FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

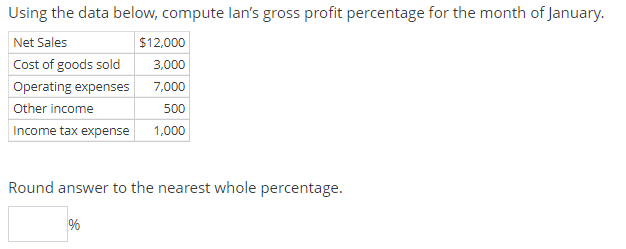

Transcribed Image Text:Using the data below, compute lan's gross profit percentage for the month of January.

Net Sales

Cost of goods sold

Operating expenses

Other income

Income tax expense

$12,000

3,000

7,000

500

1,000

Round answer to the nearest whole percentage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Requirements 1. Prepare the company's January, multistep income statement. Calculate income using the LIFO, average-cost, and FIFO methods. Label the bottom line "Operating income." Round the average cost per unit to three decimal places and all other figures to whole-dollar amounts. Show your computations. 2. Suppose you are the financial vice president of Ohio Instruments. Which inventory method will you use if your motive is to a. minimize income taxes? b. report the highest operating income? c. report operating income between the extremes of FIFO and LIFO? d. report inventory on the balance sheet at the most current cost? e. attain the best measure of net income for the income statemehi? State the reason for each of your answers. please answer all please answer all or skip do not waste question or time by giving incomplete or incorrect answer please provide answer with explanation computation formula please answer with steps thanksarrow_forwardAssume Carla Vista Company has the following reported amounts: Sales revenue $1,489,000, Sales returns and allowances $44,000. Cost of goods sold $955,145, and Operating expenses $321,200. (a) Compute net sales. Net sales $ (b) Compute gross profit. Gross profit $ (c) Compute income from operations. Income from operations $ (d) Compute the gross profit rate. (Round answer to 1 decimal place, e.g. 25.2%.) Gross profit rate %arrow_forwardRevenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous Year Sales $490,000 $446,000 Cost of merchandise sold 289,100 231,920 Selling expenses 78,400 84,740 Administrative expenses 88,200 75,820 Income tax expense 14,700 22,300 a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amounts as positive numbers. Innovation Quarter Inc. Comparative Income Statement For the Years Ended December 31 Current year Amount Current year Percent Previous year Amount Previous year Percent Sales $490,000 % $446,000 % Cost of merchandise sold 289,100 % 231,920 % % % Selling expenses 78,400 84,740 % Administrative expenses 88,200 % 75,820 % % % Income tax expense 14,700 % 22,300 % % % b. The vertical analysis indicates that the cost of merchandise sold as a percent of sales - by 7 percentage points, while selling expenses by 3…arrow_forward

- NEED ANSWER WITH EXPLANATIONarrow_forwardUsing the data below, compute lan's return on sales ratio for the month of January. Net Sales $12,000 Cost of goods sold 3,000 Operating expenses 7,000 Other income 500 Income tax expense 1,000 Round answer to the nearest whole percentage.arrow_forwardPrepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Yesarrow_forward

- Using the accounts and amounts below, calculate Gross Profit: Account Amount Sales Revenue $124,357 Net Sales 124,835 Sales Returns and Allowances 2,971 Cost of Goods Sold 37,343 Operating Expenses 20,156arrow_forwardFollowing is an incomplete current-year income statement. Determine Net Sales, Cost of goods sold and Net Income. Additional information follows: Return on total assets is 16% (average total assets is $62,500). Inventory turnover is 5 (average inventory is $7,800). Accounts receivable turnover is 8 (average accounts receivable is $7,700). Income Statement Net Sales Cost of goods sold Selling, general, and administrative expenses 8800 Income tax expenses 3800 Net Incomearrow_forwardGross Profit PercentageUsing the data below, compute Ian’s gross profit percentage for the month of January. Net Sales $12,000 Cost of goods sold 3,000 Operating expenses 7,000 Other income 500 Income tax expense 1,000 Round answer to the nearest whole percentage. Answer%arrow_forward

- The following data were provided by Mystery Incorporated for the year ended December 31: Cost of Goods Sold $ 155,000 Income Tax Expense 14,820 Merchandise Sales (gross revenue) for Cash 220,000 Merchandise Sales (gross revenue) on Credit 38,000 Office Expense 18,000 Sales Returns and Allowances 6,450 Salaries and Wages Expense 36,200 1. What was the gross profit percentage? (round your percentage to 1 decimal place)arrow_forwardUse the following selected information from Corolla to determine the Year 1 and Year 2 trend percentages for net sales using Yeari as the base Year 2. Year Net sales $ 286,200 $ 233,40o0 Cost of goods sold 149,900 131,590 Operating expenses Net earnings 53,240 51,240 30,020 21,820 Multiple Choice 122.6% for Year 2 and 100.0% for Year 1. 35.5% for Year 2 and 38.9% for Year 1. 52.4% for Year 2 and 56.4% for Year 1. 113,9% for Year 2 and 100.0% for Year 1.arrow_forwardGiven below are the account balances for Charlie Company: Gross sales - $92,000 Sales returns and allowances - $6,000 Selling expenses - $12,000 Cost of goods sold - $42,000 Interest expense - $3,000 How much is the gross profit margin?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education