Interest expense

Total expenses

Income before taxes

Income tax expense

Net income

Required

Assuming that sales were $515,000 in Year 3 and $585,000 in Year 4, prepare income statements for the two years.

$

Year 4

100.0 %

61.1

38.9

26.5

2.7

29.2

9.7

5.5

4.2 %

Year 4

0

0

0 $

Year 3

100.0 %

63.9

36.1

20.3

1.9

Year 3

22.2

13.9

7.2

6.7 %

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- NEED ANSWER WITH EXPLANATIONarrow_forwardRevenue and expense data for Young Technologies Inc. are as follows: Year 2 Year 1 Sales $500,000 $440,000 Cost of merchandise sold 325,000 242,000 Selling expenses 70,000 79,200 Administrative expenses 75,000 70,400 Income tax expense 10,500 16,400 Required: Question Content Area a. Prepare an income statement in comparative form, stating each item for both years as an amount and as a percent of sales. Round percentage amounts to nearest whole percent. Young Technologies Inc.Comparative Income StatementFor the Years Ended December 31, Year 2 and Year 1 Year 2 Amount Year 2 Percent Year 1 Amount Year 1 Percent $- Select - - Select -% $- Select - - Select -% - Select - - Select - - Select - - Select - $- Select - - Select -% $- Select - - Select -% $- Select - - Select -% $- Select - - Select -% - Select - - Select - - Select - - Select - Total expenses $fill in the blank 86d00500602205c_26 fill in the…arrow_forwardA comparative income statement is given below for McKenzie Sales, Limited, of Toronto: McKenzie Sales, Limited Comparative Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses Total expenses Net operating income Interest expense Net income before taxes This Year $ 7,350,000 4,610,000 2,740,000 1,390,000 706,000 2,096,000 644,000 101,000 $ 543,000 Last Year $ 5,586,000 3,511,500 2,074,500 1,079,500 613,500 1,693,000 381,500 87,000 $ 294,500 Members of the company's board of directors are surprised to see that net income increased by only $248,500 when sales increased by $1,764,000. Required: 1. Express each year's income statement in common-size percentages. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).)arrow_forward

- Income statements for Franklin Company for Year 3 and Year 4 follow: FRANKLIN COMPANY Income Statements Year 4 Year 3 Sales $ 201,300 $181, 300 Cost of goods sold 143, 600 121,600 Selling expenses 20,100 18, 100 Administrative expenses 12,500 14,500 Interest expense 3, 900 5,900 Total expenses 180, 100 160, 100 Income before taxes 21, 200 21,200 Income taxes expense 6, 400 3,600 Net income $ 14,800 $ 17,600 Required Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year.arrow_forwardRefer to the following selected financial information from Gomez Electronics. Compute the company's profit margin for Year 2. Net sales Cost of goods sold Interest expense Net income before tax Net income after tax Total assets Total liabilities Total equity Year 2 Year 1 $485,000 $427,550 277,600 251,420 11,000 12,000 68,550 53,980 47,350 41, 200 319,700 295,800 174,900 144, 800 168, 600 127, 200arrow_forwardFollowing is an incomplete current-year income statement. Determine Net Sales, Cost of goods sold and Net Income. Additional information follows: Return on total assets is 16% (average total assets is $62,500). Inventory turnover is 5 (average inventory is $7,800). Accounts receivable turnover is 8 (average accounts receivable is $7,700). Income Statement Net Sales Cost of goods sold Selling, general, and administrative expenses 8800 Income tax expenses 3800 Net Incomearrow_forward

- 9 )arrow_forwardAt the fiscal year ended June 30, 2020, the following information is available for Shein Company: Cost of goods sold. . .$167,400 Sales returns and allowances... 4,000 Sales revenue. 243,200 Interest expense... 5,000 Operating expenses... 88,700 Shein's net income/(net loss) for the period is Select one: a. Net income of $21,900 O b. Net income of $11,900 O c. Net loss of $11,900 O d. Net loss of $21,900arrow_forwardIncome statements for Fanning Company for Year 3 and Year 4 follow. FANNING COMPANY Income Statements. Sales Cost of goods sold. Selling expenses Administrative expenses. Interest expense Total expenses Income before taxes Income taxes expense Net income Year 4 $200,200 143,800 20,500 12,500 3,500 $180, 300 19,900 5,900 $14,000 Year 3 $180, 200 121,800 18,500 14,500 5,500 $160,300 19,900 3,100 $16,800 Required a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year.arrow_forward

- The following data were provided by Mystery Incorporated for the year ended December 31: Cost of Goods Sold $ 155,000 Income Tax Expense 14,820 Merchandise Sales (gross revenue) for Cash 220,000 Merchandise Sales (gross revenue) on Credit 38,000 Office Expense 18,000 Sales Returns and Allowances 6,450 Salaries and Wages Expense 36,200 1. What was the gross profit percentage? (round your percentage to 1 decimal place)arrow_forwardThe following information is available for Skysong Corp. for the year ended December 31, 2025. Other revenues and gains $21,600 Other expenses and losses 3,000 Cost of goods sold 281,000 Sales discounts 3,200 Sales revenue 746,000 Operating expenses 210,000 Sales returns and allowances 8,800 Prepare a multiple-step income statement for Skysong Corp. The company has a tax rate of 25%.arrow_forwardThe income statement of Booker T Industries Inc. for the current year ended June 30 is as follows: Sales $570,960 Cost of merchandise sold 324,190 Gross profit $246,770 Operating expenses: Depreciation expense $43,810 Other operating expenses 115,830 Total operating expenses 159,640 Income before income tax S87,130 Income tax expense 24,180 Net income $62,950 Changes in the balances of selected accounts from the beginning to the end of the current year are as follows: Increase Decrease Accounts receivable (net) S(12,650) Inventories 4,410 Prepaid expenses (4,220) Accounts payable (merchandise creditors) (9,000) Accrued expenses payable (operating expenses) 1,260 Income tax payable (3,020) a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the direct method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Booker T Industries Inc. Cash Flows from Operating Activities…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education