FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

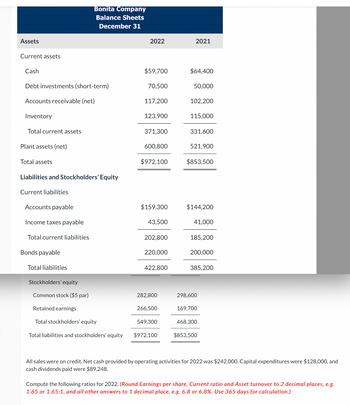

Transcribed Image Text:Assets

Current assets

Cash

Debt investments (short-term)

Accounts receivable (net)

Inventory

Total current assets

Plant assets (net)

Total assets

Liabilities and Stockholders' Equity

Current liabilities

Accounts payable

Income taxes payable

Total current liabilities

Bonita Company

Balance Sheets

December 31

Bonds payable

Total liabilities

Stockholders' equity

Common stock ($5 par)

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

2022

$59,700

70,500

117,200

123,900

371,300

600,800

$972,100

$159,300

43,500

202,800

220,000

422,800

282,800

266,500

549,300

$972,100

2021

$64,400

50,000

102,200

115,000

331,600

521,900

$853,500

$144,200

41,000

185,200

200,000

385,200

298,600

169,700

468,300

$853,500

All sales were on credit. Net cash provided by operating activities for 2022 was $242,000. Capital expenditures were $128,000, and

cash dividends paid were $89,248.

Compute the following ratios for 2022. (Round Earnings per share, Current ratio and Asset turnover to 2 decimal places, e.g.

1.65 or 1.65:1, and all other answers to 1 decimal place, e.g. 6.8 or 6.8%. Use 365 days for calculation.)

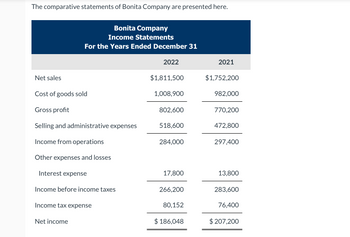

Transcribed Image Text:The comparative statements of Bonita Company are presented here.

Net sales

Bonita Company

Income Statements

For the Years Ended December 31

Cost of goods sold

Gross profit

Selling and administrative expenses

Income from operations

Other expenses and losses

Interest expense

Income before income taxes

Income tax expense

Net income

2022

$1,811,500

1,008,900

802,600

518,600

284,000

17,800

266,200

80,152

$ 186,048

2021

$1,752,200

982,000

770,200

472,800

297,400

13,800

283,600

76,400

$207,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cadux Candy Company's income statement for the year ended December 31, 2021, reported interest expense of $6 million and income tax expense of $32 million. Current assets listed in its balance sheet include cash, accounts receivable, and inventory. Property, plant, and equipment is the company's only noncurrent asset. Financial ratios for 2021 are listed below. Profitability and turnover ratios with balance sheet items in the denominator were calculated using year-end balances rather than averages Debt to equity ratio Current ratio Acid-test ratio. Times interest earned ratio Return on assets Return on equity Profit margin on sales Gross profit margin (gross profit divided by net sales) Inventory turnover Receivables turnover Assets Current assets Cash CADUX CANDY COMPANY Balance Sheet At December 31, 2021 (All values are in millions) Required: Prepare a December 31, 2021, balance sheet for the Cadux Candy Company. (Enter your answers in millions. Round your intermediate calculations…arrow_forwardPrepare a vertical analysis for the balance sheet data given below. (Round to two decimal places.) Petals, Inc. Balance Sheet December 31, 2019 Assets Current Assets: Cash and Cash Equivalents $10,000 Accounts Receivable, Net 15,600 Merchandise Inventory 38,000 Total Current Assets 63,600 Long-term Investments 15,000 Property, Plant, and Equipment, Net 195,000 Total Assets $273,600 Liabilities Current Liabilities: Accounts Payable $8,500 Notes Payable…arrow_forwardPlease solve for PART A (liquidity’s current ratio, account receivables turnover, and inventory turnover/profitability’s profit margin, asset turnover, return on assets, and earnings per share) and PART B (return on common stockholder’s equity, debt to assets ratio, and price earnings ratio)arrow_forward

- The Pharoah Company has disclosed the following financial information in its annual reports for the period ending March 31, 2017: sales of $1.416 million, cost of goods sold of $815,000, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has an average tax rate of 35 percent. Compute the cash flows to investors from operating activity. (Round answer to 2 decimal places, e.g. 15.25.) Cash flow from operating activity %24arrow_forwardCash Accounts receivable (net) Other current assets December 31 Investments Property, plant, and equipment (net) Current liabilities Long-term debt Common stock, $10 par Retained earnings 2022 $ 29,100 50,000 90,100 54,500 500,500 $724,200 $85,000 144,900 342,000 152,300 $724,200 2021 $ 17,400 Sales Less: Sales returns and allowances Net sales Cost of goods sold Gross profit Operating expenses (including income taxes) Net income Lily Corporation Income Statements For the Years Ended December 31 2022 $737,000 $599,100 39,900 697,100 424,400 44,700 95,700 272,700 182,077 70,600 370,700 $599,100 $80,500 84,200 311,000 $ 90,623 123,400 $ 17,800 47,500 2021 2020 358,200 $531,000 63,500 44,000 $69,100 $605,400 31,000 299,000 574,400 370,500 113,400 $531,000 203,900 146,460 $ 57,440 49,500arrow_forwardD4).arrow_forward

- The following December 31, 2024, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents Accounts receivable (net) $ 6,300 33,000 73,000 Inventory Property, plant, and equipment (net) 185,000 Accounts payable 52,000 Salaries payable Paid-in capital 24,000 165,000 The only asset not listed is short-term investments. The only liabilities not listed are $43,000 notes payable due in two years and related accrued interest payable of $1,000 due in four months. The current ratio at year-end is 1.5:1. Required: Determine the following at December 31, 2024: 1. Total current assets 2. Short-term investments 3. Retained earningsarrow_forwardThe Oscar Meyer Corporation earned $33 million in 2019 on sales of $450.5 million. The company's balance sheet also listed current assets of $27 million, and fixed assets of $378 million. What is the firms Return on Assets (ROA)? a. 0.211 b. 0.201 O c. -0.029 d. -0.049 e. 0.081arrow_forwardJPJ Corp has sales of $1.27 million, accounts receivable of $52,000, total assets of $4.96 million (of which $2.77 million are fixed assets), inventory of $152,000, and cost of goods sold of $604,000. What is JPJ's accounts receivable days? Fixed asset turnover? Total asset turnover? Inventory turnover? What is JPJ's accounts receivable days? JPJ's accounts receivable days are enter your response here days. (Round to two decimal places.) Part 2 What is JPJ's fixed asset turnover? JPJ's fixed asset turnover is enter your response here . (Round to two decimal places.) Part 3 What is JPJ's total asset turnover? JPJ's total asset turnover is enter your response here . (Round to two decimal places.) Part 4 What is JPJ's inventory turnover? JPJ's inventory turnover is enter your response here .arrow_forward

- JPJ Corp has sales of $1.00 million, accounts receivable of $50,000, total assets of $5.00 million (of which $3.00 million are fixed assets), inventory of $150,000, and cost of goods sold of $600,000. What is JPJ's accounts receivable days? Fixed asset turnover? Total asset turnover? Inventory turnover? What is JPJ's accounts receivable days? JPJ's accounts receivable days are days. (Round to two decimal places)arrow_forwardThe Pharoah Company has disclosed the following financial information in its annual reports for the period ending March 31, 2017: sales of $1.416 million, cost of goods sold of $815,000, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has an average tax rate of 35 percent. Compute the cash flows to investors from operating activity. (Round answer to 2 decimal places, eg. 15.25.) Cash flow from operating activity 24arrow_forwardFlounder Company has been operating for several years, and on December 31, 2017, presented the following balance sheet. FLOUNDER COMPANY BALANCE SHEET DECEMBER 31, 2017 Cash $20,900 Accounts payable $80,000 Receivables 117,000 Long-term notes payable 181,000 Inventory 75,000 Common stock (no par) 110,000 Plant assets (net) 354,000 Retained earnings 195,900 $566,900 $566,900 The net income for 2017 was $43,000. Assume that total assets are the same in 2016 and 2017.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education