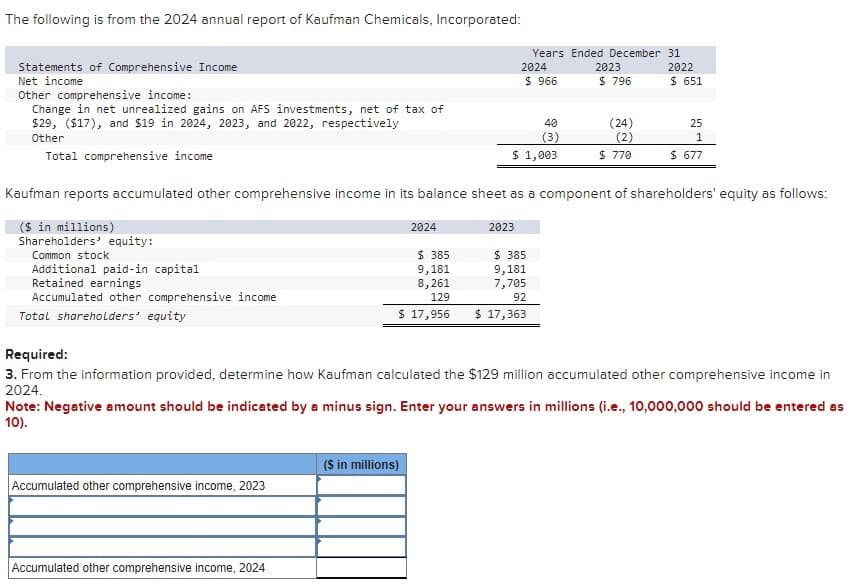

The following is from the 2024 annual report of Kaufman Chemicals, Incorporated: Statements of Comprehensive Income Net income Other comprehensive income: Change in net unrealized gains on AFS investments, net of tax of $29, ($17), and $19 in 2024, 2023, and 2022, respectively Other Total comprehensive income Additional paid-in capital Retained earnings Accumulated other comprehensive income Total shareholders' equity 2024 $385 9,181 8,261 129 $ 17,956 Years Ended December 31 2023 2024 2022 $ 966 $ 796 $ 651 40 (3) $ 1,003 Kaufman reports accumulated other comprehensive income in its balance sheet as a component of shareholders' equity as follows: ($ in millions) Shareholders' equity: Common stock 2023 (24) (2) $ 770 $385 9,181 7,705 92 $ 17,363 25 1 $ 677 Required: 3. From the information provided, determine how Kaufman calculated the $129 million accumulated other comprehensive income in 2024. Note: Negative amount should be indicated by a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

The following is from the 2024 annual report of Kaufman Chemicals, Incorporated: Statements of Comprehensive Income Net income Other comprehensive income: Change in net unrealized gains on AFS investments, net of tax of $29, ($17), and $19 in 2024, 2023, and 2022, respectively Other Total comprehensive income Additional paid-in capital Retained earnings Accumulated other comprehensive income Total shareholders' equity 2024 $385 9,181 8,261 129 $ 17,956 Years Ended December 31 2023 2024 2022 $ 966 $ 796 $ 651 40 (3) $ 1,003 Kaufman reports accumulated other comprehensive income in its balance sheet as a component of shareholders' equity as follows: ($ in millions) Shareholders' equity: Common stock 2023 (24) (2) $ 770 $385 9,181 7,705 92 $ 17,363 25 1 $ 677 Required: 3. From the information provided, determine how Kaufman calculated the $129 million accumulated other comprehensive income in 2024. Note: Negative amount should be indicated by a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter6: Accounting Quality

Section: Chapter Questions

Problem 2IC

Related questions

Question

Visno

Transcribed Image Text:The following is from the 2024 annual report of Kaufman Chemicals, Incorporated:

Statements of Comprehensive Income

Net income

Other comprehensive income:

Change in net unrealized gains on AFS investments, net of tax of

$29, ($17), and $19 in 2024, 2023, and 2022, respectively

Other

Total comprehensive income

Additional paid-in capital

Retained earnings

Accumulated other comprehensive income

Total shareholders' equity

Accumulated other comprehensive income, 2023

Accumulated other comprehensive income, 2024

2024

$385

9,181

8,261

129

$ 17,956

($ in millions)

Years Ended December

2024

$ 966

40

(3)

$ 1,003

Kaufman reports accumulated other comprehensive income in its balance sheet as a component of shareholders' equity as follows:

($ in millions)

Shareholders' equity:

Common stock

2023

2023

$385

9,181

7,705

92

$ 17,363

$ 796

(24)

(2)

$ 770

31

2022

$ 651

Required:

3. From the information provided, determine how Kaufman calculated the $129 million accumulated other comprehensive income in

2024.

Note: Negative amount should be indicated by a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as

10).

25

1

$ 677

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning