ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

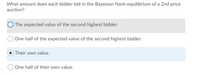

Transcribed Image Text:What amount does each bidder bid in the Bayesian Nash equilibrium of a 2nd price

auction?

O The expected value of the second highest bidder.

One half of the expected value of the second highest bidder.

Their own value.

One half of their own value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (The All-Pay Auction). The seller has an item for sale. The valuations of the bidders are independently and identically distributed on R+ with a c.d.f. F. Find the symmetric equilibrium of an auction with two bidders in which both bidders pay their own bids but only the highest bidder wins the object. Show that each bidder’s expected payment is the same in this auction and in the first-price auction.arrow_forwardSuppose there are two bidders for a single object. Each bidder has a value for the object, v1 and v2, which is randomly drawn uniformly from 0 to 80. (Note that this means the probability that a value is 25 or lower is 25/80, and more generally, the probability that a value is k or lower is k/80). Bidders see their own values but not the values of their rival bidders. Consider a first price sealed bid auction where the winner of the object is the bidder who submits the highest bid and pays the price that he bid. Suppose that you are bidder 1 and you believe that your rival always bids a constant fraction α of his value. (For example, if bidder 2’ value is 15, he will bid 15α.). 1. What is your expected winning probability of the auction from any given bid b1? (Hint, you win the auction when your bid amount b1 is greater than your opponent’s bid). 2. What is your expected payoff from any given bid, b1? (You need to write your answer as a function of v1, b1, and α). 3. Compute your best…arrow_forwardExercise 1.8. Consider the following "third-price" auction. There are n≥ 3 bidders. A single object is auctioned and Player / values the object $v,, with V, > 0. The bids are simultaneous and secret. The utility of Player / is: 0 if she does not win and (v-p) if she wins and pays $p. Every non-negative number is an admissible bid. Let b, denote the bid of Player i. The winner is the highest bidder. In case of ties the bidder with the lowest index among those who submitted the highest bid wins (e.g. if the highest bid is $120 and it is submitted by players 6, 12 and 15, then the winner is Player 6). The losers don't get anything and don't pay anything. The winner gets the object and pays the third highest bid, which is defined as follows. Let be the winner and fix a Player j such that b₁ = max({b,,...,b,}\ {b}) [if GAME THEORY - Giacomo Bonanno 39 max({b,...,b}\{b;}) contains more than one element, then we pick one of them]. Then the third price is defined as max({b₁,...,b}\{b,,b;}).…arrow_forward

- Jane is interested in buying a car from a used car dealer. Her maximum willingness to pay for thecar is 12 ($12,000). Bo, the dealer, is willing to sell the car as long as he receives at least 9($9,000). What is the Nash bargaining solution to this game?arrow_forwardWhy do sellers generally prefer a Vickrey auction to a regular sealed bid if sellers don’t receive the highest bid in the Vickrey auction? Sellers only have to sell their item if the bid is the highest-price bid. The second-highest bid in a Vickrey auction is generally higher than the highest bid in a regular sealed-bid auction. The second-highest bid is about the same in both auctions. Sellers prefer the final price is not revealed to all bidders. Sellers would never prefer Vickrey auctions.arrow_forwardPLEASE HOW TO THINK ABOUT IT AND SOLVEarrow_forward

- Within a voluntary contribution game, the Nash equilibrium level of contribution is zero, but in experiments, it is often possible to sustain positive levels of contribution for a long period. How might we best explain this? A) Participants are altruistic, and so value the payoff which other participants receive, benefiting (indirectly) from making a contribution. B) Participants believe that if they make a contribution, then other participants will be more likely to make a contribution. C) Participants in experiments believe that they have to make contributions in order to receive any payoff from their participation. D) Participants have experience of working in situations in which cooperation can be sustained for mutual benefit and so have internalised a social norm of cooperationarrow_forwardThe Government of Malaca has decided to sell pollution permits that will allow people to discharge pollutants into its largest freshwater lake. Each permit represents the right to discharge one tonne of pollutants. Malaca has determined that the lake will tolerate a maximum of 10 tonnes of pollutants per year and has decided to sell the permits using a Dutch auction. This means that the auction starts at a very high price, which is reduced in steps until the price reaches a level that will result in all 10 tonnes of pollution permits being sold at the same price. The results of the bidding are shown in table below. Price per Pollution Bidder Bidder Bidder Bidder Bidder Permit A. B D $5, 500 1 5,000 4,500 4,000 1. 1. 1 2 2. 3 2 1 2 3,500 3,000 2,500 2,000 4 3 2 4 4 4 3 4 4 1,500 7 a. What will be the price of pollution permits as a result of this auction? Price: $ b. Suppose that Bidder E happened to be an environmental protection group. If this group had not participated in the…arrow_forwardThere are three bidders participating in a first-price auction for a painting. Each bidder has a private, independent value vi for such a painting that is drawn uniformly from [0,1] Assume that each bidder i has a linear bidding function bi=avi, where a>0. What is the bidding strategy of bidder i , namely bi in the Bayesian equilibrium?arrow_forward

- The ultimatum game is a game in economic experiments. The first player (the proposer) receives a sum of money and proposes a fair proposal (F - 5;5) or unfair proposal (U - 8;2). The second player (the responder) chooses to either accept (A) or reject (R) this proposal. If the second player accepts, the money is split according to the proposal. If the second player rejects, neither player receives any money. 1 A 5:5 2 F R 0:0 U A 8:2 2 1. Find the subgame perfect Nash Equilibrium using backward induction. R 0;0arrow_forwardThere are 4 bidders with valuations that are independently and uniformly distributed between 0 and 1. In equilibrium, what is the probability that the highest bid is less than 0.2 in a first-price auction? Round your answer to two decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education